Vela Exchange, formerly Dexpools, is a decentralized trading platform built on the Arbitrum network. It offers advanced perpetual swap trading capabilities. It provides users with a secure and efficient way to trade cryptocurrencies in a decentralized manner. Using the Arbitrum network allows for fast and cheap transactions supported by a robust hybrid on-chain and off-chain architecture, making Vela an attractive option for those looking to trade digital assets.

The platform is designed to be user-friendly and offers a number of features aimed at improving the trading experience for its users. With a focus on security and privacy, Vela is poised to become a popular choice for those looking to join the growing world of decentralized finance.

Basic information

Page type Page type |

Decentralized exchange |

Easy for beginners Easy for beginners |

Yes |

Mobile application Mobile application |

No |

|

– |

|

2021 |

|

cryptocurrencies |

|

Cryptocurrencies |

|

4 |

|

6 |

|

medium |

|

very active – email, live chat, |

|

Yes, VLP, VELA |

Page Page |

https://www.vela.exchange |

Vela Exchange review

Vela Exchange was founded by Travis Skweres and Dan Peng. Both founders have extensive experience in technology and consulting. Skewres has been involved in the cryptocurrency space since 2012 and founded Portal Finance, which was acquired by the cryptocurrency exchange CoinbaseThe rest of the team worked on projects like Balancer, Black Rock, BCG, and Polygon.

Vela Exchange is a decentralized perpetual contract platform that aims to improve transaction speed and security of DeFi derivatives using a hybrid off-chain order book and on-chain settlement mode. According to official documents, Vela users can open positions based on asset performance with leverage up to 100x. Vela Exchange's reward structure is carefully balanced to manage token supply and rewards while maintaining high incentives for liquidity provision and trading.

An off-chain server caches specific data on-chain to improve performance, such as historical transaction data, notifications, configuration file data, language settings, etc.

The on-chain protocol has all open pools, collateral, VLP/VELA staking features and position management triggers. The data portal exposes APIs to third parties and pulls data from oracles and data providers.

All asset prices are fully maintained by the Vela team through a proprietary pricing service called Vela Stream and are designed to ensure performance, security, and flexibility. The platform currently pulls data directly from multiple CEX and on-chain sources into the Vela Exchange’s proprietary price feed. The Vela Stream price feed is published on-chain and is transparent for each tradable asset, reflecting a single aggregated price from the top CEXs in the ecosystem.

In order to conduct startup financing, fund management, liquidation, and delayed transactions (to reduce front-run transactions), Vela Exchange has access to the role of authority in the agreement to destroy or mint stablecoins in USD, but such stablecoins are not transferable and non-tradable. In urgent cases such as contract updates and contract amendments, Vela administrators have the right to suspend key contract functions in the agreement, except for withdrawal from the contract.

Vela Exchange fees

There are two types of trading fees on the Vela exchange: Position and Funding Fees.

Position fee:

- Crypto asset – To open a position, you will have to pay a fee of a maximum of 0.1 % of the size of the open position. The same amount must be paid to close the position.

- Forex Asset – To open a position, you will have to pay a fee of a maximum of 0.01 % of the closed position size. To close a position, you need to pay the same amount.

Financing fee: Once a position is opened, funding fees will begin to accrue based on how much is borrowed from the vault and the current financing rates (which resets every 4 hours and also depends on whether it is Long (L) or Short (S). The longer a position is held open, the higher the funding fee that will be paid when the position is closed.

Fee discounts

To pay fewer trading fees for any asset class, users can stake VELA and/or eVELA tokens.

| Stacked VELA + eVELA | Discount |

|---|---|

| 500 | 2% |

| 2,500 | 3% |

| 5,000 | 5% |

| 10,000 | 10% |

| 25,000 | 15% |

| 50,000 | 20% |

| 100,000 | 30% |

| 250,000 | 40% |

| 500,000 | 50% |

Vela Exchange instructions

On the homepage, click on “Connect Account”. This will connect to the desired wallet. Depending on the wallet, the wallet will make an authorization request to verify the connection.

Once the wallet is connected, agree to the terms and conditions and log in. This will require additional verification from the connected wallet.

Enter the desired username, email, phone number, and other required data (this can be skipped).

Once your wallet is connected, click on “Trade”.

