Coinbase is one of the largest and most well - known exchange offices for trading Bitcoin and cryptocurrencies. Founded in 2012, this San Francisco-based exchange office has become the entry point into the cryptworld for the world. Today, it operates in 102 countries in Africa, Asia, South and North America, Australia and Europe. You can use it to exchange Bitcoin, Etherea, Litecoin, Bitcoin Cash, XRP and many other popular cryptocurrencies. Using Coinbase is easy, straightforward, secure, and comes with reasonable replacement fees (though not the lowest). In addition, you can access it via a smartphone. Not only that, it makes Coinbase one of the most convenient cryptocurrency exchanges for beginners in the crypt market.

Coinbase is also one of the easiest exchange offices to use to buy Bitcoin and other cryptocurrencies for fiat currencies via bank transfer, credit card, debit card and even PayPal.

Basic information

| ✅Page type | cryptocurrency exchange office |

| ✅Easy for beginners | Yes |

| ✅Mobile application | Yes |

| 🌍Company headquarters | San Francisco, USA |

| 🌍Establishment of a company | 2012 |

| 💰Deposit method | cryptocurrencies, fiat (can be via credit card) |

| 💰Selection method | Cryptocurrencies, fiat |

| 📉Number of pairs available | 81 with Coinbase Pro |

| 📉Cryptocurrency | 96 |

| 👮♂️Trust in society | high |

| ☎Customer support | active |

| ✅Own cryptocurrency | No |

| ✅Own wallet | Yes, Coinbase Wallet |

| ✅Page | https://www.coinbase.com/ |

Coinbase reviews

As one of the world's leading exchange offices, Coinbase offers many quality crypto services. At its core, however, it provides by far the easiest way to buy and sell the most popular cryptocurrencies, such as Bitcoin, Ethereum, and more. Coinbase does this by providing quick, simple and easy ways to purchase cryptocurrency directly through your credit or debit card, bank transfer or local payment services such as iDeal in Europe.

Quick and convenient ways to buy cryptocurrencies usually come with higher fees and Coinbase is no exception. At Coinbase you will also find a professional 24/7 customer support team, a cryptocurrency wallet and you will be able to enjoy a proven platform with robust security measures.

In short, the key features you need to know include:

- One of the easiest ways to buy Bitcoin and other top altcoins. Coinbase allows you to purchase cryptocurrencies using your credit / debit cards, bank account, bank transfer, other cryptocurrencies, and other localized payment methods (varies by country).

- A global currency exchange that supports many fiat currencies. If it operates in your country or region, it is likely to accept deposits in your currency.

- Insured US currency exchange compliant. Coinbase is one of the few exchange offices that is actually regulated and insured by the FDIC. Even if it failed as a business, customers' funds held in custodian bank accounts would not be claimed by creditors.

- Coinbase's own USDC stabilcoin. Unlike most exchange offices, it uses its USD Coin (USDC) issued by the company together with Circle. It is a fully regulated, transparent and verifiable stablecoin with regular audits.

- Coinbase map. Customers can order a Visa debit card, which allows you to buy and sell goods and services using cryptocurrencies.

- Earn cryptocurrencies with Coinbase. The Earn program allows you to earn cryptocurrencies by simply learning about them. Complete courses on cryptocurrencies like EOS or Stellar Lumens and earn up to $ 50 in return.

- Other bitcoin and cryptocurrency services. As a customer, you can also use Coinbase deposit and non-custody wallets, OTC trading, institutional tools and much more.

- Great entry point for beginners. Adapted for beginners in the field of cryptocurrencies and is the entry point for most traders. Therefore, it does not contain any detailed trading charts, so if you need a more advanced trading interface, take a look at Coinbase Pro.

History

If you've heard of any cryptocurrency, it's probably Coinbase. It was founded in June 2012 by Brian Armstrong and Fred Ehrsam. Until 2013, Coinbase was the best-funded bitcoin startup and at the same time the largest cryptocurrency exchange office in the world. Since then, it has raised more than $ 540 million from venture capital companies such as Andreessen Horowitz, NYSE, Rabbit Capital and many more.

