What is cryptocurrency saving for?

You may not like it, but inflation is on the rise and your cash is losing value. But it's not just about protecting your money from amortization. Today, Stone Banks pay woefully low rates on savings accounts (in Europe, some even charge negative interest rates).

Let's be honest, traditional banking methods are becoming a bit outdated. So if you want to get a high return on borrowing your money, now is the right time to explore different ways to activate your unused savings and try cryptocurrency savings.

Cryptocurrency interest and crypto loans

While this may still be controversial, more and more investors are looking at the benefits of cryptocurrency savings accounts. Cryptocurrency savings accounts allow you to enjoy the benefits of traditional savings accounts, but with the growth potential of cryptocurrencies. It's similar to traditional bank savings, but the difference is that crypto deposits earn interest while you still own your coins.

For example, if you want a high return but don't want to risk the volatility of cryptocurrencies such as Bitcoin or Ethereum, you can choose to earn interest on stablecoins that offer high rates with greater stability. The best cryptocurrency savings accounts offer up to 12% interest on stablecoins and allow you to earn 6% interest on popular instruments such as Bitcoin and Ethereum.

In this guide, we will explore the best platforms and applications with which you can earn interest on your crypto assets. We have researched and tested the most competitive offerings for your digital assets. Below you will find some of the best places to earn interest on bitcoin, etherea, stablecoins and altcoins, as well as the best cryptocurrency savings accounts for each of these categories.

These are the best cryptocurrency savings accounts

Here are the best cryptocurrency savings accounts and applications that allow you to earn cryptocurrency interest:

