According to Coinbase's latest monthly report, long-term BTC holders have not divested their holdings, so short-term speculators are primarily responsible for the large selloff, which is exacerbating the asset's plunge.

Miners and crypto firms being forced to liquidate their positions to stay solvent amid the liquidity exodus have shown that the industry is in a credit crunch rather than a crisis specific to cryptocurrencies, Coinbase noted.

Do not miss: WHERE TO BUY BITCOIN AND CRYPTOMEN

The long-term holders did not disappoint

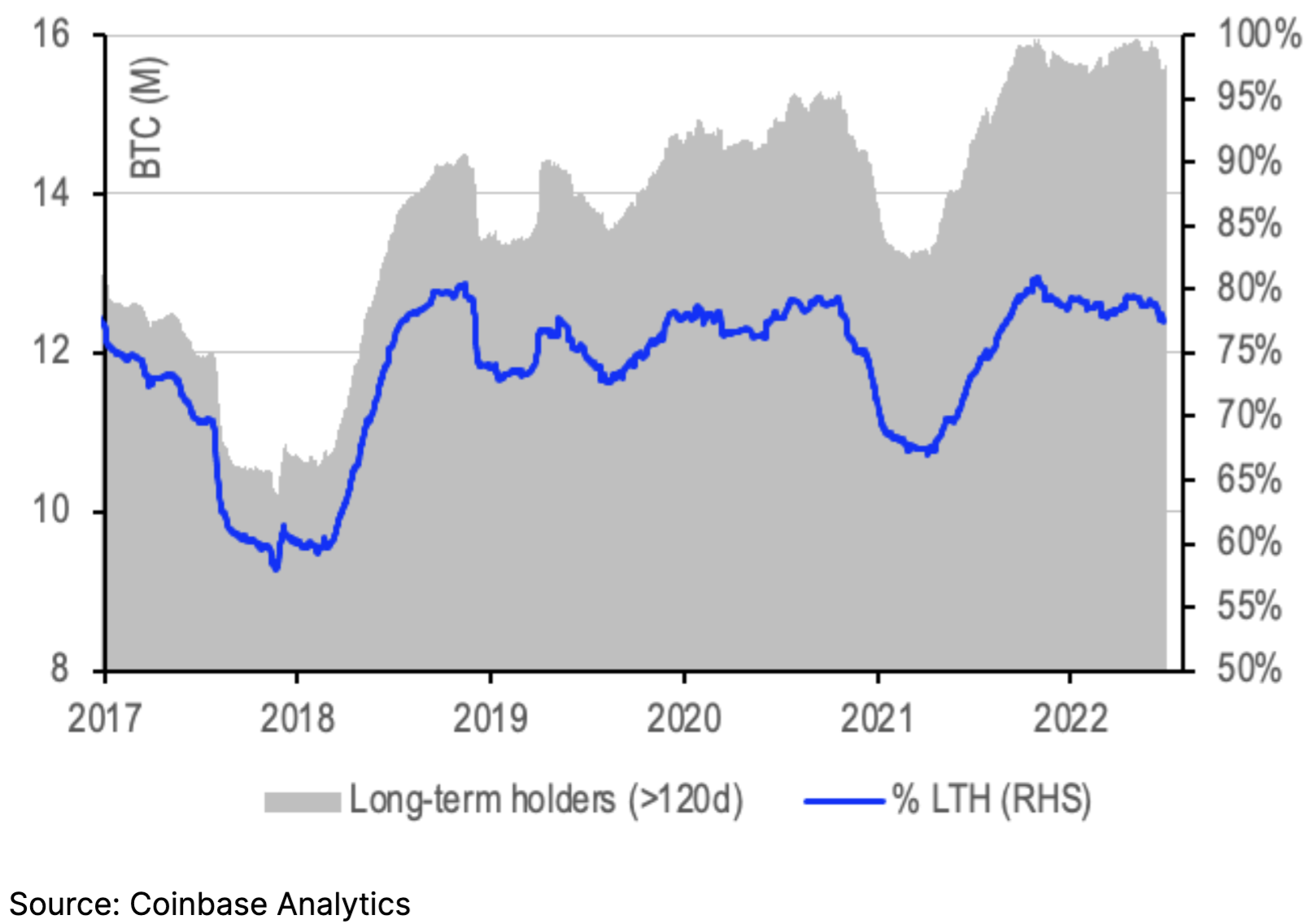

Message titled "The Elusive Bottom" looked at the overall state of the market in June as the primary cryptocurrency revealed signs of being near bottom. According to the data, long-term holders still hold 77 % of the total BTC supply.

This demonstrates the relative strength of the asset as long-term holders' ownership percentage exceeded the 60% level at the peak of the previous cycle in December 2017. Such a phenomenon is considered a positive indicator that this type of investor does not increase selling pressure during turbulent periods.

Credit crunch

The fall was primarily due to Fed rate hikes and over-indebtedness of crypto-fires, as well as miners being forced to divest their holdings as their devalued collateral threatened liquidation.