Coinbase opened the first regulated cryptocurrency exchange in the United States in January 2015. Since then, it has served more than fifty million customers. Thanks to this, it is one of the largest exchange offices on the web, whose reputation was strengthened at the end of 2017, when its mobile application became the most popular download on the Apple App Store.

Unlike other exchange offices, which require users to trade in the market, the Exchange allows users to trade their cryptocurrencies at a set price based on their market value, allowing users to buy their cryptocurrencies faster than other exchange offices.

In 2021, it became the first crypto exchange office to enter the Nasdaq. Today, more than 56 million users trade over $ 300 billion worth of cryptocurrencies on Coinbase each quarter. According to CoinMarketCap for cryptodata, it has the third largest trading volume of all exchange offices.

Coinbase fees

One of the biggest disadvantages compared to other exchange offices is its fees. When you make a cryptocurrency transaction at the exchange office - such as buying Bitcoin or exchanging your Etherea back to fiat - you will be charged both a spread fee and a Coinbase fee.

The spread is the difference (or margin) between the market price and the price you actually pay to buy or receive for sale. You can compare this to the commission or trading fee you can pay when you invest with a brokerage account.

The spread equals approximately 0.50 % of your sales and purchases of cryptocurrencies, although it can fluctuate depending on the market. For cryptocurrency transfers - such as trading Bitcoin for Ethereum - you may be charged a range of up to 2.00 % based on market fluctuations. However, there is no charge for converting your cryptocoins to other cryptocurrencies.

The Coinbase fee may also vary depending on your payment method, location and other factors. It can be either a flat fee or a percentage of your transaction. The support site explains that it charges a minimum flat fee for shifts below $ 200.

| Transaction value | Charge |

|---|---|

| $10 or less | $0.99 |

| From $10 to $25 | $1.49 |

| From $25 to $50 | $1.99 |

| From $50 to $200 | $2.99 |

For those over $ 200, they charge a variable percentage fee and also a deposit fee. They vary depending on your location, as shown below:

| Region | Standard Buy / Sell | Credit / Debit Card Purchase | Bank Transfers (SEPA) - in / out | Bank Wires - in / out |

|---|---|---|---|---|

| Europe | 1.49% | 3.99% | Freeware / € 0.15 | – |

| Great Britain | 1.49% | 3.99% | Freeware / € 0.15 | Free / £ 1 |

| Australia / Canada | 1.49% | 3.99% | Freeware / € 0.15 | – |

| Singapore | 1.49% | 3.99% | – | – |

| USA | 1.49% | 3.99% | – | $10/$25 |

And by comparison, the 3,99% fee for credit / debit card transactions is cheaper than the corresponding fees at BitPanda and BitStamp. Both are on 5 %.

However, compared to CEX.io and Kraken, the exchange office is a bit more expensive. CEX.io charges 2.99 % for Bitcoin purchases by credit / debit card, while Kraken - which is not as user-friendly and only accepts bank transfers - charges approximately 0.26 % for Bitcoin purchases.

Coinbase tutorial

Usability is one of the biggest attractions of the exchange office.

Registration

- Sign up - If you want to open an account on Coinbase, just provide your name, email address and password.

- Account Type - A confirmation email will be sent to you after you apply for an account. Confirm and set what type of account, individual or business, you wish to have.

- Verify your phone number.

- Set up a payment method - The exchange office allows its customers to pay either by bank transfer or credit card. Bank transfer payments can take several business days, while card payments are instant. The exchange also allows its users to link their Paypal account with their platform.

Creating an account is therefore a quick and easy process, although it requires your name, address, bank details and proof of identity.

