Nexo is a crypto alternative to the three main banking services - savings account, loan and credit card. The company was founded by Michael Arrington, founder of TechCrunch in 2017. The platform is known for daily interest payments, term deposits on fiat (with higher customer verification) and perhaps the simplest crypto loan ever. This Nexo review will analyze and evaluate all the features, and finally provide you with a Nexo guide and a concluding conclusion.

| ✅Full name | Nexo Capital Inc. |

| ✅Easy for beginners | No |

| ✅Mobile application | Yes |

| 🌍Company headquarters | Zug, Switzerland |

| 💰Loan | over 40 fiat currencies |

| 📉Supported stablecoins for loan disbursement | USDT, USDC |

| 📉Supported shares for EARN savings account | list |

| 💰Payment of interest | daily |

| 📉Number of pairs available | 313 |

| 📉Cryptomens on the stock exchange | 145 |

| 👮♂️Trust in society | medium |

| ☎Customer support | email (support@nexo.io), online form, live chat |

| ✅Does not support | so-called pegged wrapped coins on foreign blockchains (only natively, ie USDT on Ethereum blockchain, etc.) |

| ✅Cryptocurrencies accepted as collateral | list |

| ✅Page | Nexo.io |

Behind the company is the Bulgarian Credissimo (European fintech group founded in 2007) specializing in non-bank loans and doing business in five European countries. The group is known for providing P2P loans to Mintos.

Products and Nexo reviews

EARN "savings" account (cryptocurrency)

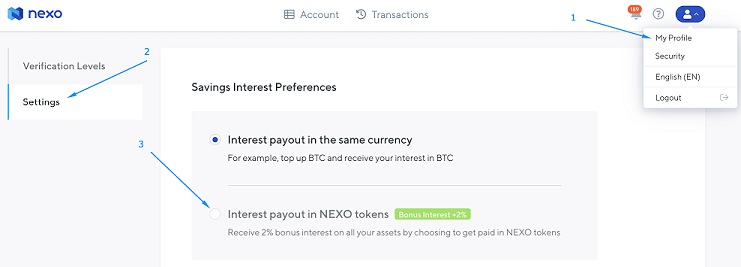

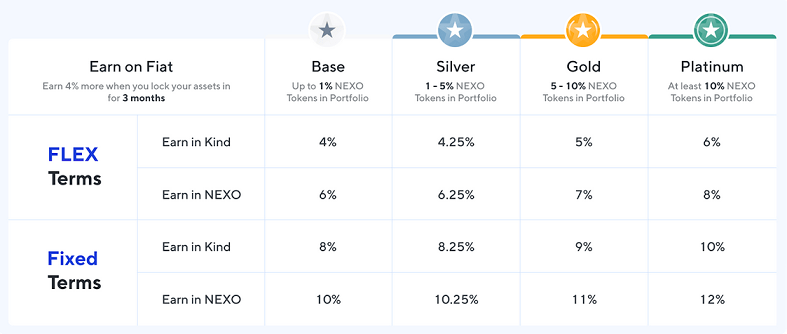

The savings account allows you to pay interest every day and calculate it immediately after making a deposit. No minimum amount. They offer the same savings for 2 fiat currencies - EUR and USD. Unfortunately, the minimum charging amount here is 1000 EUR and 10 GBP (pounds). If you get paid in their token, you have +2 %.

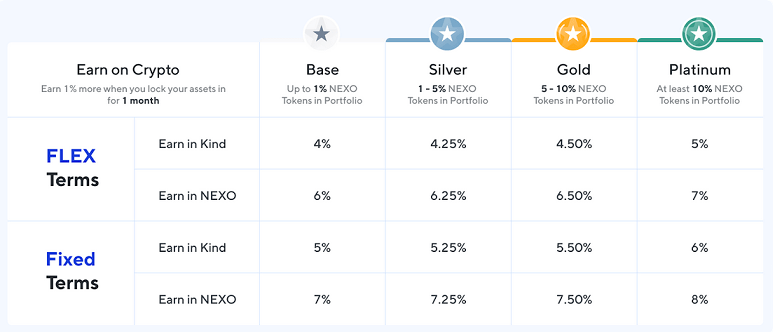

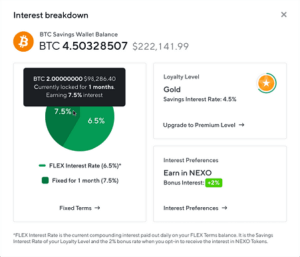

Term deposits

Term deposits are an EARN functionality that allows interest on crypto and 12% on fiat instead of 6% to 8%. The period is 1 and 3 months when you cannot dispose of the funds. Interest depends on the level of loyalty and whether you want to pay it in their token. Below is a table comparing fixed and normal (FLEX) deposits for 1 month and for 3 months:

