Have you heard of PancakeSwap, decentralized financial protocol? IN in this comprehensive guide we will delve deeper and say, how to use it to trade, provide liquidity and stack your CAKE tokens.

The DeFi sector continues to build dynamics with constant development and new, innovative solutions. One of the trends in the field of DeFi is the creation of various farming protocols with a food theme. Many DeFi protocols has recently evolved with the ability to allow users to stack their funds and earn rewards. The main part of such DeFi protocols is based on the Ethereum blockchain network.

While Ethereum has a huge community of users and developers along with tools to develop high-performance DeFi solutions, PancakeSwap uses the BNB Chain.

What is PancakeSwap

PancakeSwap is a decentralized exchange on the BNB chain and facilitates the exchange of BEP-20 tokens. Although it is the largest of the DEXs on the Binance Smart Chain, there are DEXs that have significantly higher average trading volumes on Ethereo, such as Uniswap.

BEP-20 is a type of native Binance Smart Chain tokens. BEP stands for BSC Evolution proposal. ERC-20 tokens can be converted to BEP-20 tokens via the Binance cross-chain bridge. If you do not have a Binance account, you can use any of here bridges to pack their tokens to the BEP-20 standard.

PancakeSwap was launched in September 2020 and the platform is regularly audited and verified by security companies such as Certik and SlowMist. The identity of the developers is unknown. PancakeSwap is a fork of Uniswap.

Before explaining how to use PancakeSwap, we will first discuss how it works and tokenomics. We also explain many important features in detail.

PancakeSwap uses an automated market maker (AMM) model. Trades are executed securely and automatically using protocol liquidity pools, which are created through smart contracts. Instead of looking at a list of orders and looking for someone to exchange your tokens with, PancakeSwap users will lock their tokens into liquidity pools using smart contracts. This will allow you to exchange as many tokens as you want while users become liquidity providers (LPs) and deposit their shares in the fund to earn a share of trading fees and other rewards.

The native PancakeSwap token is called CAKE and works mainly as a control token, but it can also be used for staking and other DeFi-specific options. The main functions of PancakeSwap (which are displayed in their top menu) are:

- Trade: includes trading, limit orders, adding liquidity

- Earn: yield farming

- Win: lottery

- NFT

Pancakeswap reviews

Trading

To use all these features on PancakeSwap, you must first connect your wallet to the app. The most used wallets include MetaMask, TrustWallet and Binance Chain. Before you start looking for a way to use PancakeSwap, make sure you have a compatible wallet.