Design

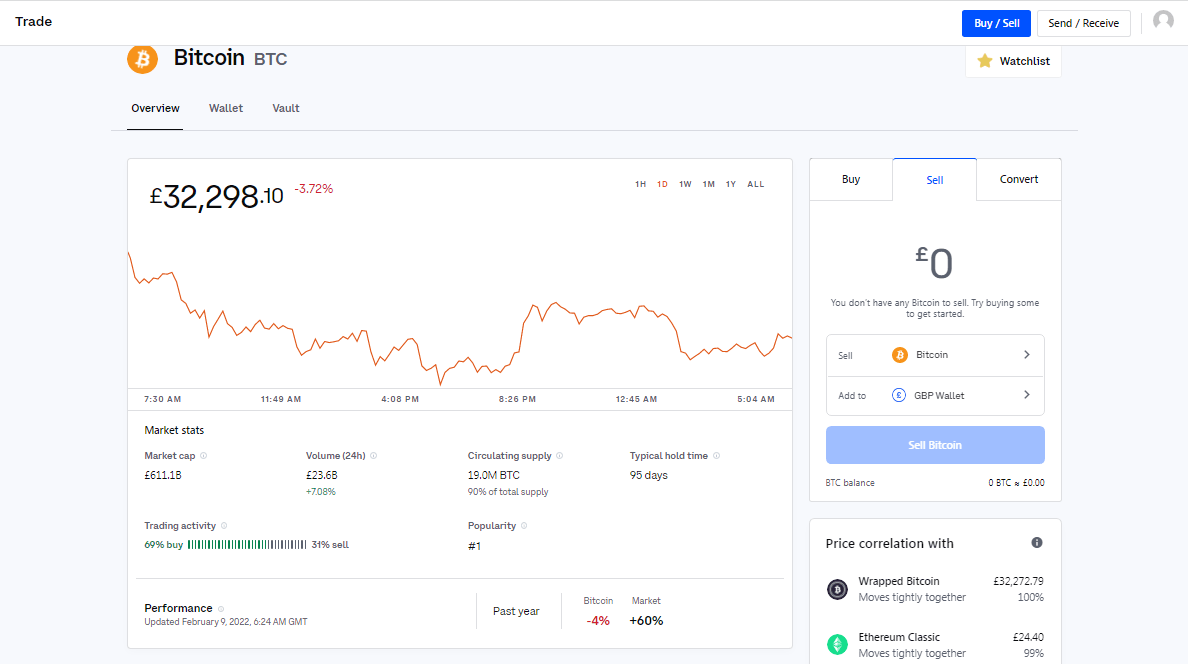

The website itself is clearly arranged with easy navigation on the site and interfaces. The dashboard shows users the changing value of bitcoin (or three other tradable cryptocurrencies), shows them their recent transactions and their currency portfolio.

The website is intended for new and amateur investors who do not require charts or advanced types of orders in their investment activities. This makes it one of the most affordable and user-friendly digital exchange offices.

This type of intuitive layout is also available in the web's mobile application. You can download it from the Apple App Store and Google Play.

