The company behind the Terra ecosystem, now called the Terra Classic, Terraform Labs (TFL) could be behind the collapse of its native algorithmic stablecoin UST. According to news CoinDesk Korea investigators linked the company to the attack, which led to the loss of the UST's peg to the US dollar.

You might be interested in: THE BEST FOREX BROKER IN EUROPE - TOP FOREX BROKER PLATFORMS IN 2022

Is it behind the collapse of UST Terraform Labs?

Investigators from the intelligence and blockchain security company Uppsala used forensic techniques to track down the attacker. In this sense, they concluded that the address behind the UST collapse, called Wallet A, was managed by Terraform Labs.

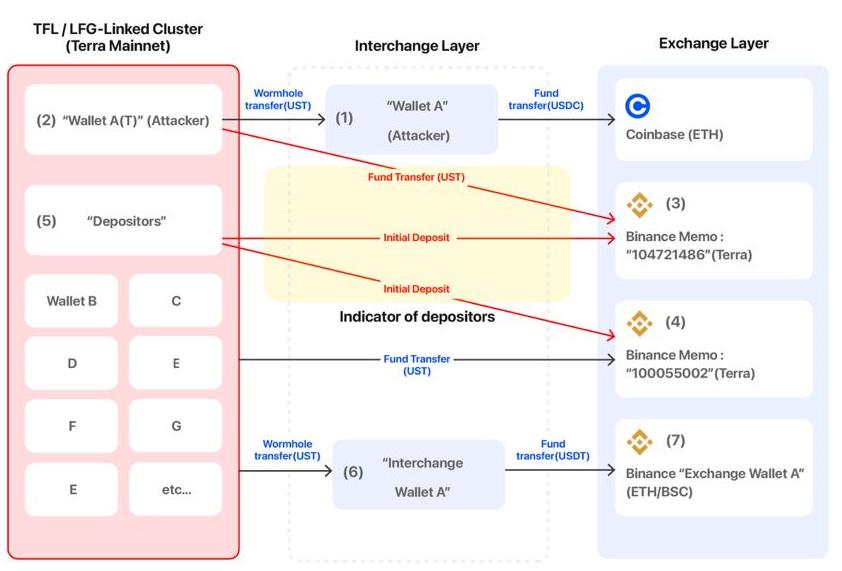

Wallet A was created on May 7 in the Ethereum network. These data coincide with the first decrease in UST. As seen below, investigators linked Wallet A on Etherea and Wallet A (T) on the Terra network to a series of flows that allow attackers to destroy UST and LUNA.

Flows are monitored to several addresses on Binance and Coinbase and to other resources transferred to the DeFi Curve protocol. The investigator claimed that Wallet A was behind the withdrawal of $ 150 million from the Curve liquidity pool created to maintain the "liquidity of the Terra blockchain." The report states:

Before and after this transaction, a large amount of UST was deposited on various exchanges around the world, which accelerated depegging. For this reason, several blockchain analysis companies around the world list Wallet A as an attacker's wallet.

When the attack occurred, Wallet A received a large amount of UST from Wallet A (T) from the Terra blockchain. Interactions between these wallets are linked by their notes and information required by the platforms to identify a particular user for the allocation of transferred funds.

Investigators further claim that an entity in the Terra ecosystem has publicly identified itself as the owner of one of the wallets that allegedly participated in the attack, LUNC DAO. They concluded:

The combination of the above findings discovered through on-chain forensic analysis, Binance's wallet '104721486', LFG wallet, LUNC DAO wallet, wallet A (T) and wallet A, which received UST from wallet A (T), all leads to the conclusion that the wallets are either owned by the same owner or managed by a single group. This means that Terraform Labs or LFG entered into a financial transaction that caused Terra to collapse on its own.

According to CoinDesk, the South Seoul District Attorney's Office is aware of suspicious financial flows related to Wallet A and the TFL. The prosecutor's office spokesman said:

We monitor the flow of problematic wallets and coins through on-chain forensic technology. In addition to allegations of fraud, allegations of breach of trust may be made depending on the results of the Do Kwona investigation.

Do not miss: HUOBI REVIEWS - ROBUST PLATFORM WITH A WIDE RANGE OF SERVICES AND PRODUCTS