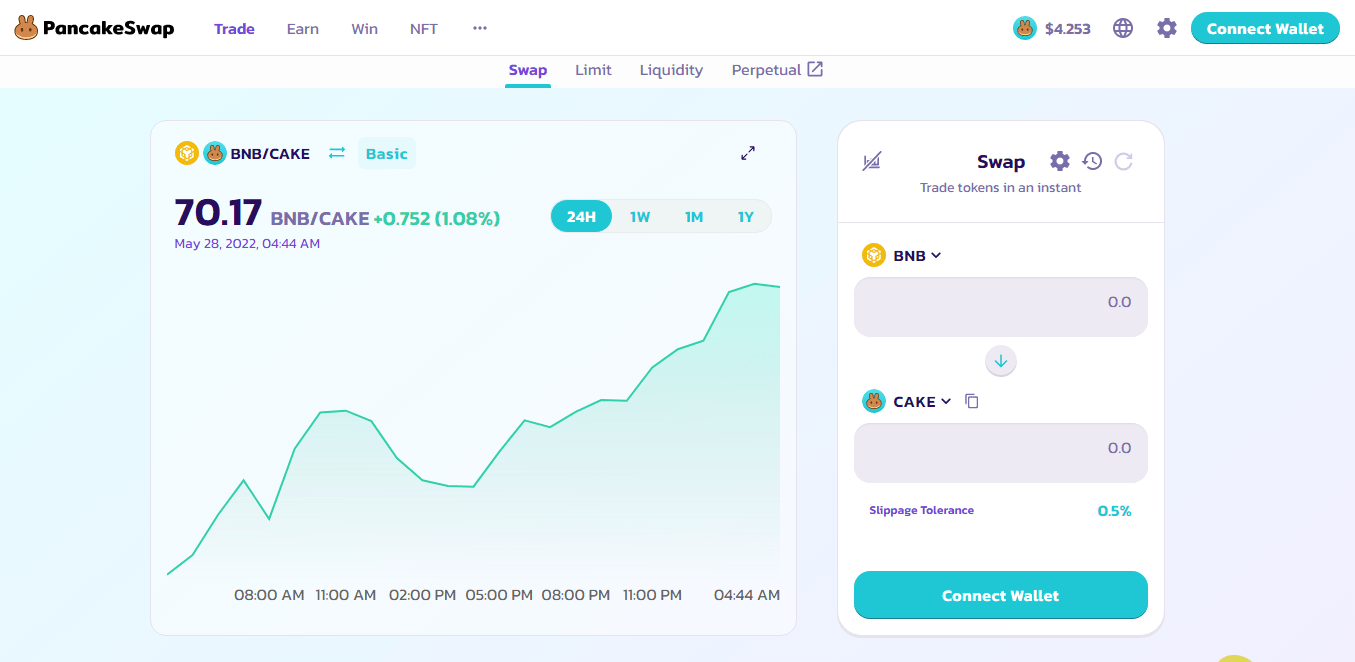

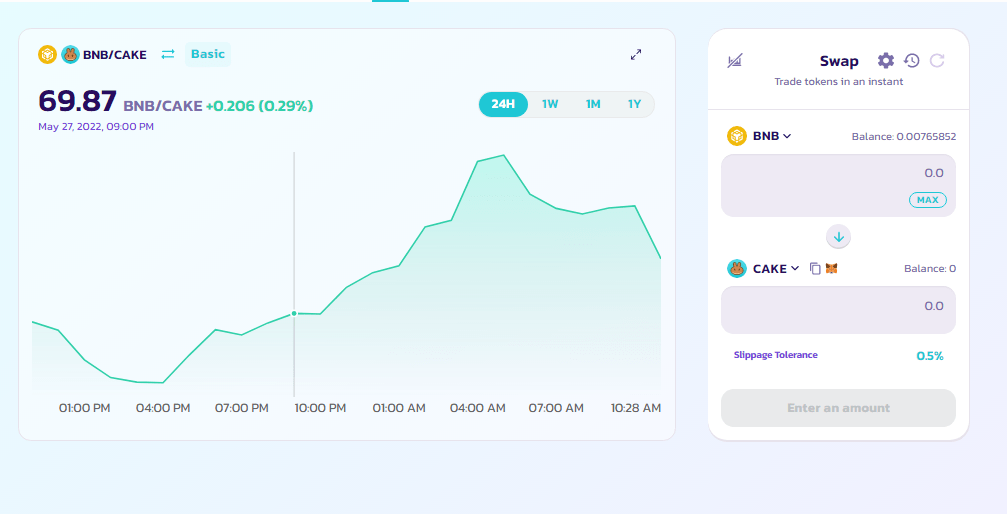

The trading function is similar to other AMMs and facilitates the trading of cryptocurrencies on the BNB Chain. At the heart of PancakeSwap are the three options that all AMMs now have: trading, liquidity pool and limit orders.

Trading on PancakeSwap is straightforward, and you can access this option by clicking on "Trade" and selecting the pair of tokens you want to exchange.

If you want more control over your store, you can use the feature Limit Order, which allows you to place trading orders at a set price, not the current market price. For both normal and limit orders, traders can adjust the default transaction speed (standard, fast, or instant) as well as the slip tolerance, as you would for regular trades.

Traders can also ban multi-hops for their trades if they only want to trade direct couples. If you have previously used AMM, you need to be familiar with how you can add liquidity to the protocol.

You can find the option in the section Trade > Liquiditywhere you can choose the two coins you want to put in the liquidity pool. However, before using this feature on any DEX, make sure you understand the temporary loss. After you successfully deposit liquidity on the protocol, you will receive LP tokens, which represent your share in the liquidity pool.

