Huobi is one of the largest cryptocurrency exchanges, which is largely based on Asian users and has been in operation since 2013. It has recently made some brand modifications and today its main offering is Huobi Global, its global cryptobourse that offers a trading platform. It is an exchange with wide support for many altcoins and a large range of stablecoins, along with HUSD's own invention, the stablecoin covered by the USD. Huobi also has its own token Huobi Token (HT), which it seeks to sell as a utility token and is working hard to promote its use, for contests, fee rebates, voting on certain matters and more.

Following its relocation to Singapore in 2020, following a ban by the Chinese government on cryptocurrency trading, Huobi established offices in other parts of the world, such as Hong Kong, the United States, and South Korea, and began exploring cryptots in Japan. However, the ban on cryptocurrencies in China and the expulsion of Huobi from the nation could not prevent cryptoburging in its operations and currently has more than 3 million active account holders.

Basic information

| ✅Page type | cryptocurrency exchange and exchange office |

| ✅Easy for beginners | No |

| ✅Mobile application | Yes |

| 🌍Company headquarters | Seychelles |

| 🌍Establishment of a company | 2013 |

| 💰Deposit method | cryptocurrencies, fiat |

| 💰Selection method | Cryptocurrencies, fiat |

| 📉Number of pairs available | 800 |

| 📉Cryptomens on the stock exchange | 400+ |

| 👮♂️Trust in society | high |

| ☎Customer support | active |

| ✅Self cryptocurrency | Yes, Huobi Token (HT) |

| ✅Page | https://www.huobi.com/ |

Huobi reviews

Huobi's user experience is exceptional, though not perfect, compared to other altcoin exchanges. The website itself is easy to navigate and creates a pleasant balance between functional, visually pleasing and elegant. The stock exchange manages to attract significant volumes to its platform, and many of the trading pairs they offer show high trading activity compared to other stock exchanges. The Huobi Exchange has the following functions ready for its registered clients:

- Easy user interface - As with many other exchanges, the Huobi website is easy to navigate and balance features, visual pleasure and elegance. There are the right pricing channels, charting tools, market depth data structured within the trading interface. The alternative HADAX crypt market, which supports smaller tokens and altcoins, also benefits from Huobi's professional interface and features.

- Flash Trade -This is one of the most interesting features on Huobi, which includes order book, index chart and market chart. Flash Trade allows users to test trading volume in real time, especially in times of high volatility.

- Compatible on multiple platforms - Huobi platform is compatible with multiple platforms such as Mac, Windows, iOS and Android.

- Safety - Security measures in Huobi are robust. The platform is integrated in Singapore, where crypto regulation is advanced and supports various blockchain startups. It provides several security mechanisms to protect user accounts, such as two-factor authentication, which is available for both SMS and Authenticator applications.

- Fast customer service - Huobi responds quickly to customer issues. Contacting the customer service team is also very easy. The customer support team will respond immediately to any business issues within an hour.

- Extensive list of business couples – Like many stock exchanges, Huobi offers an extensive list of digital currencies available for trading. The wide selection of available Huobi crypto pairs is largely focused on listing projects from Asia.

- User Protection Fund - Like the leading regulated exchange Binance, which offers insurance called SAFU, Huobi transfers its profits to its "User Protection Fund", which is insurance to cover against theft, hacks or other unforeseen events that may affect users' wallets. This is a huge plus for its customers, because getting such insurance coverage means the certainty that they will get their funds back if something gets out of control while trading on the stock exchange.

- Derivatives and margin trading - The founders of Huobi realized that it was not enough to provide a trading platform only for cryptocurrencies; clients expect something more from the stock exchange to survive in the cryptocurrency market. It launched its own derivative products for both swap trading and futures markets. Soon after launching its derivative products, Huobi focused on margin trading and is now one of the market leaders offering C2C support and margin loans.

- Institutional business accounts – As one of the largest crypto exchanges, Huobi has attracted institutional investors and traders from around the world. To meet the needs of these investors, it launched a separate trading section, which includes OTC (Over-the-counter) trading and dark pool trading.

- Smart-Chain analysis - Smart-Chain Analysis is a very useful feature offered on the Huobi platform. It provides users with an overview of various assets and more than 50 different business indicators.

- Huobi API – Huobi global allows its users to encrypt their trading shoes using the Huobi API key or the REST API. In order for users to start trading with the Huobi API, users must first generate their API key, which they should not share with anyone.

History

Huobi Global was founded in 2013 in Beijing by Leon Li, a former Oracle engineer who purchased the Huobi domain in 2013 to provide a cryptocurrency trading platform for individuals in mainland China and beyond. The platform expanded rapidly to become one of the three largest cryptobourses in China, providing traders with ample liquidity.