It is added every day, but FIXED (term deposit) is paid out after 1/3 months. The account can then look like this:

You can create a term deposit by clicking on the last button in the row of the given cryptocurrency in the report. Honestly, FIXED makes the platform a bit cluttered and the user often doesn't know why he has such an interest (more in the Nexo manual). In addition, the main page shows the interest you will receive only if you hold part of their tokens. The main product is EARN (FLEX). In addition to high interest rates, the risks and volatility of the token need to be considered when paying out their token.

Loan

Cryptocurrency loans can be taken for as little as $ 10, which is great because you don't have to worry about large amounts right away and you can try the loan for literally a few dollars first.

Debit Card

Credit the card allows 2% cashback, is free of charge and if you do not repay at all, a cryptocurrency will be sold to you, which the credit is secured without affecting your reputation. Unfortunately, Europe has not received a card yet.

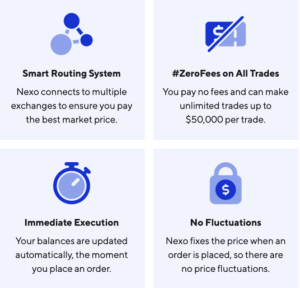

Exchange office

Nexo has its own currency exchange for almost a hundred digital assets. It works by connecting to five other exchange offices at once to find the best price and swap. Rather, it aesthetically complements the platform's portfolio, as it is not possible to trade fiat on it.

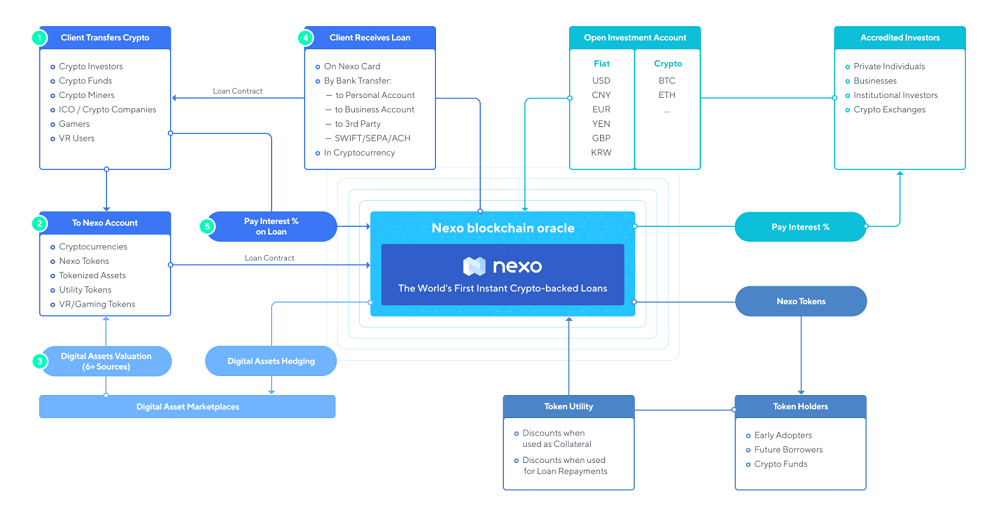

Nexo blockchain a oracle

In 2020, the company took steps to increase the decentralization of its network and began using Chainlink on Ethereo to measure the price of cryptocurrencies.

You might be interested in: Is Chainlink a good investment?

Token with dividend

The platform has its own token, which is the first serious to pay dividends to its holders in the form of 30 % net profit. More than $ 9 million has been paid out in the last three years. Payments are made monthly at ETH, only to users with advanced verification and regardless of which account (vision Nexo Instructions) the tokens hold.