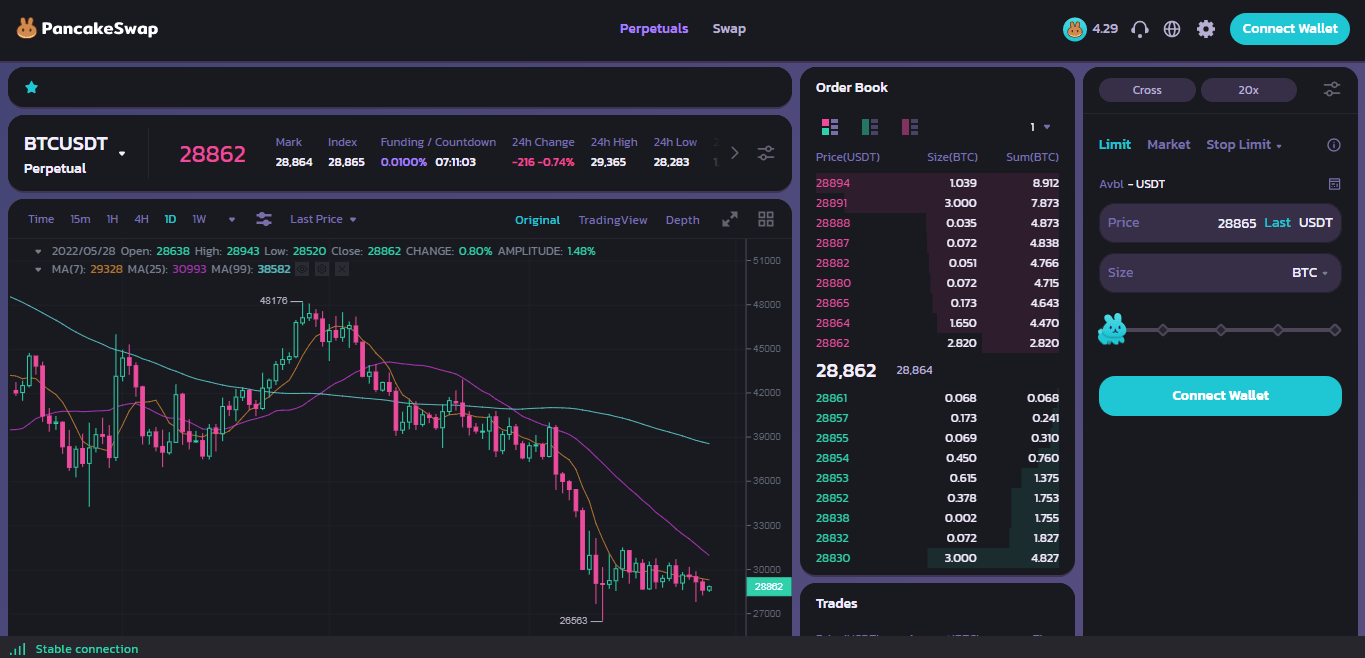

In section Perpetual you can trade derivatives for trading in the underlying asset without an expiration date.

Perpetual

It allows users to trade on margin (trade with borrowed funds) and be capital efficient, ie instead of having capital to trade the large face value of the underlying asset (say 10,000 BTC), users can only enter part of the face value and use leverage. Users can trade in both directions by buying (long) and selling (short), which is crucial in the current market volatility. In short, users use borrowed funds to bet on the future price of an asset.

Earn

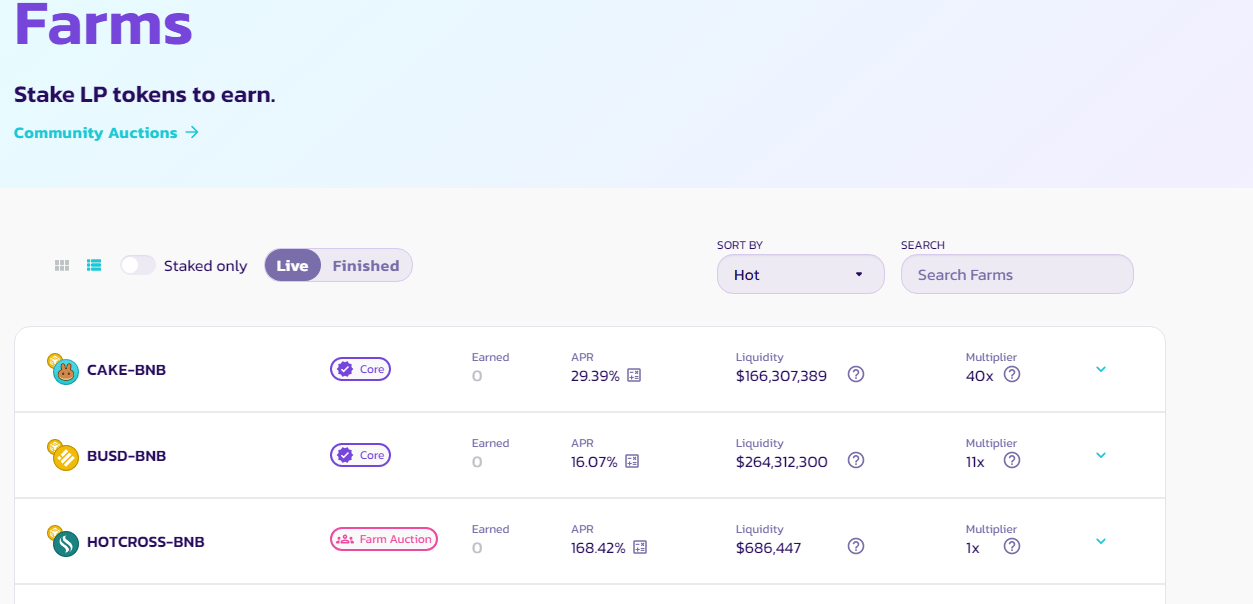

As with other DEX, you also receive rewards through Yield Farming on PancakeSwap. After receiving an LP token from your liquidity pool, you can use it to generate revenue. Different LP token farms promise different yields.