However, the changing regulatory environment in China forced Huobi to move its cryptocurrency trading services abroad in 2017. The company subsequently registered in the Seychelles and established a new headquarters in Singapore with a view to expanding to other Asian markets and the rest of the world.

Huobi Global has successfully expanded its user base outside China to become one of the most liquid crypto exchanges in the world.

However, in 2019, Bitwise Asset Management accused Huobi Global of washing ttrading in order to inflate trading volume data. While Huobi denied the allegations, she announced that she had put in place measures to discourage wash trading on her platform.

Regulatory problems led to the closure of the US branch of Huobi Global, HBUS, in late 2019, and in 2021 forced the stock exchange to close its Beijing-based entity, informing all remaining users in mainland China that the accounts would be closed by the end of 2021.

Despite its failures, Huobi has managed to build a thriving cryptoactive ecosystem, composed of its own blockchain, the Huobi Eco Chain; Huobi token (HT); stabelcoin covered dollar called HUSD; and more. Today, Huobi Global claims to serve tens of millions of users in more than 100 countries.

Huobi fees

Depositing tokens to Huobi is free. Withdrawal fees vary depending on the type of cryptocurrency and is determined by the network.

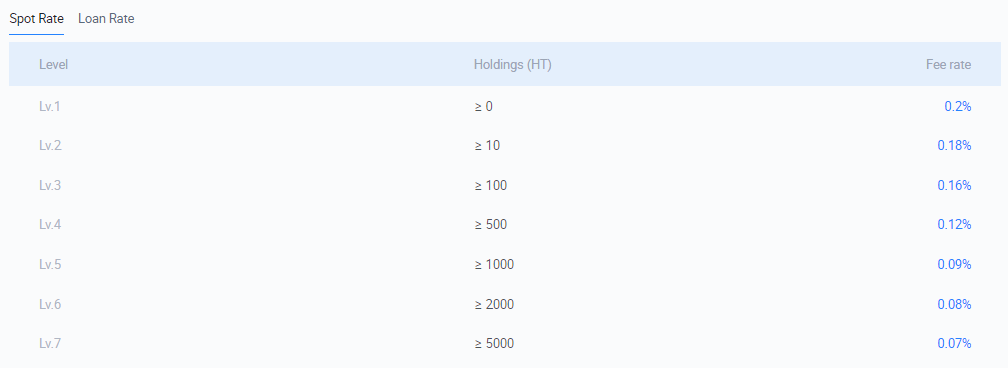

The basic trading fee is 0.2 %. You will get a lower fee if you own a certain number of Huobi tokens.

For professional traders, macro fees start at 0.0362 % and taker fees start at 0.0462 %. Fees are reduced based on HT holding and trading volume.

Huobi futures fees for USD and coin margin pairs have a different transaction fee compared to the Huobi spot exchange. Purchase and sale transactions will require 0.02 % for creators and 0.04 % for payee orders.

Holding HT tokens does not offer any discounts on fees, however, a discounted rate can be obtained by becoming a Huobi VIP client by trading more than 25 million in 30 days. Fee rates for futures and swap contracts can be found HERE.

Huobi tutorial

Account opening

Opening an account on the Huobi exchange platform is very easy. To register an account with Huobi, you will need to enter your email address or phone number and password. You will also receive a confirmation email or SMS and verify.

Once you've verified your email address, you'll have access to the platform and explore its products and features.

However, with basic registration you will be subject to low trading, withdrawal limits and you will not have access to some of the platform's features. You will need to complete verification to increase these limits. The name of the user registered with Huobi should be exactly the same as it appears in the bank accounts of each user who intends to link to the Huobi account.

Users must upload government-issued IDs to verify nationality, such as passports, driver's licenses, social security numbers, military certificates, etc. After uploading documents, users are required to upload a selfie with any government-issued document.

Trading on Huobi

Huobi offers different cryptocurrency markets that can be traded using the same user account. Individuals can speculate on digital currencies using spot exchanges, margin exchanges, futures market, options and USDT-swaps with leverage up to 125x. PCryptocurrency trading products with leverage allow customers to secure their positions to balance the crypto portfolio and exposure to market conditions.

Spot trading

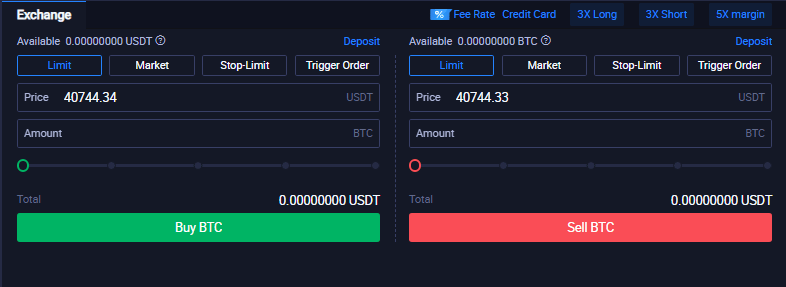

The user interface on Huobi is well laid out, responsive on all devices and visually appealing.The top menu includes quick drop-down menus for access to all Huobi features and services. The tables and order windows are located in the middle with the order book on the right. Clicking on the price will automatically fill in the limit orders. Changing business pairs or logging out of Huobi does not remove any drawing tools or patterns that overlap the chart. The chart analysis therefore remains on the chart until the trader removes it.