Nexo comparison

Even without the involvement of a token, the interest rates for cryptocurrencies are relatively decent (4 %). In order to get a normal (5.9%) loan, but again you need to hold that token… Loans manage price data from Chainlink, which is interesting, but we don't know how they are evaluated. The daily interest payment is phenomenal, but due to the objectivity of the Nexo review, I would welcome more attention to the growth of debt when you do not pay the loan.

Nexo tutorial

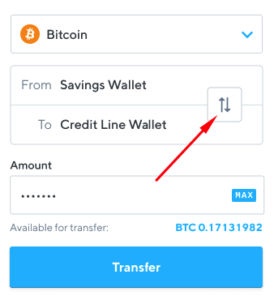

The platform has two types of accounts - savings and credit, in two versions - fiat and crypto. To make transfers between accounts, click the last button in the row of the relevant cryptocurrency.

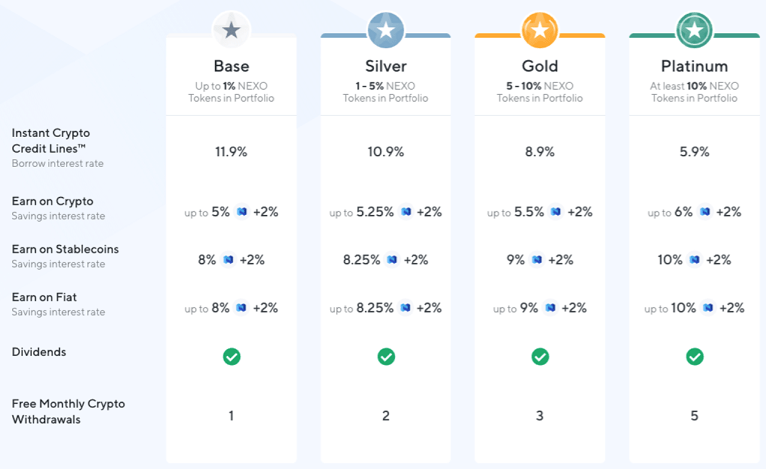

Levels of fidelity

Loyalty levels depend on the proportion of NEXO token held in your accounts, which you have to hold. The bonus is cheaper loans, higher interest rates and more withdrawals (cryptocurrencies to an external address, ie outside Nexo) for free.

Create an account

You can also open an account with Nexo as a corporation, which is quite interesting, but now to open a current account. You create an account just like any other Internet service.

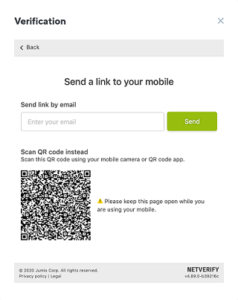

Basic authentication requires an address, phone number, and name. Advanced verification requires a scan of the ID card (OP, passport or driver's license) and is performed by an external partner Jumio. This can also be done via a mobile phone, if you open a link in it or scan a QR code.

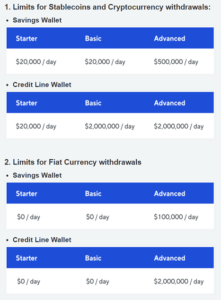

The daily selection limit then depends on the level of your verification.

Nexo withdrawal and deposit guide

Deposits

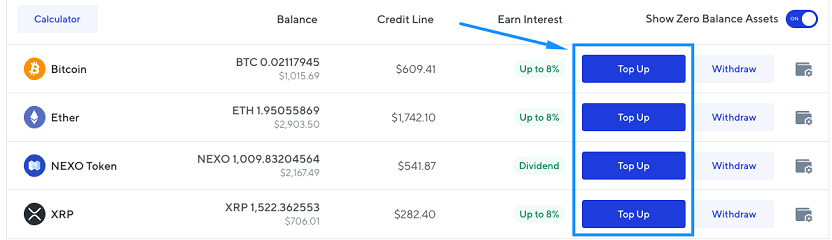

You make the deposit at the end of the title page after logging in, where you can see all supported cryptocurrencies. To the right, click Top Up next to the relevant cryptocurrency and you will immediately see the deposit blockchain address that you enter when sending coins from the stock exchange, mobile wallet, etc. Nexo does not support the purchase of cryptocurrencies directly on the platform. Send all coins in theirs native form - wrapped coins representing another coin on a foreign blockchain are not supported and if you send them to the address, you will lose them forever.