Available farms can be found in the section Earn> Farms. This is a list of incentives where they can stack their LP tokens to earn rewards. These pools can only generate rewards for a limited time and you will need to cancel your LP tokens if you want to withdraw the liquidity provided by the protocol on the Liquidity card. In addition, the liquidity provided will not appear on the Liquidity tab if LP tokens are stacked on farms.

Farm Aution

Every two weeks, PancakeSwap (PCS) holds a weekly auction of community farms. Projects included in the list of allowed may apply for the right to operate a liquidity farm. All CAKE bid winners are burned, this is good for PCS because it reduces the supply of their token and is one of the main benefits for PCS of these auctions.

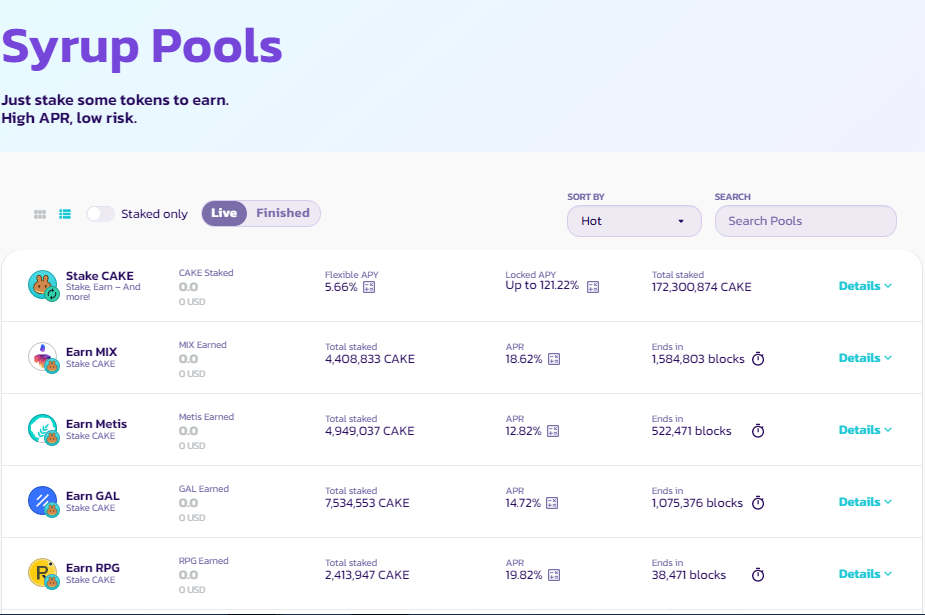

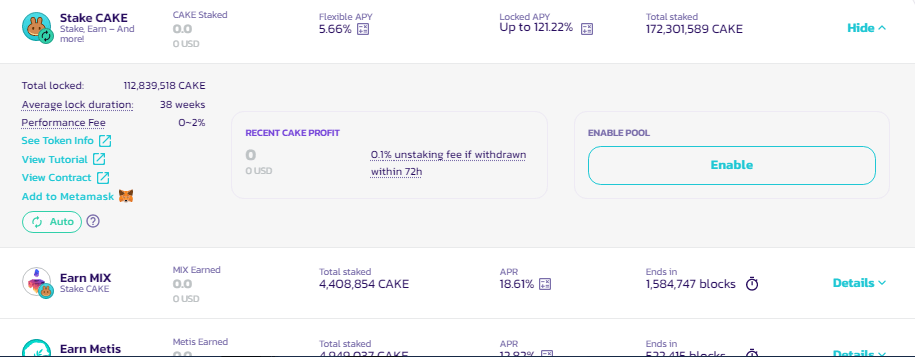

Another feature is Syrup Pools, which allow merchants to stack CAKE tokens to obtain more tokens. These are also pools motivated by the various projects listed. However, Pools Syrup does not pose a risk of temporary loss and is an easy way to generate more rewards.

Some pools have yields over 100% APR. There are two types of pools for stacking your CAKE to generate more profits - Auto and Manual CAKE:

- Auto CAKE - Pool automatically generates rewards. This means that CAKE's crypto rewards can be automatically re-invested in the same pool.

- Manual Cake - Merchants must manually collect rewards to multiply their earnings.

CAKE tokens stacked in Syrup pools can be selected at any time.