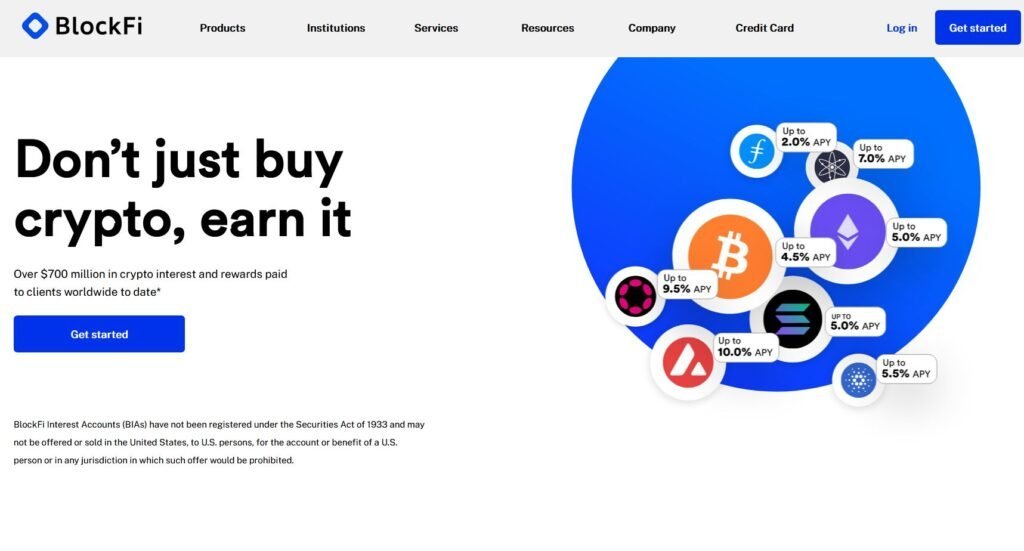

- BlockFi: The best place for interest overall

- Nexo: Best for daily interest payments

- Celsius Network: Best rates on most coins and best reputation

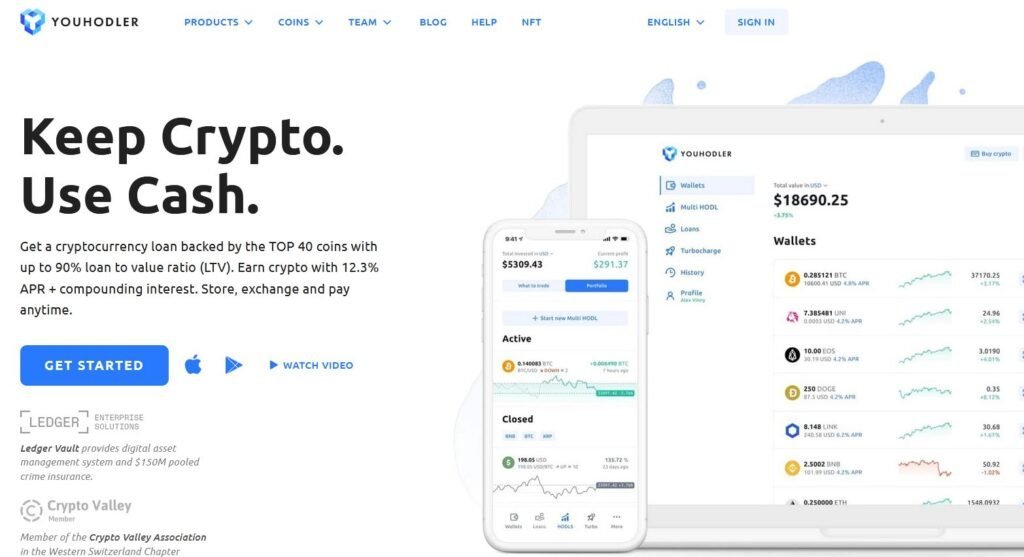

- YouHodler: Best for stablecoins

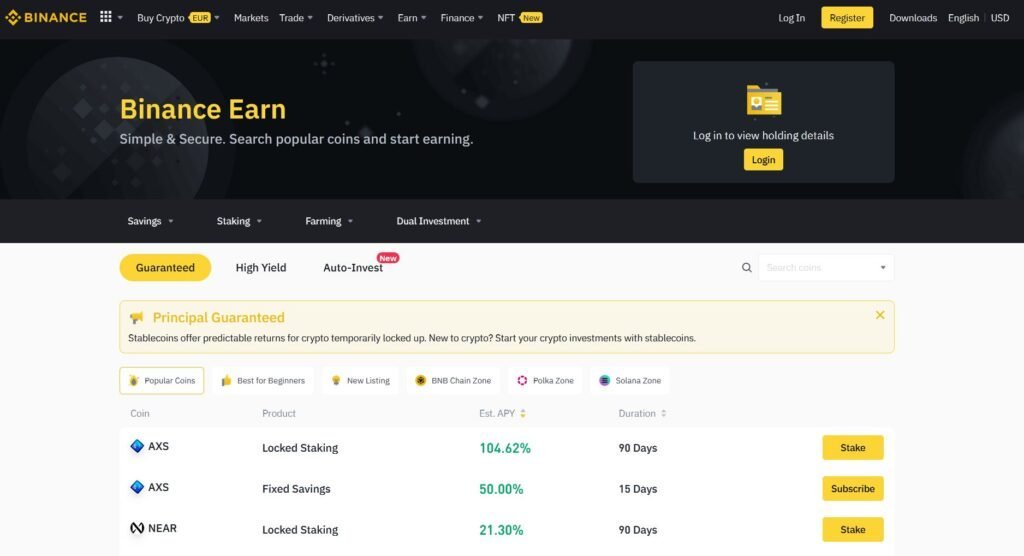

- Binance Earn: Best for advanced users and DeFi

- CoinLoan: A great European savings solution

With so many market players, it can help if you compare cryptocurrency rates side by side before deciding where to put your money. Of course, high interest rates should not be the only criterion for choosing a cryptocurrency savings account. Make your own decisions and compare these platforms to find the one that best suits your needs.

Keep your crypto private

Use a hardware wallet to keep your cryptocurrencies safe. Consider moving some of your resources to cold storage for maximum security.

You might be interested in: Cryptocurr wallets and wallet hardware - TOP selection

The best sites to bring you cryptocurrency interest and cryptocurrency loans: A full comparison

Below is a comparison of the most trusted platforms where you can earn interest on Bitcoin, Etherea and other known cryptocurrencies.