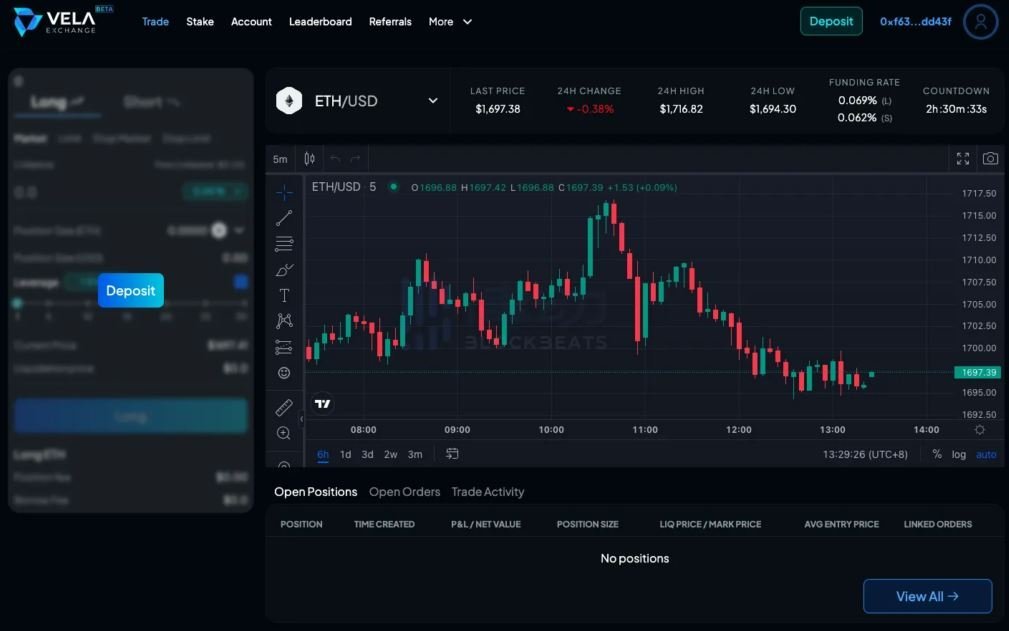

Trading

- To start trading on Vela, you can choose between long or short trades after making deposits.

- If you want to make a long or short trade, there are several risk management options. There are “market, limit, stop market, and stop limit.”

- Once the desired risk management option is selected, enter the amount of cryptocurrency that will be used as collateral.

- For a "market" order, the market order will find the corresponding price tag because it is automated. For a limit, the corresponding price tag can be selected manually.

- You can choose the leverage level before executing a trade. On Vela, it ranges from 1x to 30x.

- If you do not want to use leverage, uncheck the leverage box.

- To place an order, click either “Long” or “Short” and then confirm it.

- A transaction fee will be requested to confirm the order.

- Once this is confirmed, the trade will be executed and will appear under "open positions".

Closing and adjusting a position

Click on the "three dots" and select the desired action.

- It will display “close position, add to position, edit position, edit SL/TP and Add trading stop.”.

- Adding to a position requires the use of ETH. This ETH will be added to the existing position to increase the profit margin. (This is mainly used by traders who use leverage).

To adjust collateral, you can add or remove it from the collateral used. Removing it from the collateral used reduces the profit margin, and adding it brings in more profit.

- Adjust SL- Stop loss or TP- Take profit.

- SL is used to prevent a position from falling below a certain set price. You also choose the percentage to be closed from the open position.

- TP allows you to take profits without closing your position. For this purpose, a trigger price will be set, as well as the amount to be withdrawn.

- A trailing stop can also be added.

- To close a position, select "Close position" and select the exact percentage you want to close.

To confirm each one, Vela requests verification from the connected wallet and takes a transaction fee.

Staking

Click on the “stake” icon next to the menu bar. This is right next to the “trade” icon.

You can choose to either mint VLP or withdraw VLP. USDC is needed to mint VLP and VLP is needed to redeem VLP.

Option "VLP and Vela and eVela" is where both Vela can be staked in exchange for eVela and eVela can be staked in exchange for more Vela tokens.

Key Features of Vela Exchange

The trading process on Vela is similar to other decentralized exchanges and allows users to buy and sell cryptocurrencies using a secure and transparent platform. Some of the features offered by Vela include:

- Order book: Vela maintains a real-time order book that displays current buy and sell orders for a particular cryptocurrency. This allows traders to see the current market price and make informed decisions about their trades.

- Business couples: Vela offers a range of trading pairs that allow users to trade between different cryptocurrencies. This provides traders with flexibility and allows them to take advantage of price movements across multiple assets.

- Liquidity pool: Vela operates liquidity pools, like GMX, which are pools of funds used to provide liquidity to the platform. This helps ensure that users always have enough liquidity available to execute their trades, even during periods of high demand.

- Decentralized nature: As a decentralized exchange, Vela operates on the Arbitrum network and is not controlled by a single entity. This provides users with greater security and privacy compared to centralized exchanges.

- User-friendly interface : Vela is designed to be user-friendly, with a simple and intuitive interface that makes it easy for users to trade cryptocurrencies. The platform is also mobile-friendly, allowing users to trade on the go.

In short, Vela Exchange offers a number of features aimed at improving the trading experience for its users while providing a secure and transparent platform for cryptocurrency trading.

