Between 2011 and 2021, the proportion of the world's adult population that had bank accounts rose from 51 % to 76 %, the results of the World Bank's latest survey - the Global Financial Index - showed. However, approximately 1.4 billion adults still do not have a bank account and do not have the money or identification needed to open a bank account.

You might be interested in: 7 FAVORITE WAYS TO BUY A BITCOIN CARD IN 2022

World Bank Survey – The creation of infrastructure plays an important role

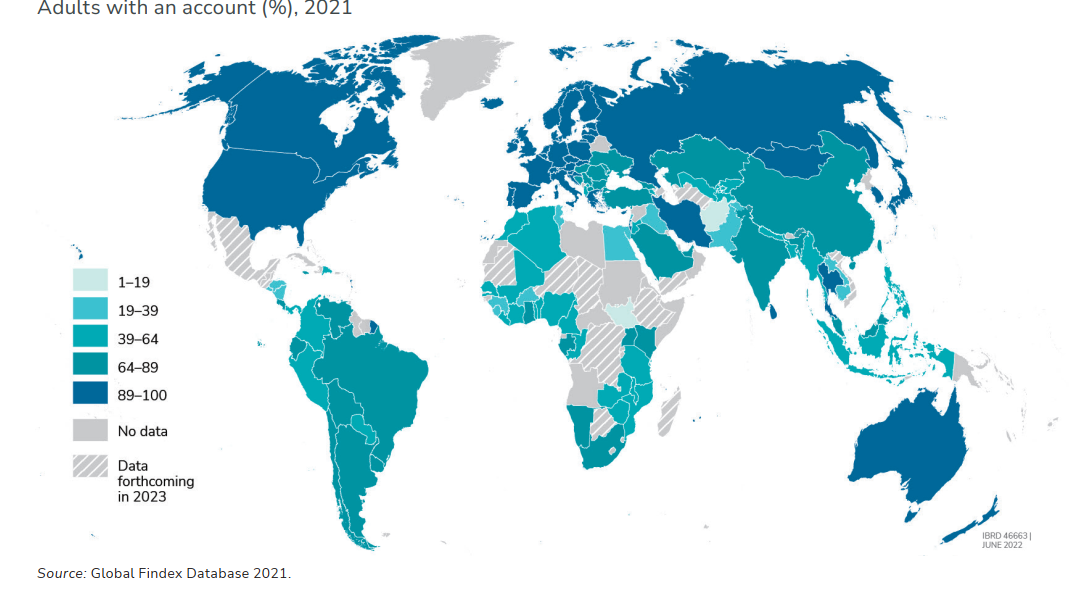

According to Global Financial Index (Findex) survey findings the percentage of the world's adult population with a bank account is now 76 %, a fifty percent increase from 51 % recorded in 2011. In developing economies, the average rate of account ownership increased by 8 percentage points between 2017 and 2021, from 63 % to 71 %.

While in the past it was China and India that accounted for most of the growth, the latest report notes that "recent growth in account ownership has occurred in dozens of developing economies."

As for sub-Saharan Africa, home to a significant proportion of adults without a bank account, the World Bank's survey results show that "55 percent of adults have an account, including 33 percent of adults who had a mobile money account." According to the survey, this is "the largest share of any region in the world and more than three times the 10 percent global average of mobile account ownership."

The same region is also home to about 11 economies where a larger proportion of adults "only had a mobile account, not an account with a bank or other financial institution," the survey report said.

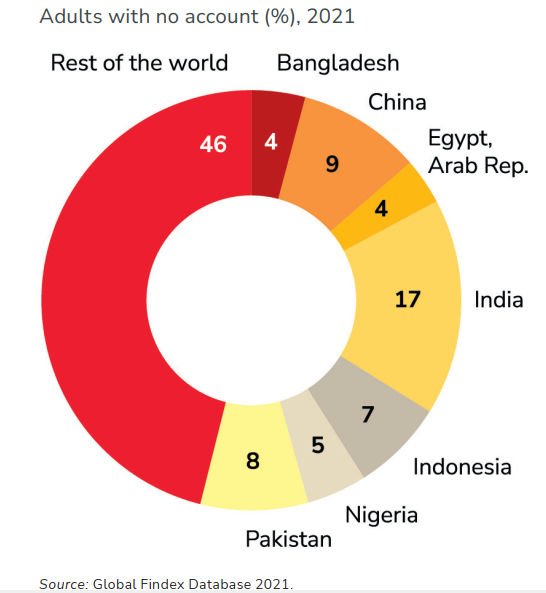

Despite the encouraging findings, the study found that up to 1.4 billion of the world's adult population still do not have a bank account. Reasons for this state range from lack of money, distance to the nearest financial institution and lack of identification documents needed to open an account.

However, the barriers preventing hundreds of millions of adults from opening bank accounts can be overcome once the infrastructure is in place to enable it, the survey report notes.

"The creation of infrastructure plays an important role. For example, global efforts to increase inclusive access to trusted identification systems and mobile phones could be used to increase account ownership among hard-to-reach populations."

The survey report concluded, like many other reports and studies before it, that the outbreak of the Covid-19 pandemic helped accelerate the rise in adoption and use of digital payments. To support this claim, the report points to India, where restrictions on people's movement have forced more than 80 million adults to make a digital payment for the first time. It seems that the trend will follow in other developing economies as well. Excluding China, “20 percent of adults [in developing economies] made a digital payment at a merchant in 2021.

Do not miss: WHERE TO BUY BITCOIN AND CRYPTOMEN