CeFi credit companies drastically increased their short-term debt during the bull market. They took huge loans from DeFi protocols and lent capital to counterparties who paid even higher interest rates. The snowball continued to roll until a strong correction hit the market, leading to a contagion effect that quickly spread throughout the market.

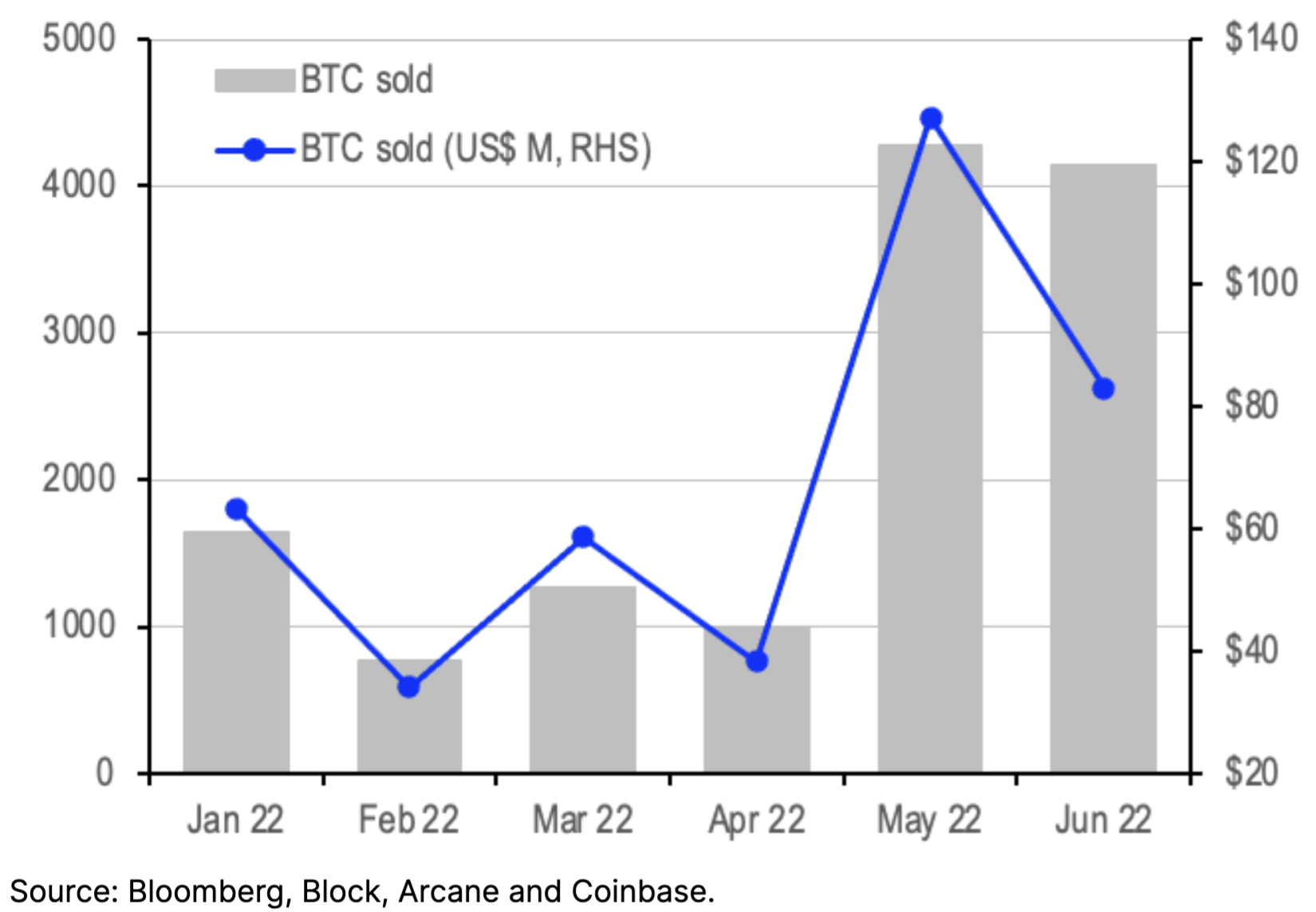

With the ongoing credit crunch, publicly traded miners who took out huge loans backed by BTC or mining machines during the bull market were forced to sell their positions as asset prices fell.

However, since the 28 largest public mining companies only account for 20 % of the Bitcoin hashrate, their sales will not drastically affect trading volume.

Stablecoin Concerns

With the Fed vowing to raise rates to combat rampant inflation, investors tend to pull capital from DeFi protocols to seek higher returns from traditional finance. The impact is reflected in the decline in the total market capitalization of stablecoins, which fell from $162 billion at the beginning of May to $149 billion at the end of June.

$12.6 billion in capital may have left the crypto ecosystem in pursuit of higher returns. With the June CPI coming in at 9.1 %, much higher than Wall Street expected, another rate hike of 0.75 % will follow this month. Hence, the outflow of stablecoins is expected to increase accordingly.

You might be interested in: 7 FAVORITE WAYS TO BUY A BITCOIN CARD IN 2022