VELA token, VLP and tokenomics

Vela Exchange is supported by a robust token infrastructure that facilitates community member rewards and other tools.

VELA

The primary utility token of the Vela Exchange ecosystem. VELA can be traded on Arbitrum via Camelot DEX (VELA/ETH), Uniswap V3 (VELA/USD), and TraderJoe (VELA/ETH).

Passenger

A liquidity provider token that provides rewards and incentives to holders and stakeholders. Liquidity provider tokens, escrow tokens, and information on other aspects of the rewards infrastructure can be found in the section Rewards .

Tokenomics

The VELA token serves several key functions within the platform, including:

- Management: VELA holders have the opportunity to participate in the platform's governance, voting on key decisions such as upgrades and new features.

- Staking: VELA holders can stake their tokens to receive rewards for participating in the security and stability of the network.

- Liquidity provision: VELA holders can provide liquidity to the platform's liquidity pools and earn rewards in exchange for helping ensure that users have sufficient liquidity available to execute their trades.

- Business fees: VELA can be used to pay trading fees on the platform, providing a discount compared to fees paid in other cryptocurrencies.

- Access to premium features: VELA holders can access premium features of the platform, such as advanced trading tools and analytics.

The Vela Exchange tokenomics are designed to incentivize users to participate in the platform and support its growth. By holding and using VELA, users can benefit from lower fees, access to premium features, and staking rewards and liquidity provision. The token also provides a mechanism for decentralized governance, allowing VELA holders to shape the future direction of the platform. All of these use cases would create more demand to buy and hold the token.

Deposits and withdrawals

Below we summarize how to make deposits and withdrawals on Vela Exchange.

Deposits

- Click on “deposit.”

- Select the token you want to insert. (Currently, only USDC can be deposited).

- Click “approve” to grant the exchange permission to deduct the fee from the connected wallet.

- Select the amount you want to deposit and click deposit.

Another way to make a deposit is to click on “account”. Once you click on account and select a deposit crypto, it leads to the path just explained. Another alternative is to select the "cash in/cash out" option.

Through this, you can make deposits and withdrawals through integrated payment platforms that convert fiat to cryptocurrencies and vice versa.

Selections

To withdraw, users can use the “Cash in / Cash out” option and click to withdraw cryptocurrency. It will be sent to the desired bank accounts via integrated payment platforms.

Another method is to make a withdrawal from the “deposit and withdrawal” section. This will send the cryptocurrency to the connected wallet.

Affiliate program

Vela Exchange offers an affiliate program where you will receive up to 20% of all fees generated by your referred users who sign up using your affiliate ID. Your referral ID can be easily shared via Twitter, Telegram, or simply copied and pasted anywhere you want.

When the person you refer connects their wallet to the exchange, they will see the following pop-up window.

Accessible from the top navigation bar, this page will show you a detailed breakdown of all your referral fees earned, along with a list of all users who have joined using your ID.

Referral fees are paid automatically in USD, which can be withdrawn in USDC at any time.

Supported assets

Vela Exchange supports a variety of assets with prices derived from proprietary price sources. It offers 3 asset types; Crypto, Forex, and Marke Cap. Each of these asset types and pairs offered has a different funding rate and open interest limits due to varying volatility. As the reserve grows, VELA will add more pairs based on community demand.

Open Interest Limit: It is the maximum allowed $ for individual and sum of all user positions (same asset, same direction). As a risk management tool, there are different OI limits for each asset and direction.

Cryptocurrencies

VELA currently offers the following pairs:

- BTC / USD

- ETH / USD

- DOGE / USD

Leverage range: 1x to 30x

- SOL / USD

- AVAX / USD

- MATIC/USD

- ARB/USD

Leverage range: 1x to 50x

Crypto markets are always open, there are no time restrictions and gaps that would affect order strategies such as stop loss.

Forex

- EUR/USD

- GBP/USD

- USD/JPY

Leverage range: 1x to 100x

Unlike crypto markets, Forex markets are not always open.

Market Cap

- USDC Mcap/USD

Leverage range: 1x to 30x

Market Cap is directly linked to the crypto markets, so it is always open, there are no time restrictions and gaps that would affect order strategies.

Conclusion

Vela Exchange is one of the latest protocols to enter the growing DEX category. Frankly, there aren’t many decentralized derivatives trading platforms on the market, although the number of projects is growing. Vela Exchange uses GMX’s GLP-incentivized liquidity model and also offers incentives for market makers, ensuring that the protocol will perform when it comes to attracting liquidity.

Vela has learned a lot from its predecessors. The highly competitive environment in favor of Vela Exchange means that the protocol must stand out from the crowd by providing best-in-class UX, CEX-like features, and security. Trading cryptocurrencies can be risky, ensure that a proper risk management system is in place and do your own due diligence before taking a trading position.