If you want to trade in oil, stocks, gold or cryptocurrencies, there is hardly a better option than eToro. eToro is a global multi-asset platform that users allows you to trade CFDs of the most popular stocks, commodities such as oil, indices and more than 15 major cryptocurrencies.

It is a fully regulated stock exchange and broker with more than 10 million registered users Worldwide. Compared to other cryptocurrency trading services, the broker does not allow you to withdraw your crypto assets unless you use a dedicated wallet that is available for iOS and Android.

Launched in 2007, the platform is an active supporter of Bitcoin and has been offering BTC trading services since 2013. The broker, known as a social trading platform, is best suited for new traders and investors who want to learn and experience the best of both worlds. - Cryptocurrencies and traditional finance worlds.

Basic information

| ✅Page type | stock exchange and broker |

| ✅Easy for beginners | Yes |

| ✅Mobile application | Yes |

| 🌍Company headquarters | Limassol, Cyprus |

| 💰Selection method | Cryptocurrencies, fiat |

| 📉Number of pairs available | 43 |

| 📉Cryptomens on the stock exchange | 16 |

| 👮♂️Trust in society | high |

| ☎Customer support | very active |

| ✅Page | https://www.etoro.com/ |

VISIT Broker

68 % retail investors incurred losses.

eToro reviews

eToro, a multi-asset platform for social trading, is ideal for investors who are new to the world of investment. The platform has been a pioneer of online investment since 2006 and has gained a reputation as a trusted broker. The platform is an excellent choice if you are interested in trading cryptocurrencies or traditional assets such as stocks, commodities such as oil or gold or ETFs, and it acts as a single point of contact for all these products.

Advanced traders can benefit from margin trading, which gives you access to countless leveraged trading tools. Less experienced traders can benefit from eToro social trading, where you can track and copy seasoned investors, their surveys and knowledge.

Key features include:

- Social trading eToro. The broker offers a unique social trading experience, making it the best social platform for traders. You can track, copy, communicate with your favorite merchants, and create your own news channel to keep track of your preferred assets and news.

- One of the best trading platforms for learning. It contains many educational materials, including a virtual portfolio for training.

- Wide range of assets. In addition to 16 cryptocurrencies, you can also trade in traditional markets such as stocks, bonds, forex, ETFs, commodities and other markets.

- Excellent customer support. If a problem occurs, you can contact the team by phone, live chat and email. In addition, the platform is translated into more than 20 languages, including Czech. Customer service is available 24 hours a day from Monday to Friday.

- Mobile business applications. It's easily accessible on the go, so you can trade from your Android or iOS phone.

The platform's trading tools include:

- 47 currency pairs (including CZK, EUR, USD, CAD, GBP, AUD, PLN, SGD, SEK, JPY and many others).

- 13 CFDs of stock indices (SPX 500, UK100, NSDQ100, China50, AUS200 and others).

- More than 1300 stock CFDs.

- 83 commodity CFDs (including oil, gold, silver, copper, natural gas and platinum).

- 16 cryptocurrencies (BTC, ETH, BCH, XRP, DASH, LTC, ETC, ADA, EOS, NEO, XLM, IOTA, TRX, ZEC, BNB & XTZ).

Unfortunately, you will not find shares of Czech companies at the broker.

History

eToro, a company founded in 2006, has a history going beyond Bitcoin and Cryptocurrencies. It started operating as an online foreign exchange brokerage. In 2010, it launched its well-known copy trading feature, which allows users to copy the investment strategies of successful traders.

The first involvement in the cryptocurrency sector came in January 2014, when it began offering Bitcoin trading to the three million users it boasted at the time. At the time, these were CFD transactions, which meant that the trader did not purchase the underlying asset (eg Bitcoin). Instead, it was an agreement to either pay the difference if the price of the asset fell or receive the difference if it rose. However, in September 2018, the broker switched to offering direct cryptocurrency trades, so you now actually own and can withdraw cryptocurrencies purchased into your eToro wallet.

Today, the broker boasts more than ten million users, and its growth is driven primarily by the crypto boom. On a platform of this size, the interface is efficient and simple and the mobile application allows convenient management of your portfolio on the go.

VISIT Broker

68 % retail investors incurred losses.

eToro fees

Compared to "standard" cryptoplatforms (eg Coinbase or Binance), the eToro fee structure is a bit different and slightly complicated.

