According to a CoinShares report is the first week of August the sixth consecutive week of growth in inflows into cryptocurrencies.

You might be interested in: 7 FAVORITE WAYS TO BUY A BITCOIN CARD IN 2022

Institutional investors are increasing capital inflows into the crypto sector

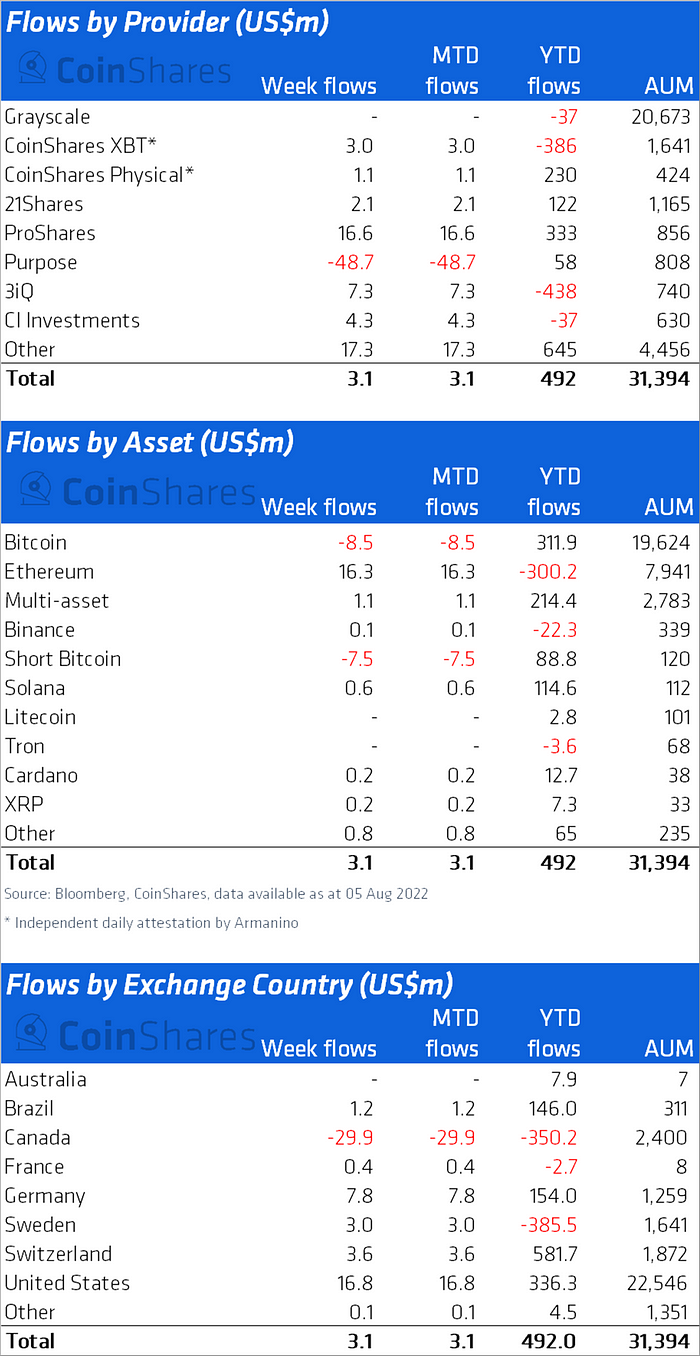

The first week of August saw record inflows to the crypto market with $3 million in digital asset investment products.

It was the sixth consecutive week of inflows to the market, totaling $529 million. July ended with inflows of $474 million after outflows of $481 million in June.

This should be another sign, Bank of America experts warn, that we are moving towards a bull market spiral for cryptocurrencies after the big drops in May and June.

There are many signs, both from a technical analysis point of view and precisely from a purely economic point of view, such as capital flows and outflows from exchanges to cryptocurrencies and related products.

The bank's report reads:

“Investors are shedding margins as risky assets rise. Tight supply and continued net outflows from the stock markets indicate that investors continue to HODL”.

Specifically, in the first week of the month, experts CoinShares reported Bitcoin outflows totaling $8.5 million, while investment products related to shorting BTC saw record outflows totaling $7.5 million for the second week in a row, indicating positive sentiment for the major digital currency.

How have these inflows affected cryptocurrency prices?

Ethereum, which has seen exponential growth in its price in recent weeks, has seen inflows totaling $16 million, with $159 million in inflows over the past six weeks.

CoinShares experts write in the report:

"We believe this turnaround in investor sentiment is due to greater clarity around the timing of The Merge update."

Another very interesting finding from the report is the record number of new investment products released in the second quarter of the year, despite the large declines experienced by the entire crypto market. An impressive 32 new products, one step away from the record 33 achieved in the last quarter of 2021.

These numbers, according to many experts, show renewed interest from investors who are once again buying digital assets at a discount. Market sentiment seems to be positive again.

The fact that the market influx is increasing shows how the demand for institutional crypto products is growing. Among them, Ethereum seems to be the digital currency that has the most growth potential.

Do not miss: WHERE TO BUY BITCOIN AND CRYPTOMEN