There is also the ability to switch between light and dark mode and add charts to the favorites list. Overall, we could not complain about the business experience and it is doing well compared to other top trading platforms.

Indicators, drawing tools and commands

Huobi offers its users two user interfaces to choose from. The default graphing window was developed by Huobi and it's easy to view the graphs for each pair. However, users can switch to TradingView charts, which are known for providing excellent trading tools and features for creating cryptocurrency charts. There is a wide range of time frames and tools for drawing trend lines, adding indicators and chart patterns for perfect trade timing.

The Command window provides a number of commands, such as limit, market, stop-limit and trigger order. The latter allows a person to place an order on the market at a predetermined price and quantity, which is executed when the trigger price is reached. The order essentially combines a market and a limit order and can be used as a stop-loss order to protect capital. This feature is available on a very small number of exchanges, but it is important to note that this is not a guaranteed stop order.

At the top of the order window is a description of the fees. It's a great way to check the correctness of creator and recipient fees based on quantities or discounts for holding HT tokens.

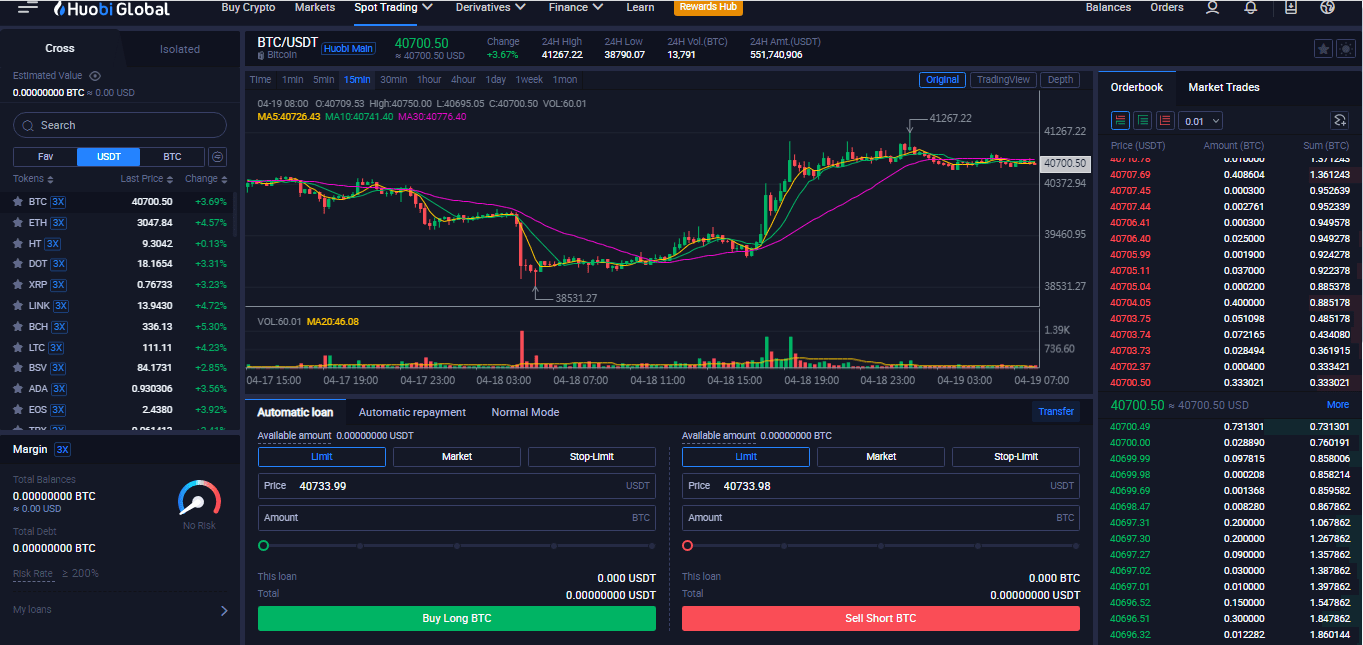

Margin trading

Margin Trading allows you to borrow funds to conduct leverage trading, which means you can open a position that is larger than your account balance.