Because eToro is an intermediary service, not an exchange office, it does not charge trading fees like regular cryptobourses. However, when you sell and buy cryptocurrencies using leverage, you pay something called "spread fees" (ie when you borrow from the eToro trading platform to buy). In other words, if you want to sell (or trade a margin) cryptocurrency, you must pay a percentage of the sale price. This percentage is derived from the "spread" of the asset and represents the difference between its "purchase" price and the "sale" price.

For example, if you sell one Bitcoin for a market price of $ 7,000, you will also have to pay 0.75 % of the value of that one Bitcoin (0.75 % is the current BTC spread at the time of writing). Assuming 1 BTC equals $ 7,000, you will have to pay $ 52.50.

You can look at the spread values in detail here.

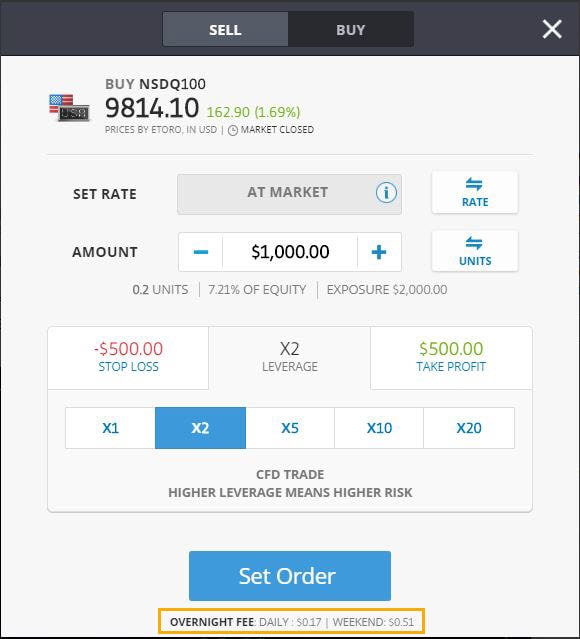

And for each advanced cryptocurrency trader, the broker charges "next day" fees, often referred to as "rollover fees" on other cryptocurrency trading platforms. Because the trader borrows money from eToro to hold the trading position, eToro basically charges him interest.

Next day transfer fees at eToro

Let's take a look at the next day's transfer (per unit) for some of the most popular cryptocurrencies currently listed on eToro:

| Bitcoin | 0.75% | 4.377224 |

|---|---|---|

| Bitcoin Cash | 1.9% | 0.161194 |

| Ethereum | 1.9% | 0.117836 |

| XRP | 2.45% | 0.000158 |

| Cardano | 2.9% | 0.000033 |

| EOS | 2.9% | 0.002339 |

| Dash | 2.9% | 0.062788 |

| Binance Coin | 2.45% | 0.013034 |

| TRON | 3.5% | 0.000013 |

The fees for moving to the next day are quite high. The number of units purchased is taken, multiplied by the price of each unit, and then multiplied by the eToro markup added to the monthly LIBOR (the international interest rate that banks use for loans) at the time of calculation. The result is divided by 365 to reflect the daily fee.

Next day fees will appear at the bottom of the window when you open a new store.

Spread fees generally mean that trading in buying or selling cryptocurrencies on eToro is more expensive than trading on other platforms. For example, Binance and Bitstamp charge 0.1 % for each trade a user makes, which is significantly cheaper compared to an eToro spread fee of 0.75 % per BTC.

Finally, eToro also charges collection and inactivity fees. Withdrawals are a $ 5 flat rate, and users can withdraw $ 30 or more. The inactivity fee is $ 10 per month. It is charged to any user whose account has not been active for 4 or 12 months, depending on whether they have made a deposit.

eToro tutorial

But eToro is not just about copying other stores. Of course, you can also act on your own and, over time, become one of the most popular investors, who will earn extra income by having other users start copying it.

You do not need to download and install any software to get started with eToro, as eToro works on a web platform. It is a clear platform, the operation of which will be understood by a new user in a few minutes.

VISIT Broker

68 % retail investors incurred losses.

How to log in to eToro

Click on the "Visit eToro" button above to go to the eToro homepage. Once there, you will see a "register" button in the upper right corner.