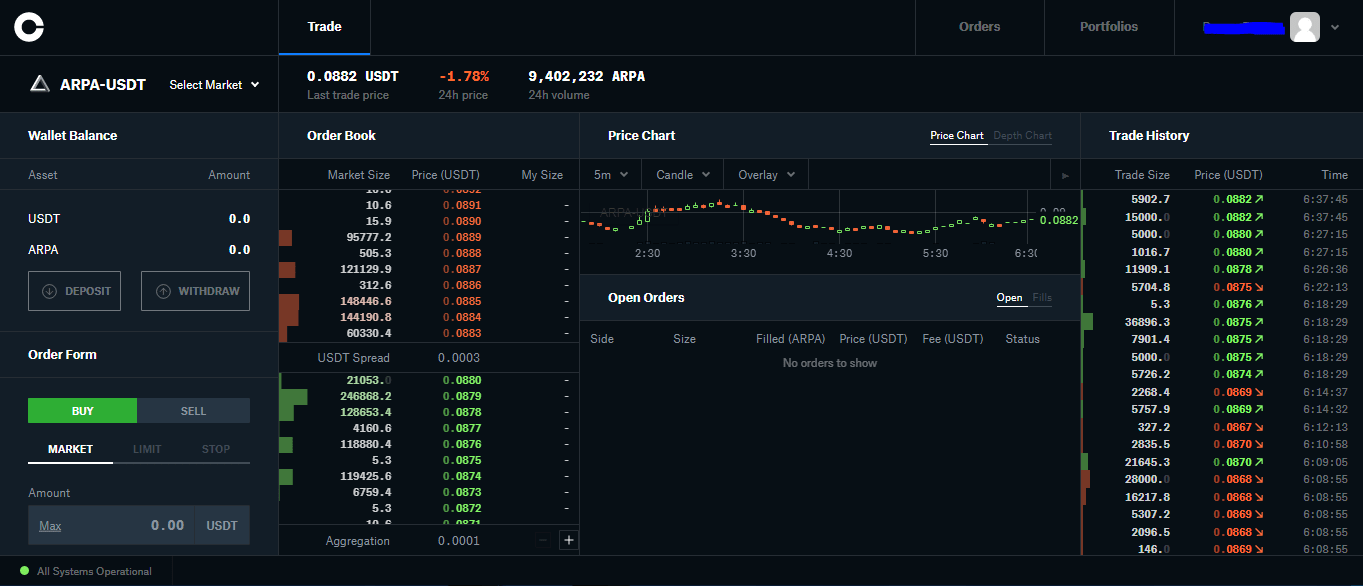

Coinbase Pro

Coinbase offers another free trading platform called Coinbase Pro, which charges lower fees and other features for people who are interested in actively trading cryptocurrencies. You will find that you can avoid charges by using the Pro version as your shopping / trading platform by sending a bank transfer to Coinbase and then using Pro to make a purchase.

All customers automatically have a Pro account, you log in with the same login information as on the Coinbase website. If you want to buy and sell coins more actively, Coinbase Pro offers more tools and news, as well as cheaper shops from which you can benefit.

Coinbase Pro includes real-time order books, business history, and charting tools. The interface is also highly intuitive.

Cryptocurrency management

The exchange office offers various options when it comes to storing cryptocurrencies.

You can save your crypto at the exchange office. This is the easiest option - just log in, buy a cryptocurrency and leave it in your account. This way, you will not have access to your private keys; instead, the security of your coins will depend on security measures (and the protection of your own account).

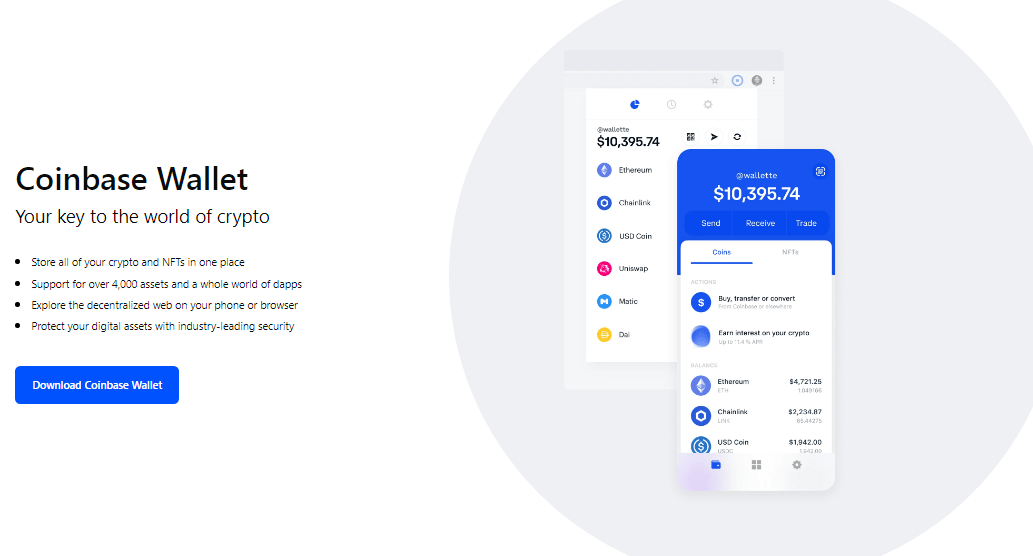

Coinbase Wallet

You can also choose to move your holdings to a separate wallet software, Coinbase Wallet. This is a standalone application that, unlike leaving your coins on Coinbase, gives you control over your private keys. This control means that you can do more with your cryptocurrencies, such as moving coins between wallets and engaging in other decentralized financial activities that require crypto transfers and out-of-exchange payments.