1. BlockFi

BlockFi interest account is the best known and objectively the best place to earn interest on Bitcoin, Etherea and stablecoins. Founded in 2017, BlockFi is a fully regulated and licensed provider of cryptocurrency savings accounts, loans, and currency exchange services with financial licenses to operate in 48 U.S. states. Interest accounts are available to users worldwide, except for 3 states and countries that are subject to US, UK or EU sanctions.

Benefits

- Welcome bonus up to $250 for new users

- Best interest rates for Bitcoin

- The best known and most trusted lending platform

- With $ 450 million in venture capital support

- Works with Gemini and BitGo as reserve managers

- Free monthly withdrawals

Things to keep in mind

- It has no FDIC or SIPC insurance

- Rates are subject to change

- It only supports USD as a fiat currency

With a BlockFi interest account, investors can earn up to 8.6% compound interest per year on their savings, borrow cash for a cryptocurrency, and exchange a variety of coins at competitive prices. With the upcoming BlockFi credit card, users will be able to get Bitcoin cashback with every purchase. It can be said that BlockFi is evolving into a full-fledged cryptobank.

Note: BIAs have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States to American persons, for the account or benefit of American persons, or in a jurisdiction in which such an offer is prohibited.

BlockFi is probably the most trusted offering in the cryptocurrency list, thanks to its partnership with leading blockchain authorities and many financial licenses from top regulators. BlockFi has support for big names like Coinbase and Fidelity and uses Gemini, the most trusted crypto asset manager, as its own manager.

Key features

- Minimum deposit: No minimum deposit required

- Fees: $0 monthly / annual fees; 1 selection of crypt and stablecoin per month for free

- Supported coins: BTC, ETH, LTC, LINK, USDC, PAX, GUSD, USDT

- Bitcoin interest rate: Up to 4.5%

- Ethereum interest rate: Up to 5%

- Stablecoin interest rate: Up to 9.3%

Registration with BlockFi is free, so anyone who wants to earn interest on their cryptocurrency assets can easily test whether the service suits them. The BlockFi interest account does not require any minimum deposit or balance and does not require monthly or annual fees. BlockFi also offers one free cryptocurrency selection each calendar month, and the same goes for stablecoin.

2. Nexo: Best for daily interest

Nexo is one of the oldest platforms for lending cryptocurrencies, it has been active in this field since 2018. It has slowly but surely gained its user base and now boasts more than 2.5 million users worldwide. Nexo is a regulated financial services provider and is insured up to $ 375 million with Bitgo and Ledger.

Benefits

- When you invite friends, you earn $ 10 in BTC

- Up to 8% interest on BTC and ETH

- One of the first lending platforms on the market

- Daily interest payment

- Insurance of $ 375 million

- Free monthly withdrawals

- Nexo credit card with up to 2% cashback

Things to keep in mind

- It has no FDIC or SIPC insurance

- Rates are subject to change

- Nexo tokens are required to get the best savings rate

Special offer: Get up to 10% on BTC and ETH. Invite your friends to Nexo and get $ 100 in BTC.

Nexo offers maximum annual interest rates of 20%, up to 8% per year for bitcoin and ether, and up to 12% on stablecoins. Interest is paid every day, so funds are accumulated quickly.

Key features

- Minimum deposit: 0.001 BTC / 0.01 ETH / 1.0 stablecoin

- Fees: $0 monthly / annual fees; 1 to 5 selections of crypto and stablecoin per month for free

- Supported coins: 27, including BTC, ETH, LTC, LINK, USDC, PAX, GUSD, USDT

- Bitcoin interest rate: 6% to 8%

- Ethereum interest rate: 6% to 8%

- Stablecoin interest rate: Up to 12%

When it comes to security, Nexo offers two-factor authentication, IP whitelisting, and a wallet system for cold storage. They are ISO / IEC 27001 certified and use separate wallets with multiple signatures for the secure storage of their clients' funds. In terms of insurance, Nexo is insured for a total of $ 375 million for digital assets and uses real-time reserve audits in partnership with Armanino.