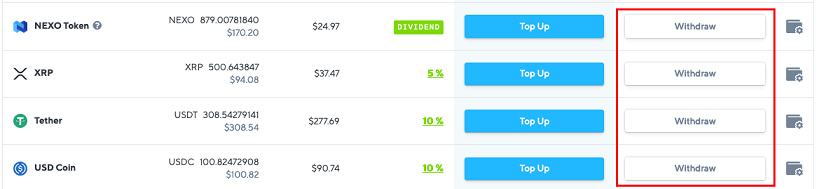

Selections

The withdrawal button is next to the deposits. Pay attention to the XRP, XLM, EOS, BNB and NEXO token on the Binance blockchain (BEP2), where you must also add a destination tag or "memo" to the transaction form. For new accounts and accounts with a significant amount of NEXO token, this can take up to 24 hours.

Depending on your level of fidelity, you can choose a crypt to an external address 1x-5x / month for free. An unlimited number of fiat withdrawals, transfers in Nexo Wallet and credit withdrawals are completely free. The platform does not charge any exchange fees or fees for arranging a loan.

Loan

Loan without credit control as in a bank.

However, you cannot select LTV on a platform such as BlockFi, because it is calculated by the algorithm depending on the volatility. This makes comparability difficult because you have one rate but different LTVs.

- LTV = Loan To Value (percentage ratio of the loan amount to the collateral or collateral)

Source: Support

Source: Support

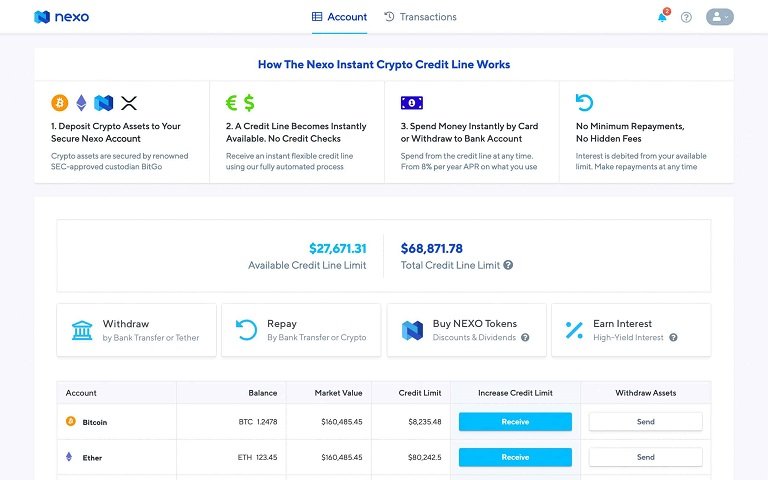

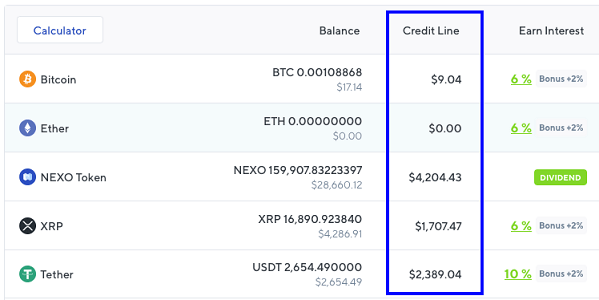

In the account where your cryptocurrencies are displayed, you can immediately see what credit you would receive if you used all the cryptocurrencies as collateral.

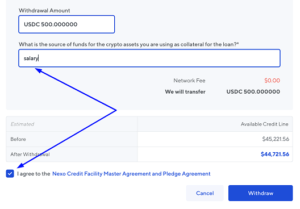

If you take out a loan in stablecoin, you only need zero degree of KYC verification. You can take a minimum of $ 50 (in stablecoins) or $ 500 in Fiat, up to a maximum of $ 2 million.

Notification of high LTV caused by a decrease in the price of collateral or its selection comes via email and SMS. The limit is 83.3 %, then the cryptocurrencies for collateral are transferred from the savings account to the credit account. If there is not enough in the savings account either, the collateral will start selling automatically to reduce the LTV score to a safe level. It is sold in installments, they do not liquidate the entire position, but you pay stock exchange fees because they sell the crypto.