Win

On the Win tab, PancakeSwap users will find other ways to improve their crypto portfolio. This includes trading competitions, price prediction for BNB, this option is a Beta phase and users cannot cancel or modify it after entering a position.

You can join the lottery and try your luck for some promising rewards. LOterie can take about 6 hours and you have to attend with tickets.

One ticket costs 10 CAKE tokens and includes a random combination of four numbers between 1 and 14. There is a jackpot of 50 % from the entire lottery pools at stake. Ticket numbers should match the four winning ticket numbers in exactly the same order. You can also win rewards if two or more numbers in your ticket are in the same position as the winning ticket.

NFT

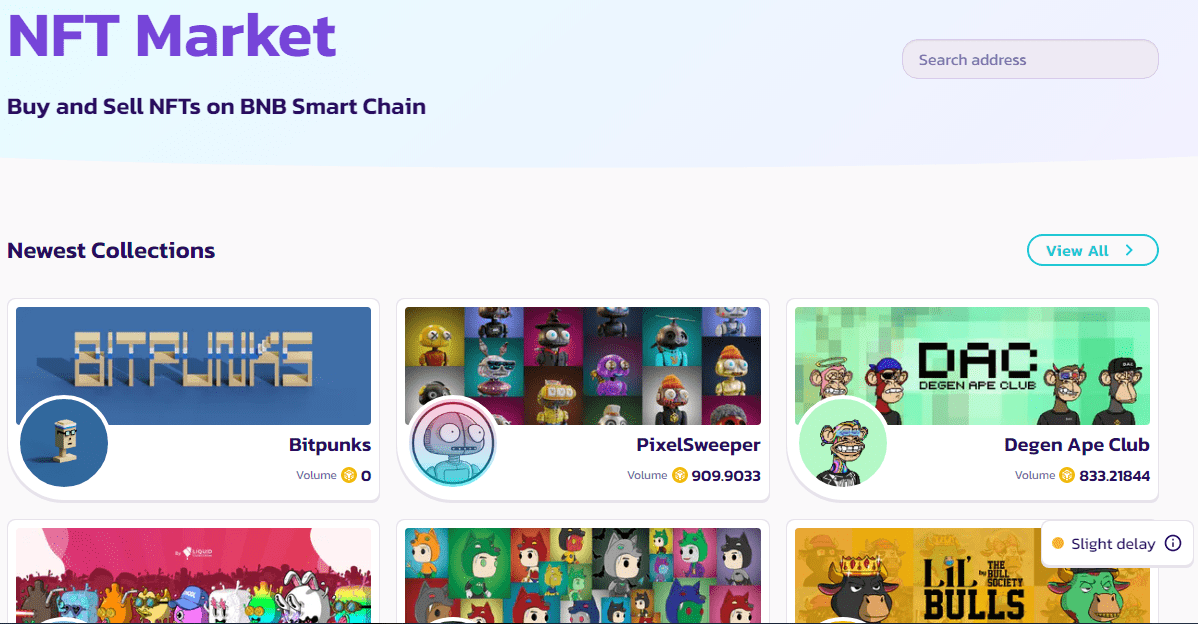

PancakeSwap offers an NFT marketplace for users to buy and sell NFTs on the BNB Smart Chain.

The NFT collections displayed are categorized as Recent Collections, Hot Collections, and Recent Items. The platform charges 2 % from any NFT sale and uses these fees to repurchase CAKE tokens and burn them weekly. NFT creators can earn royalties for their digital art. Anyone can become an NFT artist if they apply via the NFT application form.