How to use the Coinbase Wallet App

- Download the app for iOS or Android

- Connect your Coinbase.com account by clicking on "Connect now”In the notification or by selecting“ Connect to Coinbase ”from the Settings menu.

Coinbase Custody

The exchange also offers custody of cryptocurrency assets for institutions in the form of their custody program, which charges a setup fee of $ 100,000 and a minimum holding of $ 10 million, so you can see that it is aimed at banks, hedge funds and other financial institutions that would require such service.

For large financial organizations, custody services are a way to safely store their assets in a way that is insured. Client assets are held in separate repositories and Coinbase Custody operates its own nodes and validators and operates first-class institutional-level security and infrastructure standards. The escrow service also allows asset holders to stack their tokens and earn a team for their clients.

The platform has also set up an administration service for institutions Coinbase Prime, an integrated solution that provides secure storage, an advanced trading platform and world-class services, so institutions can manage their crypto assets in one place.

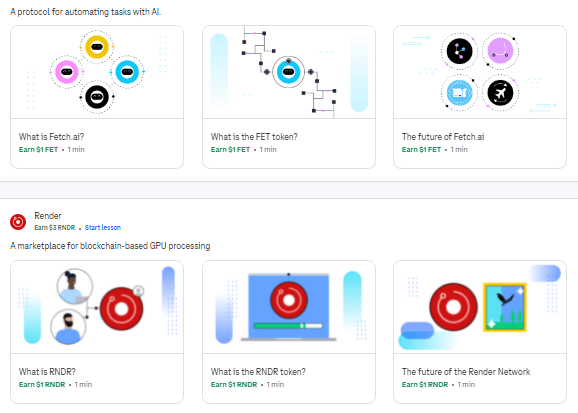

Coinbase earn

Education is a big part of investing in cryptocurrencies, especially for beginners. The exchange offers the Coinbase Learn Center with a beginner's guide to various coins and cryptocurrencies, regular updates on what's happening in the market, and recommendations for additional resources.

It also motivates users to actively learn through Coinbase Earn. You can watch short videos and take quizzes about specific altcoins, and the exchange office will put a small amount of this crypt in your wallet as a reward.

Stablecoin USDC

Coinbase also supports USDC (USD Coin), ERC-20 token and "stablecoin" with a price linked to the price of the US dollar. As a result, coin holders can always buy $ 1 Coin for $ 1.00 and protect themselves from digital asset volatility.

The USDC is created through the Center, a consortium that together holds $ 1 for each USDC, with funds held in a closely monitored and audited bank account. Stablecoins are issued by regulated and licensed financial institutions that maintain full reserves of equivalent fiat currency, and these issuers are required to report their reserves in USD on a regular basis, with Grant Thornton LLP preparing monthly reports about these holdings.

As a result, the USDC is fully transparent and the project operates under U.S. money transfer laws, and the CENTER open source technology project has received early-stage financial contributions from Circle and Coinbase to assist in the development. The company remains responsible for managing the currency and connecting a growing number of users and networks of different stakeholders.

In addition to support from Coinbase and Coinbase Pro, USDC is also traded on leading exchanges such as Binance, Bitfinex, Kucoin, OKEx and Poloniex. As an ERC-20 token, it also integrates with various wallets and can be used on decentralized platforms such as Bitpay, BlockFi, Dharma, Nexo, Melonport and Loom.

Deposits and withdrawals

Buying Bitcoin is a quick process with a credit or debit card at Coinbase. Purchasing by bank or bank transfer takes approximately 1-3 business days in most parts of the world before the transaction is settled. Cryptocurrency deposits do not cost you a penny (except for network fees) and their settlement speed depends on the speed of the blockchain.