You can repay part or all of the loan early at any time. There are no minimum loan repayments. You can do it in a Fiat, crypt or in combination. However, interest is added to your outstanding balance each day after midnight. There are minimum amountswith which this can be done.

If you repay the loan or part of it within 30 days of the last withdrawal, you will be charged a standard interest rate of 11.9 % regardless of the loyalty levels for the full 30 days. The reason is to protect the platform from malicious behavior.

The standard loan period is 1 year. If you do not repay the loan, it is automatically extended for another year. This period resets with each credit account withdrawal.

Card

The Nexo card does not require any verification of the client's creditworthiness, has no fees and gives 2% cashback on everything (in the crypt or their token). The amount of credit is determined by the collateral on the "Instant Crypto Credit Card" balance sheet. You also have three virtual credit cards, which increases security. However, only some users with high fidelity were given initial access to the card, and the rest are still waiting, so the Nexo review cannot fully evaluate it.

FAQ

It is safe?

Resources in the cold wallet are physically held by the custodian BitGo (managing Tether), who has 5 % resources insured. The company has also entered into a partnership with Ledger, which is insured by the same parent company as GitGo (duplicate insurance). Nexo is currently under management via 4 billion But the insurance numbers on the site are extremely confusing because it adds up the insurance of all the funds of companies with which it has a client crypto.

As for the account, the primary is email. If you do not have a properly secured email (2FA authentication, strong password, etc.), you are in danger.

When the SEC intervened against Rippl, the company sold XRP collateral without notice and disbursed the loans secured by it.

How does he pay me interest?

In the currency you entered or in their token.

How to get interest consist of?

Daily.

How do I get borrowed money?

Via bank transfer within 3-5 days.

How to take a loan?

Log in and enter cryptocurrencies. Then click on the "Withdrawal Loan" button and set the currency, collateral and amount.

What is a crypto loan for?

So that you can use the value of your cryptocurrencies without having to sell them at the wrong time.

Can they advise me on taxes?

Unfortunately, no.

Is it possible to arrange collateral in the middle of the duration with a different crypt or NEXO token than I originally chose?

Yes.

What is a "Credit Line" balance sheet?

These are funds in a loan wallet that are used as collateral. More in the Nexo tutorial.

How is interest paid?

It's up to you, though they are added to the existing loan every day.

What happens if I don't have to pay interest?

Unpaid interest will be added to the existing loan (debt) until the LTV (debt ratio) rises to a critical level and the collateral is sold. Accumulated interest is paid at the same time as the repayment. If concepts are a problem for you, go to the Nexo manual, Loan section.

What does "Withdrawal Funds From Credit Line" mean?

Choose a potential loan. These are not funds that you have in your account, but that you are able to reach with a loan.

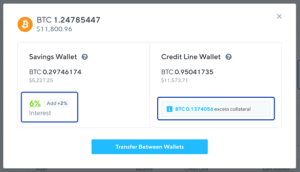

What if I have excess collateral caused by a rise in the price of bitcoin?

Then you can convert it to "Saving Account". However, this does not happen automatically.

If I give their token as collateral, will I still receive dividends?

Yes.

Will their token not have problems with the authorities if they behave like stocks?

If tokens from their ICO get into the hands of "non-accredited investors" from the US, they may have a problem because this token is a limited security.

Conclusion

We are at the end of the Nexo review and it is time to recap:

- The user interface is friendly even for those who have not yet encountered a cryptocurrency exchange. Youtube tutorials, updates on the most interesting events from the world of cryptocurrencies, etc. are regularly posted on the web.

- I like openness of society regarding ICO - they used the money for capital for loans and do not insist that it financed IT facilities

- Unfortunately, you have only one way to find out if they distribute the profit to the dividend tokens fairly - to estimate it

- Their "Blockchain Oracle" is highly semi-decentralized - the platform token runs on Ethereo and has nothing to do with the oracle system. At most, Chainlink only supplies data to the company and other operational calculations are performed centrally

- The company accrues interest most often from the sacred six crypto savings accounts (Binance, BlockFi, Crypto.com, Celsius and Gemini).

If you liked the objectivity of today's Nexo reviews and instructions, write to us in the comments :).