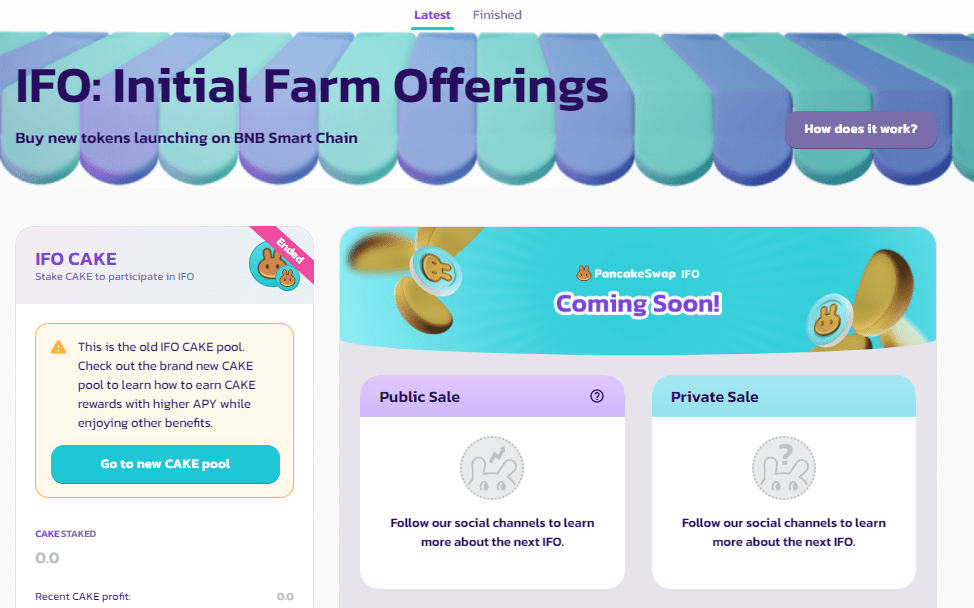

IFO (initial farming offer)

New projects can use IFO (Initial Farm Offerings), which help them get their tokens into the hands of users through revenue management. PancakeSwap facilitates this by requiring LP tokens from each staking pool to be kept in the log in order to gain access to token sales. This dynamic creates rewards for liquidity providers and supports the creation of an initial liquidity token pool.

Token Cake

CAKE is a native and control PancakeSwap token and was launched in September 2020. It is a native BSC token BEP-20. The primary purpose of CAKE is to support the provision of liquidity to PancakeSwap. For beginners who want to know how to use PancakeSwap, the most important thing to note is that CAKE is the center of everything.

Native token CAKE does not have a maximum supply, which means that the protocol regularly burns tokens to reduce its inventory. Approximately 364,400 CAKE tokens are minted each day and distributed as follows:

- Syrup pool: 288 000 CAKE

- Farms 72 400 CAKE

- Lottery fund 4,000 CAKE

Repurchase mechanism and PancakeSwap tool

The PancakeSwap team also uses several mechanisms to repurchase CAKE tokens and burn them on a weekly basis:

- 100 % CAKE tokens used in profile creation and NFT embossing

- 20% CAKE used in lottery tickets

- 100 % CAKE participation fees at IFO

- 3% CAKE from each round in the prediction markets

- 2% CAKE from each yield harvest in the CAKE automatic fund

- 0.05% CAKE from each store on PancakeSwap v2

- 100% CAKE from the winners of the farm auction

- 100% CAKE from NFT market platform fees

What is the CAKE token used for? As you can see, PancakeSwap offers many features that include the use of CAKE. These are the following:

- Administration: Users can use it to vote on new features on the PancakeSwap platform (new pools, etc.).

- Staking: Holders can stack their tokens to gain more CAKE or other tokens in the Syrup pools.

- Farm: Holders can use it to store liquidity and earn more rewards at the farm.

- Win: Holders can use CAKE to purchase lottery tickets.

- NFT: Users must pay fees for the NFT platform in CAKE.

CAKE tokens reached their historic high on April 30, 2021, when they peaked at 44.18 $.

The CAKE token can be traded on most centralized exchanges, such as Binance, Gate.io and KuCoin, as well as DEXs, including PancakeSwap.

Pancakeswap tutorial

Like other DEXs, PancakeSwap offers an easy token exchange platform in the BNB Chain. You will need some BNB (native coin in the BSC network) in your wallet to pay the fees, no matter what operation you are going to perform on PancakeSwap DEX.

Step 1. Attach your wallet to PancakeSwap

The first thing you need to do with any decentralized application (DApp) is connect your wallet. Otherwise, you will not have access to any of the DApp functions. PancakeSwap supports many different private wallets, including Metamask, Binance Chain Wallet, Coinbase Wallet, TrustWallet, WalletConnect and more.

After clicking on Connect Wallet you will see a list of supported wallets.

Step 2. Go to the Trade page

On the page, you can select tokens and the amount you want to exchange. If this is the first time you have traded this token on PancakeSwap, you will need to enable it before you can exchange tokens on PancakeSwap DEX.

Enabling this particular token means allowing DEX to access it, and you will need to confirm this action from your wallet. As with any blockchain promotion, this counts as a transaction (a fee will be charged) and you will need to confirm the transaction from your wallet.

After you enable tokens from your wallet, the Swap option appears on PancakeSwap.

Step 3. Trade tokens on PancakeSwap

Note that you can adjust the slip tolerance and other settings from the settings menu. When you are ready, click Swap. A pop-up window will appear listing all the details of your store. Click on Confirm Swap. Please note that if you wait too long, the price will change and you will have to accept the updated price.

You will then need to confirm the transaction from your wallet. After confirming the swap from your wallet, the transaction is sent to the blockchain and displayed as pending on PancakeSwap. After a few moments, the transaction will be completed and you will receive this message. You can view all the details of your transaction on BscScan.