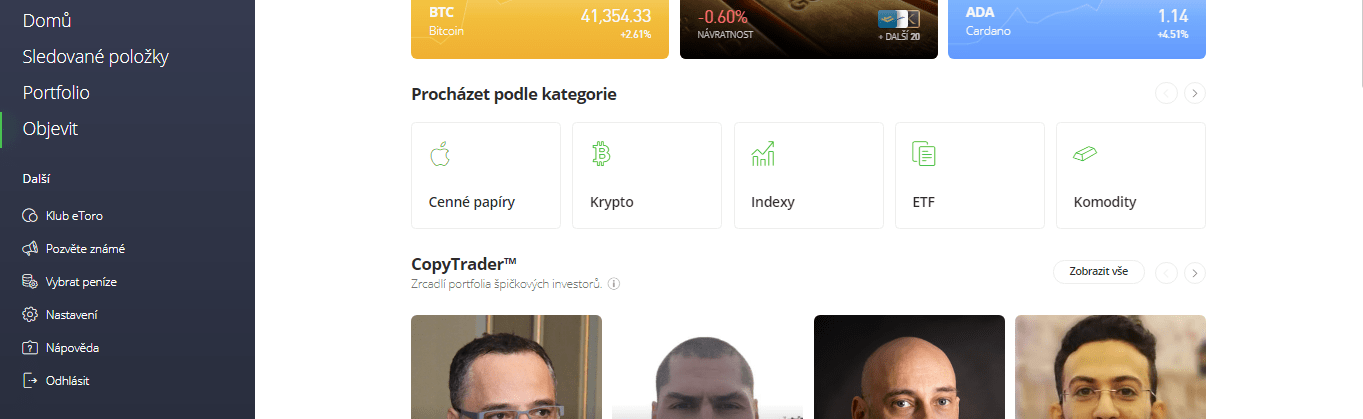

After verifying your email address, you will be taken to a user interface where you will need to go through the KYC process.

The layout of the eToro trading platform is user-friendly and easy to navigate. The user has a control panel on the left side of the screen. The right side shows all the graphs, data and profiles you will need to make investment decisions. Likewise, the eToro mobile applications allow you to do almost anything you can do on the desktop version of the trading platform. Being able to receive notifications means you can keep track of your stores no matter where you are. The applications are available for both Android and iOS devices.

eToro offers several basic features that make it very suitable for beginners and novice traders. It provides a virtual portfolio, a "demo mode" that allows users to trade without depositing real money. You will be provided with a "test" $ 100,000 in this eToro demo account. With this time-limited trial account, you can test everything from copying traders to investing yourself. With this mode, you can buy as many 'virtual' BTCs, DASHs or XRPs as you want and see how each cryptocurrency is doing.

The use of copy trading is excellent for traders who are unsure of their ability to consistently select winners. With CopyTrader, eToro allows you to copy the most powerful traders in various asset markets (eg commodities, stocks, ETFs and crypto). You choose the amount you invest, which then reflects each action the trader takes. In addition, users can make adjustments here and there (eg copying only new stores instead of all open positions).

Copy Trading and Copy Portfolio on eToro

As such, eToro is a social media platform for traders that bridges the gap between you, your favorite traders and your favorite markets.

Copy Trading

Copy Trading eToro allows you to copy the actions of traders of your choice. It's like seasoned traders from all over the world trading on your behalf. You can follow specific marketers on a social channel, track their actions in real time and sign up to copy everything they do.

- The minimum amount to invest in a trader is $ 200.

- The maximum number of merchants that can be copied at one time is 100.

- The maximum amount you can invest in one trader is $ 2,000,000.

To copy merchants to eToro, follow these simple steps:

1. Click "Discover" on your profile taskbar. Then, in the Copy Trader sketch, click "show all".

2. Choose among the most successful eToro merchants, who are grouped and categorized under "Editor's Choice", "Most Copied" and other options.

3. Click on the selected merchant to view his / her profile and click on the "Copy" button. Set the monetary value for the copy and the amount for Stop-Loss. You can also choose to copy already opened or only new stores.

New trades are opened at the same rate as the copied trader. All steps of the copied trader, including changes in the Stop Loss and Take Profit settings and closing the trade, are automatically copied to your account. If the copied trader expands Stop Loss by adding money to the trading position, your Stop Loss settings will be adjusted in the same way. However, your amount for this position will remain the same as its starting amount. Therefore, you may sometimes notice a difference in profit percentage between your copy account and the copied merchant account.

