Bitcoin (BTC), the largest cryptocurrency in the world, saw a sudden rise after the announcement of the US inflation rate. BTC prices have increased by 25 % in the last few days. However, the expert suggests that one should check whether the growth is organic.

You might be interested in: 7 FAVORITE WAYS TO BUY A BITCOIN CARD IN 2022

Is whale accumulation really the main factor in growth?

Cryptoquant analyst IT Tech has published its address data distribution of bitcoin balances, to check if this is whale accumulation or rebalancing of wallets by exchanges. The author mentioned that many addresses with 1k to 10k BTC have reduced the amount of coins held. However, addresses holding 10,000 or more have increased the amount of BTC.

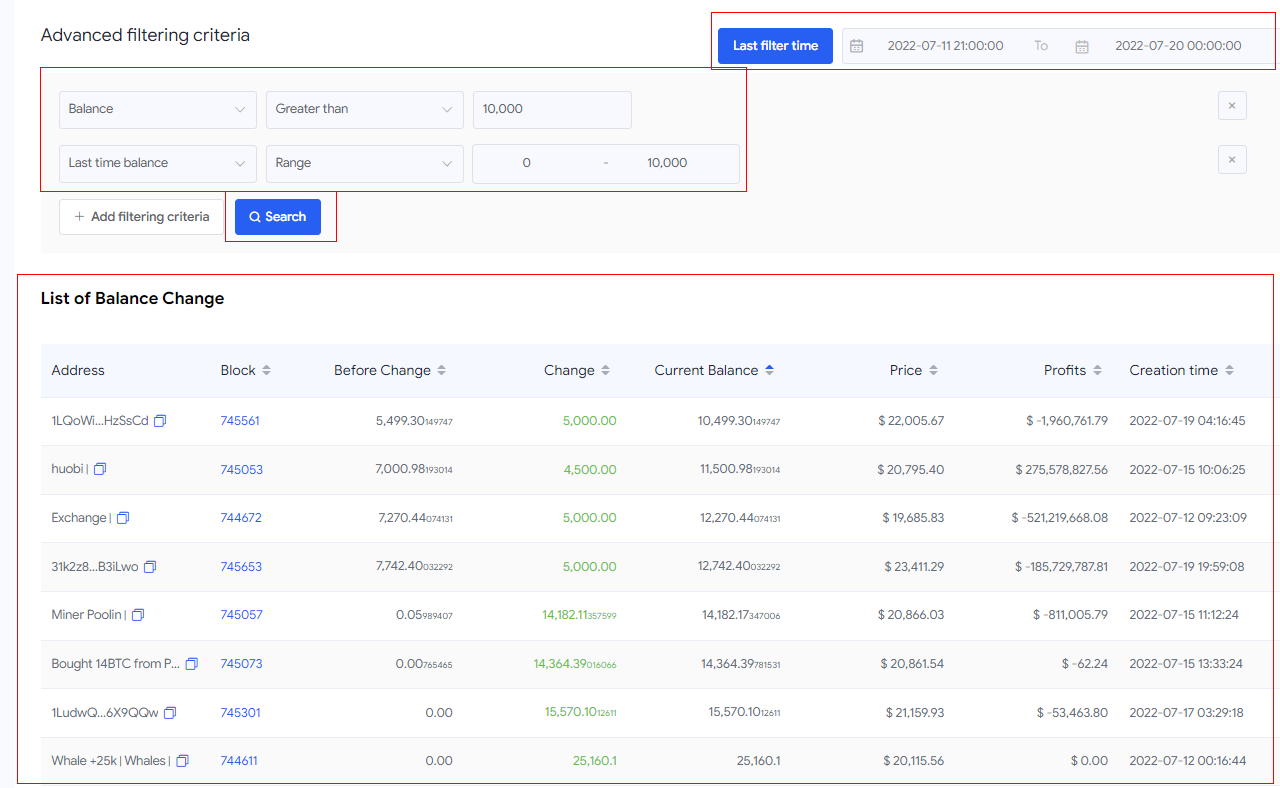

Another report shows data from 07/11/2022 to 07/20/2022 and shows that the number of addresses holding between 1k and 10k BTC has decreased, but the number of addresses holding more than 10k BTC has increased from 94 to 98. He added that he checked all addresses in this period and found that 4 out of 8 addresses still have values over 10k+ and assumes that these addresses belong to exchanges.