Please note that new tokens may not be visible in your wallet interface. In this case, you may need to import the addresses of the amrt contracts into your wallet. Each wallet has a different option. The addresses of the token agreements can be found on the BscScan transaction confirmation.

Limit order

Limit orders allow you to obtain swaps at required prices by leaving instructions to fill out orders to buy or sell at specific prices. The trade will only be executed if the price on PancakeSwap reaches your limit price (or better).

How to stack CAKE token?

As we mentioned, learning to use PancakeSwap and using CAKE tokens go hand in hand. Let's see how easy it is to stack CAKE tokens on PancakeSwap. We assume that you have already connected your wallet to DEX.

Step 1. Go to the Pools page

To start stacking CAKE tokens and generate additional CAKE tokens or others through Syrup pools, you'll need to go to the Earn> Pools. On the Pools page, you will see all the different pools to which you can lock your CAKE tokens.

Step 2. Select and enable the Syrup pool

We assume you already have CAKE tokens in your wallet. If you do not have any CAKE tokens, you can use the PancakeSwap swap option to buy and sell CAKE.

Note that you can choose between CAKE pools and other pools depending on what rewards you are looking for. If you want to generate more CAKE tokens from your already owned CAKE, you can choose one of the CAKE pools (automatic or manual).

If you want another token, feel free to browse the list. You can also sort the pools (Hot, APR, Total Stake, Earned, Latest). Once you have decided on the pool in which you want to insert your CAKE token, click on it and the options for inserting your CAKE will appear. If this is the first time you have entered your CAKE in this pool, you will need to enable the fund, which is associated with a fee.

Step 3. Click CAKE

After activating the fund, the option will be available Stake. You can then choose how many CAKE tokens to insert into this pool. Click on Confirm. You will need to confirm the transaction from your wallet.

How to add liquidity to PancakeSwap?

If you want to generate passive income from your cryptocurrencies held, you can add liquidity to PancakeSwap and get a portion of the trading fees paid by those who use the trading feature.

Liquidity providers earn 0.17 % of all trades on this pair in proportion to their share of the pool. Fees are added to the pool, increase in real time and can be claimed by withdrawing the liquidity provided. Before proceeding, make sure you understand the risks involved in providing liquidity, such as Impermanent Loss (volatile loss). This may affect your potential liquidity gain on any AMM DEX.

Step 1. Go to the Liquidity page and choose your pair

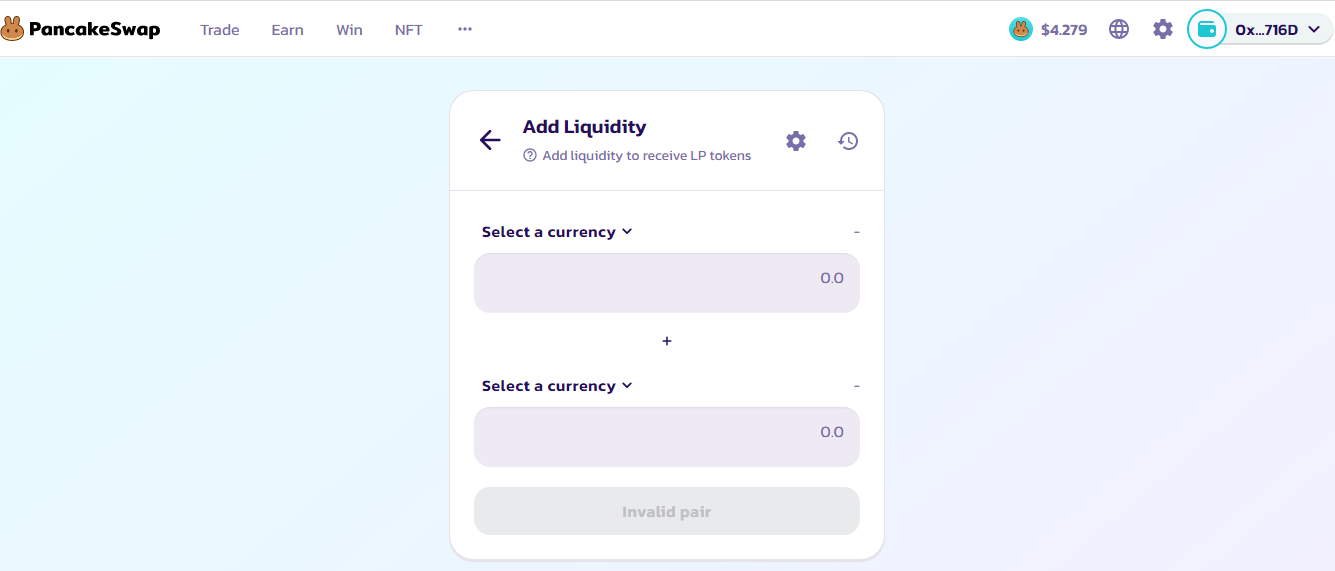

To add liquidity to the PancakeSwap protocol, go to Shop> Liquidity. Click Add Liquidity and select the tokens you want to insert into the liquidity pool.