CopyPortfolios

CopyPortfolios companies are thematic investment tools designed to provide long-term double-digit returns. Each CopyPortfolio combines different items or a group of merchants and is constantly optimized by machine learning algorithms.

General information about CopyPortfolio:

- The minimum investment amount is only $ 1,000.

- The default Stop Loss setting for CopyPortfolio is 10 %.

You will find them on the main panel as Smart Portfolios, they are a thematic investment tool developed by eToro, and they combine various investment items into a single portfolio based on a set market strategy or focus on a specific market segment. The company's financial experts determine the composition of each CopyPortfolio in conjunction with a machine learning algorithm designed to reduce risk and increase profits.

For example, BigTech CopyPortfolio brings together major companies from individual technology sectors and thus offers investment in this sector as a whole.

VISIT Broker

68 % retail investors incurred losses.

Deposit and withdrawal methods on eToro

Users can only deposit Fiat currency into their account unless you transfer the cryptocurrency directly to your eToro Wallet. In addition, you can use your credit / debit cards and many other options, such as bank transfer, popular payment processors such as PayPal, Skrill & Neteller, Klarna, iDEAL and more. All fiat funds on eToro will be converted to one of your preferred currencies in US dollars or euros, so if you deposit GBP or Czech crown into your account, eToro will convert them to USD or Euro. As such, you will be charged a conversion fee. The minimum first deposit ranges from $ 50 to $ 10,000 depending on your jurisdiction.

Withdrawals work in essentially the same way, with credit / debit card, bank transfer, and PayPal options available. However, there is a flat fee of $ 5 for each withdrawal, so plan your withdrawals to avoid additional costs. The eToro crypto wallet also allows platform users to hold and select the cryptocurrencies it supports.

Overview of other stock exchanges and exchange offices you will find here

eToro security

During our inspection of the website and trading platform, we found that the broker had not experienced any significant scandals in the past. However, security is not the main selling point of eToro. This is mainly because until 2017, cryptocurrencies were not directly traded and transferred through the platform. Instead, users had a CFD, which means they agreed to either pay or receive the difference if the price of the coin fell or rose.

In other words, eToro did not hold any crypto owned by its customers. There was no need to use the types of security measures deployed on competing crypto platforms, such as cold wallets and multi-sig authentication.

Today, it offers direct purchases of cryptocurrencies and stores most of the funds in a secure cold store. Keep in mind, however, that your eToro wallet stores your private key, so you need to trust the trading platform to secure your funds. This means that they keep their customers' funds separate from their commercial bank accounts. eToro also deals only with large, internationally recognized financial institutions such as Barclays Banks and Coutts. In addition, eToro is one of the safest platforms in terms of general financial compliance, regulated by CySEC in Europe, FinCEN in the US and FCA in the UK.

VISIT Broker

68 % retail investors incurred losses.

- Easy to use

- Social and regulated platform

- Ability to track and copy other merchants

- Useful training feature - "virtual account"

- Selections do not work for all cryptocurrencies

- It is not a stock market, so there is no marketplace for buyers / sellers

|

Závěrečné shrnutí

eToro is a very popular, innovative and trusted broker that has been providing its services almost all over the world since 2007. Maybe that's why millions of people from more than 200 countries trust the broker. eToro is a unique platform for social trading with a diverse range of investment products. Although everything comes at a higher cost than regular cryptocurrency trading services, the benefits outweigh the costs because the broker offers significantly more. Overall, eToro is a great place to start exploring the world of online investment, diversifying your portfolio, connecting with other investors and building a career as a predatory trader. |

5.0

|

FAQ

1️⃣ Is eToro a scam?

No. Etoro has been a stable company for many years, offering its clients many types of trading. In addition to shares, eToro can also trade forex, cryptocurrencies, indices, commodities and other underlying assets. You can find out what fees this company has and what experience we have with them in our review on DigitalniTrend.cz

2️⃣ What is the experience of its users with eToro?

Its clients and traders have mostly positive experiences with eToro.

3️⃣ What are the fees of eToro?

eToro requires a $ 5 fee to withdraw money from their platform. However, other fees are relatively low and vary from instrument to instrument and asset to asset.

4️⃣ Does the broker offer an eToro demo account?

Yes. It is possible to register with the eToro broker and trade for a trial without risk using a so-called demo account. Your eToro demo account will provide you with a $ 100,000 test, which you can trade indefinitely. The money earned does not have to bother you, but of course you cannot choose the money earned. Find out more in our review.