Read: Nexo Review: Payout of interest once / daily and a simple loan

3. Celsius Network:

Celsius Network is probably the most transparent platform for lending cryptocurrencies on this list, but also the most profitable for investors. It was founded in 2017 by serial entrepreneur Alex Mashinsky (one of the inventors of VOIP), and now reports investments worth around $ 200 million and 40,000 active wallets.

Benefits

- $ 40 registration bonus for new users

- Unlimited number of free selections

- The largest selection of coins for which interest can be obtained

- Weekly payout

- Transparent society with public data and statistics

- No weekly or monthly fees

Things to keep in mind

- It has no FDIC or SIPC insurance

- Rates may change weekly

- The highest rates require the user to earn in CEL tokens

Celsius offers a great mobile solution for earning interest from your crypt. What's more, Celsius works with several highly trusted institutions and security companies, which increases trust in the company.

Celsius Network delivers some of the best interest rates for cryptocurrencies and accepts a wide variety of popular cryptocurrencies and stablecoins, including Bitcoin, Ethereum, USDC, PAX, and several others. What's more, it pays interest on a weekly basis, with the option to earn more if you are paid in the native token of the CEL platform.

Key features

- Minimum deposit: No minimum deposit required

- Fees: $0 monthly / annual fees; unlimited free selections

- Supported coins: BTC, ETH, LTC, XRP, OMG, BCH, ZRX, BTG, ZEC, XLM, DASH, TUSD, GUSD, DAI, PAX, USDT, TGBP, TAUD, TCAD, THKD, EOS, SGA

- Bitcoin interest rate: Up to 4.4%

- Ethereum interest rate: Up to 6,35%

- Stablecoin interest rate: Up to 12,65%

Celsius Network is secured by multi-factor authentication, dual private key vault, encryption and third-party solutions. Assets are divided between cold stores and exchange offices for additional security.

4. YouHodler

YouHodler is a European banking platform for crypto asset management, based in Cyprus and Switzerland. The company offers attractive cryptocurrency savings accounts with a high compound interest rate of up to 12% and cryptofiat loans with a high interest rate of up to 90%.

The total number of cryptocurrencies and stablecoins from which you can earn interest is currently 25. The rewards for BTC are at 4.8%, ETH 5.5%, LINK 6.2%, and stablecoins are around 12%. YouHodler has no locking periods and investors can withdraw or sell their assets at any time.

Benefits

- Up to 4.8% interest on BTC and 4.8% on ETH

- Support for 25 coins and tokens

- Weekly payout

- $ 150 million Combined Crime Insurance with Ledger Vault

- Zero weekly or monthly fees

- No lockout periods and no special tokens are required to get the best rates

Things to keep in mind

- It has no FDIC or SIPC insurance

- Not available in the US

- Start-up company

YouHodler Cryptocurrency Savings Account pays interest on most major coins, including BTC, ETH, USDT, USDC, TUSD, and PAX deposits, as well as BNB, PAXG, XRP, LINK, and XLM. Accumulated interest is paid once a week and the weekly interest period begins to accrue as soon as you deposit funds into your savings account.

You can convert between different cryptocurrencies, stablecoins and fiat currency on a mobile application or directly on the web interface, and trading fees are generally low. YouHodler supports EUR, USD, CHF, and GBP, and supports cards and bank transfers.

Key features

- Minimum deposit: $ 5 in cryptocurrency equivalent

- Fees: $0 monthly / annual fees; unlimited free selections

- Supported coins: BTC, ETH, ADA, BAT, BCH, BNB, BSV, COMP, DASH, EOS, ETC, HT, LINK, LTC, MKR, PAXG, REP, TRX, UNI, XLM, XMR, XRP, XTZ

- Supported stablecoins: DAI, HUSD, PAX, TUSD, USDC, USDT, EURS

- Bitcoin interest rate: Up to 4.8%

- Ethereum interest rate: Up to 4.5%

- Stablecoin interest rate: Up to 12%

- Other important information: Supports USD, EUR, GBP, CHF fiat transfers

In terms of security, YouHodler works with Ledger to manage client funds in hot and cold wallets, and has a crypto crime insurance program worth up to $ 150 million. YouHodler is a member of the Blockchain Association of Switzerland, an independent body that promotes the use of blockchain solutions in Europe. The Swiss part of the company is also regulated by local authorities in Switzerland.