Step 2. Select the tokens you want to add as liquidity

As with any AMM DEX, you will need to enter the same amount of two different tokens when adding liquidity. You can choose any pair of chips and you will receive LP chips that will represent your deposit in a particular liquidity fund. Note that there are special incentive funds that allow you to bet your LP tokens to get even more rewards. Not all LP chips can be wagered, so make sure you have the current funds below Farmami .

Step 3. Deposit liquidity on PancakeSwap

After you select a few tokens to save, you will receive a summary of your deposit stating how many LP tokens you will receive. You will need to confirm the transaction from your wallet.

After a few moments, you will receive a confirmation from PancakeSwap and your wallet that the smart contract transaction has been completed. You should now see the liquidity provided on the page Liqudity.

Fees

Fees for recipients and creators are 0.20 %.

Safety

As with other decentralized exchanges, the question "is PancakeSwap safe" is becoming inevitable. For starters, auditing with an external auditor such as CertiK has the advantage. However, audit and security functions do not necessarily mean that your funds are safe on the stock exchange. You have to face the risks of bugs and vulnerabilities in PancakeSwapbecause it runs on smart contracts.

Benefits

- High return APY.

Disadvantages

- The BSC trading process is complex.

- Risk of temporary loss in liquidity pools.

Conclusion

If you want to trade BEP-20 tokens that are native to the BNB Chain, you will most likely choose the PancakeSwap application as the default DeFi. The protocol offers many different functions, from cryptocurrency trading to staking tokens. Users can participate in yield farming and other DeFi operations.

Pancakeswap is definitely the main competitor of other major decentralized exchanges. Other different functions on the stock exchange, such as lotteries and NFT rewards, also represent a strong argument for the platform. In addition, the possibilities of the BNB Chain also serve as a fundamental support for the growth of the decentralized stock exchange. However, concerns such as "PancakeSwap is safe" continue to be a barrier.

FAQ

Is PancakeSwap Exchange better than Uniswap Currency Exchange?

PancakeSwap and Uniswap are both automated market makers (AMMs) and both offer the opportunity to earn high interest rates by providing liquidity. The only real difference between these two decentralized exchanges is the blockchain network on which they are. It could be argued that PancakeSwap is better because the network fees on Binance Smart Chain are much lower than Ethereum (Uniswap network) and PancakeSwap offers pools without permanent loss (Syrup Pools).

What is slippage on PancakeSwap Exchange?

Slippage refers to the difference between the expected price of a trade (what you see) and the price at which the trade is executed (what you get). Slippage on PancakeSwap indicates the amount you can receive if the price of the assets you exchange fluctuates during the trade. Setting up a slippage will cause your transaction to fail if the slippage is larger than you set, which will save you from getting less for the swap than you wanted.

How to add liquidity for farming to PancakeSwap exchange office?

In order to add liquidity to a PancakeSwap exchange office, you must have two assets that are a valid liquidity pair, such as CAKE and USDT. There is a "Liquidity" option in the same "Trade" section as "Exchange". Once you click on it and unlock your wallet, select the two assets you want to provide liquidity to (amounts will need to be equivalent, such as $ 100 in CAKE + $ 100 in USDT) and then click on "Supply". Once you approve the transaction, you will receive Liquidity Pool (LP) tokens in your wallet. Go to "Farm", find the pair you have chips for, and then add them to the pool to start earning rewards.

What is an impermanent loss on a PancakeSwap exchange office?

Impermanent loss occurs when you provide liquidity to a liquidity fund and the price of your deposited assets changes compared to when you deposited them. The greater this change, the more you are exposed to volatile loss. This is a paper loss until you remove the liquidity, there is an actual loss and the amount fluctuates with the price of the deposited assets.

What is CAKE?

CAKE is a native PancakeSwap Exchange token. It can be invested in Syrup Pools funds for returns in CAKE or other assets or combined with another asset as a pair of liquidity funds to generate returns.

Where can I buy CAKE tokens?

You can buy CAKE on both decentralized and centralized exchanges including:

Binance exchange

KuCoin Exchange

Crypto.com Exchange (buy and sell only at this moment)

PancakeSwap

OpenOcean