I set the time range and advanced filters as follows. Result – 8 addresses.

The analyst concluded that the number of addresses does not indicate who is behind these transactions. People might assume that whales accumulate more. But these were not whale addresses. He added that investors should be wary of rumors circulating on social media.

Another trader and analyst known as Capo commented on the same topic. According to him, Bitcoin is now at a moment of decision. The market is starting to decide whether the next move will be accumulation or rebalancing.

In the first case, investors start buying and accumulating BTC, setting the market up for a cycle of appreciation, and as the rebalancing occurs, there are several sell-offs, especially among small investors.

But Capo says the current move looks more like a rebalancing due to a number of factors. First, accumulations typically have larger ranges, and the current range is small, he said.

According to him, indicators suggest that the current increase is likely to be temporary. He calls the latest price jump a "water bomb" and is confident that eventually a correction will occur again. However, the analyst did not make predictions about the intensity of the devaluation.

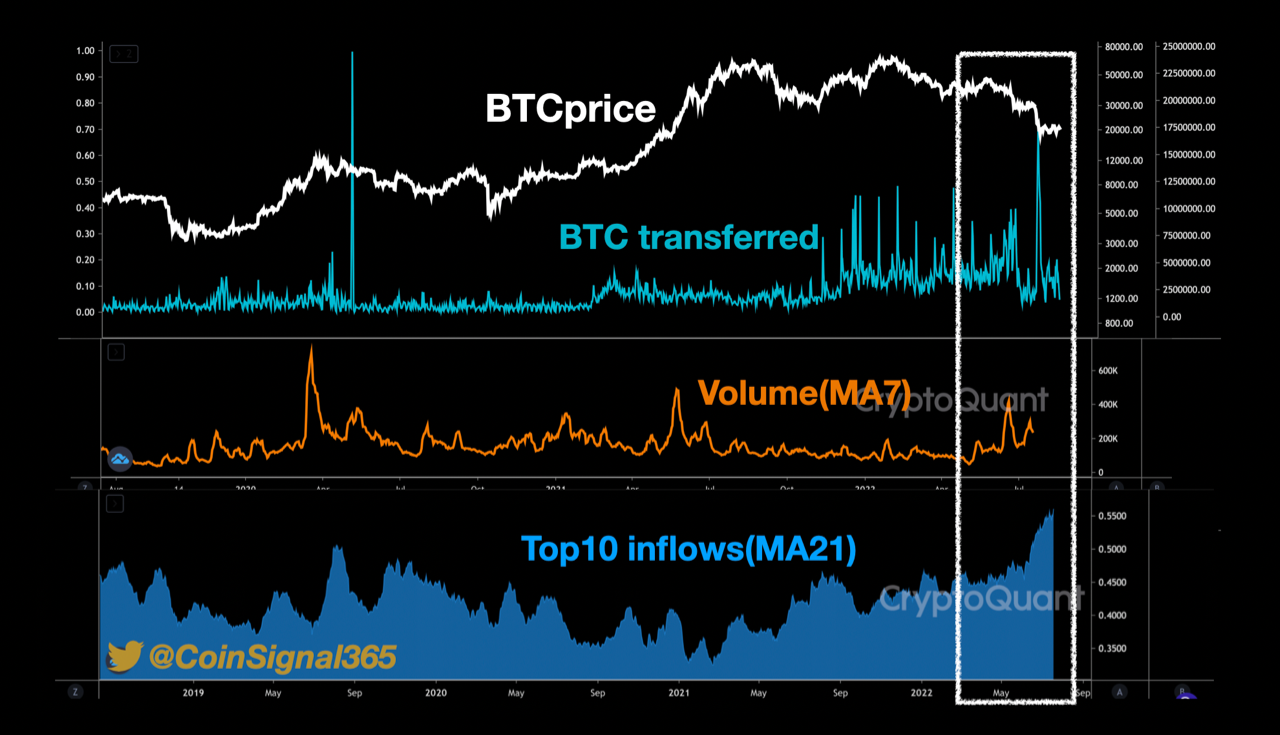

On the other hand, according to cryptoquant the global crypto market is recovering for the first time after the recent crash. The amount of tokens transferred is small, but the volumes are increasing. However, the trend of whale deposits on stock exchanges is at an all-time high.

Do not miss: WHERE TO BUY BITCOIN AND CRYPTOMEN