5. Binance Earn - The largest crypto ecosystem

Binance Earn is a comprehensive solution for crypto interest from Binance. With Binance Earn you get a full set of products for stacking and saving, for passive earnings from your crypto savings without the need for any trading. There are more than 60 cryptocurrencies and stablecoins from which you can choose and earn interest under fixed or flexible conditions.

Benefits

- The largest cryptocurrency exchange office in the world

- It supports the largest number of coins and tokens

- Highest industrial rates through DeFi solutions

- Support for ETH 2.0 stacking with up to 20% APY

- Flexible and solid conditions

Things to keep in mind

- It has no FDIC or SIPC insurance

- Slow customer support

- It seems complicated for beginners

Users can choose between common savings products, stacking and DeFi solutions. Each of these choices brings its own risks, conditions and returns. These include savings with flexible or fixed conditions, locked stacking, Defi Stacking, ETH 2.0 stacking, liquid swap, launchpool and BNB revenue aggregator safe.

If you are not interested in trading, but want to increase your savings, interest-bearing products from Binance are a good choice. While many of the features on offer may initially act as a deterrent, Binance's savings and stacking solutions can potentially generate passive income if you are willing to learn how to use them.

Key features

- Minimum deposit: Is different

- Fees: $0 monthly / annual fees

- Supported coins: BTC, ETH, ETH2, and all other known coins and tokens

- Bitcoin interest rate: Up to 7,49%

- Ethereum interest rate: Up to 20%

- Stablecoin interest rate: Up to 15%

- Other important information: Authorized European users can register to obtain Binance Visa card and earn up to 8% cashback

You might be interested in: Binance Exchange Review - TOP platform for cryptocurrency trading (2022)

6. Coinloan

Coinloan is a European platform for lending cryptocurrencies, which is licensed and authorized in the EU. The company was launched in 2016 and operates under the regulation of the Estonian Financial Supervision Authority, which means that it holds a European financial license.

Benefits

- Licensed and certified platform

- High yield of up to 12% APY

- Client resources are stored with BitGo and insured on $ 100 million and Lloyd's.

- Intuitive and easy-to-use platform

- Excellent customer support

Things to keep in mind

- It has no FDIC or SIPC insurance

- Relatively anonymous company with undisclosed team members

- Lack of transparency

The platform allows you to earn passive income by investing fiat currency and stablecoins for a high return on returns. If you are an investor, your deposits are used to create loan offers on the Coinloan platform.

Your deposit receives daily interest, which is credited directly to your wallet on the first calendar day of each month. Rates for the Coinloan interest account may vary and may increase up to 12% per year.

Key features

- Minimum deposit: crypto of $100

- Fees: $0 monthly / annual fees

- Supported coins: BTC, ETH, TUSD, LTC, USDC, PAX, XMR, BCH, USDT, BUSD

- Bitcoin interest rates: Up to 5.2%

- Ethereum interest rates: Up to 5.2%

- Stablecoin interest rates: Up to 10.3%

In terms of security, CoinLoan keeps crypto assets offline, in cold wallets with multiple signatures and with BitGo digital asset manager and Lloyd's $ 100 million insurance. In addition, all transactions comply with the standard cryptocurrency protection (CCSS).