For withdrawals, the exchange office allows you to receive funds back to your bank or PayPal account. It can cost you anything from $ 0.15 to $ 25 depending on your location and preferred method.

If you want to choose cryptocurrencies, you can do so by downloading them directly to your cryptocurrency. Selections of cryptocurrencies from Coinbase are free and the speed of their implementation depends on the state and occupancy of the network (the standard time is up to an hour).

Safety

The exchange states that it stores 98 % cryptocurrencies of customers offline, in cold storage (the remaining 2 % are used to facilitate trading volume). The exchange office also has a fuse to protect the possession of cryptocurrencies. Experts say robust measures like this are why a mainstream exchange like Coinbase could cost a little higher.

However, there is no guarantee that your coins will be restored to your wallet if your crypto is stolen in the event of a massive security breach. In that case, "we will do our best to accommodate you," says Coinbase on its website. "However, total losses can exceed the return on insurance, so your funds can still be lost."

The insurance also does not cover losses caused by unauthorized access to your personal account. In other words, if your identity is stolen or someone finds out the password to your account and steals cryptocurrencies from your wallet, you will no longer be able to access them.

Overview of other stock exchanges and exchange offices you will find here

Although it can be useful for faster trades, most people do not need to store cash on Coinbase. But any holdings of funds that you keep in the exchange office are associated with other users in one of three ways: held in US bank accounts or invested in US government bonds or financial market funds. Coinbase states that money deposited in bank accounts as cash is insured by the FDIC up to the current maximum of $ 250,000.

Other security measures include two-phase authentication, biometric login (such as fingerprint and Face ID), and data encryption. Always protect your personal security by using strong passwords, not repeating passwords across accounts, enabling two-factor authentication, and regularly monitoring your accounts for any unauthorized activity.

In addition, it is fully regulated by an exchange office and holds the various licenses required to operate in different countries.

Unfortunately, the exchange has still not removed the SMS-based 2FA verification method, although it has proven to be uncertain in the past. If you can, try avoiding 2FA based SMS.

The exchange office is taking several more measures to increase the security of its operations:

- Bitcoin and altcoins are geographically distributed from various repositories around the world.

- All site traffic is encrypted.

- Customer wallets and keys are all encrypted (AES-256 encryption).

- Employees undergo checks and must encrypt their hard drives.

- The exchange runs a bug bounty program that motivates coders to alert them to possible errors.

Overall, Coinbase has proven to be a highly secure cryptocurrency exchange office.

- Simple, easy to use interface

- Decent selection of proven projects

- Secure customer support 24/7

- Regulated

- Educational tools

- Strong security measures

- Relatively high fees

- No business charts

- Service availability varies by country

|

Závěrečné shrnutí

Coinbase is the world's leading cryptocurrency exchange, which has made the purchase and sale of cryptocurrencies accessible to almost everyone. If you are looking for a good and reputable currency exchange for your first purchase of cryptocurrencies, look no further - Coinbase is the place to go. If you are a more experienced trader, try another exchange from the company - Coinbase Pro, which is aimed at more advanced players in the crypto market. Overall, it's a good introduction to the world of cryptocurrencies and allows users to immerse themselves in the world of cryptocurrencies without feeling like it's a special new world. |

5.0

|

FAQ

Need a minimum balance to join Coinbase Pro?

No, the Pro trading platform can be used by all Coinbase customers, regardless of their account size.

Is Coinbase suitable for beginners?

Yes, due to the user-friendliness of its web and application interfaces, Coinbase is often considered one of the best cryptocurrency offices for beginners. However, experienced traders may want to look for a platform that provides more charting tools and / or charges lower trading fees.

How do I get my money from Coinbase?

Customers can select their cryptocurrency to fiat at any time via ACH transfer. These transfers usually take 1-2 business days to complete. Coinbase also supports 24/7 instant withdrawals to bank accounts or cards for an additional fee.

Does Coinbase offer any bonuses or other promotions?

Yes, new customers can get 5 $ in bitcoins after successfully verifying their account by providing their photo ID.