Comparison of rates from the best cryptocurrency interest accounts

For a better overview, we present a comparison of the best savings accounts for Bitcoin and other cryptocurrencies. The rates presented are the maximum that can be obtained, with or without loyalty programs or tokens.

| Order | Company | Stablecoins | Bitcoin | Ethereum |

| 1 | BlockFi | 8.6% | 6% | 5.25% |

| 2 | Nexo | 12% | 6% | 6% |

| 3 | Celsius Network | 10.5% | 4.74% | 5.5% |

| 4 | YouHodler | 12% | 4.8% | 4.5% |

| 5 | Binance | 12.4% | 7.40% | |

| 6 | CoinLoan | 10.3% | 5.2% | 5.2% |

Rates are from May 6, 2021, but are not guaranteed and may vary on a daily basis

Instructions: How to choose a reliable cryptocurrency savings account

Given that interest income from crypto savings accounts exceeds traditional bank savings accounts, it is not surprising that investors are trying to earn interest on their unused cryptocurrencies. While it's worth doing your own research before deciding which cryptocurrency savings account to invest with, here are a few basic factors to consider when choosing the best way to get interest from your crypt:

- Securing: If you are an investor, your embedded digital assets are lent to people who apply for loans (borrowers) at a pre - agreed interest rate. Borrowers secure their loans with crypto assets, which are usually of much greater value than the amount lent. This is called "overcollaterization", and this is where crypto-loans are based. "Overcollateralization" ensures that cryptocurrency loans are repaid on time and in full.

- Transparency: The authenticity of the crypto company where you plan to invest your assets is defined by how transparent it is to its users. Look for companies that constantly communicate with their users. When registering, you should know everything about fees and other conditions. A reliable crypto company should have active accounts on social networks and constantly provide up-to-date information for its community of users.

- Company history: Carefully examine the history of the interest account provider you are going to invest in. Has there been steady growth over time? Has there been a security breach? With a long history of cryptocurrency hacking and asset theft in excess of billions of dollars, you need to properly consider the security history of your interest account provider.

- Regulation and licensing: Make sure that the crypto interest account provider has the appropriate licenses to perform the operations. Working with an unregulated company puts you at serious risk, as there will be no legal penalty in the event of a mistake or loss.

- Understanding insurance: Can investors keep their digital assets in crypto savings accounts while sleeping peacefully? Unlike traditional banking, deposits in crypto savings accounts are not insured by the FDIC or any other government compensation system. Keep this in mind when looking for the right savings account to invest in. Keeping your funds in a fully proven crypto savings account is the best way to earn interest without jeopardizing your entire investment.

- Security protocols: Examine in detail the security protocols of the crypto savings account provider with which you want to invest your funds. This is very important because it can mean the difference between being a victim of hackers and thieves or earning some passive income safely.

- Cold storage: Cold storage means storing digital assets on servers in an offline environment, cut off from the Internet. This measure is an important security protocol that stops theft through a hacker attack. Additional security can be obtained by combining cold storage with multiple signatures to create multisig (multiple private keys) cold storage. Multisignature is the process of using more than just one key to authorize a bitcoin transaction. This eliminates the risk of single line failure and makes it more difficult to compromise the wallet.

- Rewards program for finding errors: To tighten security, the best cryptographic companies are trying to motivate hackers to detect and report vulnerabilities by offering them a reward. The fault finding program will allow the crypto company to identify and resolve security flaws before they are exploited by criminals, which could lead to the loss of assets.

- Two-factor verification: This is necessary if you have active digital assets anywhere. Two-factor authentication is simply the second layer of security in the form of unique code generated by an application on your phone. Google Authentication 2FA is the most popular program-based authenticator, another from Microsoft.

How crypto interest savings accounts work

A crypto savings account works much like a regular financial savings account. You deposit a certain amount in cryptocurrencies, BTC, ETH, USDT, etc. into the account and you will earn interest.

The only difference is that you will receive interest on your cryptocurrencies instead of real fiat money. However, it also means you have quick access to your resources. However, earning interest from the crypt also carries more risks than earning interest from the bank, depending on what digital asset you provide.

Interest rates and risks

The crypto interest you earn is likely to vary depending on your account. Different cryptocurrencies will offer different interest rates, so you should do some research before choosing a savings account that will give you the highest possible return.

While the idea of depositing large amounts of cryptocurrencies in an interest-bearing account may seem like a great idea, it carries some risks. If someone makes a hacking attack on a website where you hold your funds, they may be able to steal them all. If the lending platform goes bankrupt or is the subject of litigation, your funds may be at risk.

Differences between current and crypto savings account

There are several key differences between a current financial savings account and a savings account that pays interest in cryptocurrencies.

- Insurance: The current savings account will be insured by the government or other financial authority. If your bank goes bankrupt, you will not lose access to the funds in your account. However, if the cryptocurrency savings platform is hacked or fails, chances are you'll never see your resources again. However, many crypto-loan platforms now offer protection in the form of insurance, which can be purchased for a monthly or annual fee.

- Interest rates: Nowadays, a current savings account typically does not pay any high interest rates. Some banks offer interest rates around 0.1-0.5%. If you earn an annual return of 1% per year, you don't have much options left. On the other hand, a crypto savings account will pay out much more, sometimes up to 5-10%.

- Re-mortgage: Few people know the concept of mortgage, but this is one of the ways banks and crypto banks make money on your deposit. A re-mortgage basically means that the creditor can use whatever is deposited with him as collateral for a loan he provides to someone else. In other words, if you deposit $ 100,000 into an interest-bearing savings account where re-mortgages apply, there is a chance that this money will be lent to third parties. If this happens, your savings account may over time be worth less than the original $ 100,000 without you noticing.

In conclusion - The best savings accounts for cryptocurrencies

Cryptocurrencies are fast becoming mainstream, and a growing number of companies now offer crypto savings accounts that pay monthly or even daily dividends. These companies provide a great investment opportunity for cryptocurrency owners who are looking for ways to generate passive income.

This income is achieved through high-interest loans offered to those interested in a crypto loan. The cryptocurrency area is full of merchants looking to borrow a crypt to overcome capital gaps if we want to mention just one of the purposes. Crypto interest rates are therefore significantly higher than for Fiat, with some providers offering rates up to 15% APY.

With such a high yield, it's no surprise that cryptocurrency owners are increasingly demanding reliable crypto savings accounts where they can deposit their crypto to make money. However, before investing your hard earned savings in a crypto savings account, there are many factors to consider. These include interest rates, security protocols, insurance, platform reliability, and more that you could read about above.

The six crypto savings accounts in this article are currently among the best in the field of cryptocurrencies. Some allow you to invest a cryptocurrency and earn interest directly, or invest a fiat and earn interest in cryptocurrencies. Putting your funds into the right savings account and platform will hopefully bring you multiple rewards of your digital assets over time.

FAQ - Frequently Asked Questions

What is a crypto interest account?

A crypto interest account or a crypto savings account works the same as a regular savings account. The difference is that instead of depositing cash from which you will earn interest, you deposit crypto assets and get crypto interest.

Why are crypto interest rates so high?

Cryptocurrency rates can be as high as 13% as the crypto-loan industry is still in its infancy and demand for loans is growing exponentially. These blockchain companies make money by lending coins to borrowers at a higher rate than they pay you in interest. Another reason for the high rates is that traditional financial institutions refuse to cooperate with companies that have something to do with cryptocurrencies.

Are Crypto Interest Accounts Safe?

Crypto savings accounts are not insured by any government, but the most secure crypto loan platforms take extreme measures to protect your assets from misuse and hacking. Lending companies such as BlockFi have comprehensive security systems to reduce counterparty risk and implement automated call-to-call systems for borrowers. Remember, however, that you should always invest only as much money as you can afford to lose.

Is the crypto-lending industry regulated?

The best platforms for lending cryptocurrencies are licensed from several different tax authorities as money transfers (USA) or as companies with crypto assets (UK).

How do crypto loans work?

Crypto lending means lending digital assets through platforms specializing in lending or crypto exchange, at interest. The platform connects you with borrowers, individuals or institutional companies that back up their loans with tangible security, such as cryptocurrency or real money. You will get your cryptocurrencies back with interest as soon as the borrower repays his loan.

Should I lend all my crypto for interest?

You should consider the risk that will arise if you move your crypto assets from the security of your hardware wallet to the credit platform administrators. Always check if they have insurance and to what extent you can receive compensation for any loss in the event that your account is hacked.