Huobi cross margin trading allows you to prevent liquidations by having a shared account for all your open positions. Suppose one of your positions loses and the other wins. The one in profit can then cover the losses and prevent the liquidation of this position.

Huobi isolated margin trading increases your chances of disposal; however, it reduces the chances of further losses from your main account. It does so by dealing with the capital of each position separately.

Cross and isolated margin trading has three regimes.

- Automatic loan - Instead of the classic loan, you can choose the automatic loan mode. Huobi will automatically lend you the necessary funds to open a position of your choice.

- Automatic repayment - You can repay the loan manually, or you can choose only the automatic repayment mode. Now all your incoming profits will first be used to repay your loan.

- Normal – The normal mode simply allows you to open or close positions and you can repay the loan amount manually.

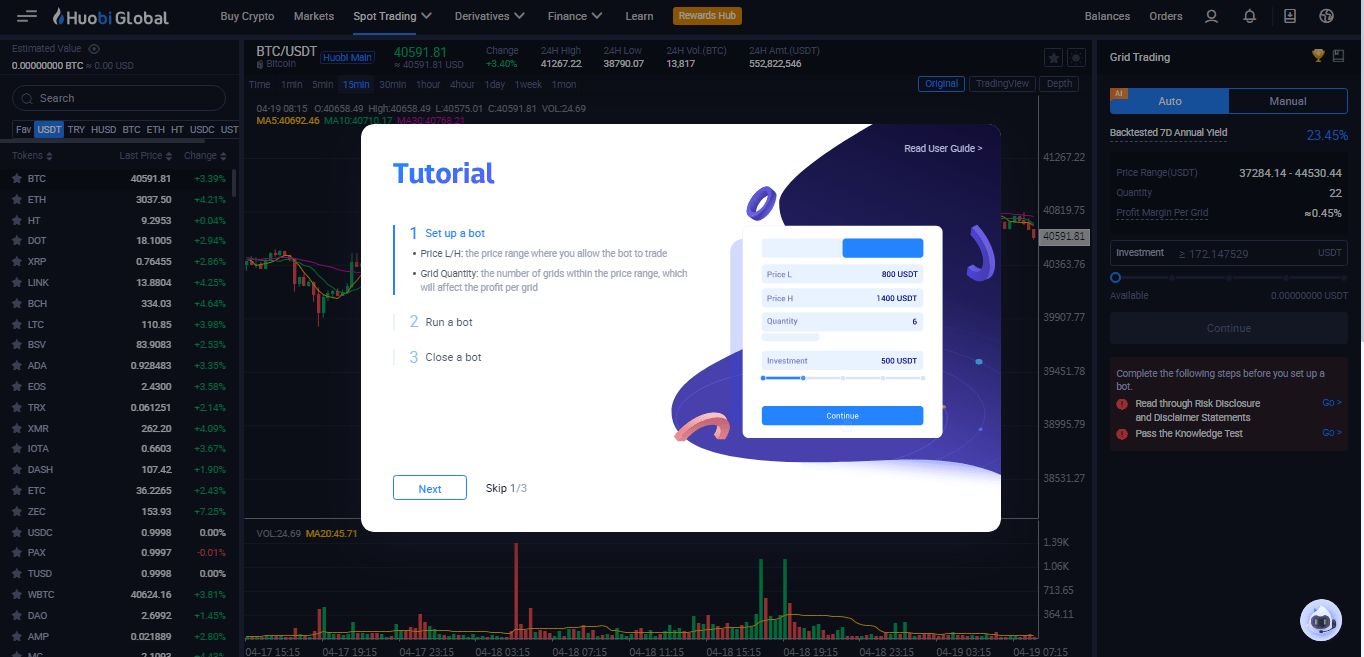

Grid Trading Bot

Huobi has introduced trading shoes to automate spot trading. The Grid Trading function is an automatic robot that places orders within a defined range. Purchase orders can be placed at the lower end of the range, which is automatically sold as soon as the price reaches a defined point at the top of the grid. Based on current back-test data, the Huobi grid trading bot has a 7-day annual yield of 23.47 %, although past performance does not indicate future performance.

In order to start using the robot, marketers will first need to complete a knowledge test, which should not be a problem for advanced users. The selection of trading robots available for Huobi is limited to the Grid Trading robot only. Individuals who want to automate advanced crypto strategies, such as arbitrage trading and based on technical metrics, will need to use alternative platforms.

Bot trading offers beginners two ways to start their journey trading on the grid.

- Car - The system sets the most suitable parameters based on the analysis of historical data, where users only need to set the amount of investment.

- Manual - You can set your own parameters.

Derivatives trading

Huobi has a platform for derivatives that is currently 4. the largest platform for derivatives trading, in terms of volumes. Using the Huobi futures market is an excellent way to short-circuit Bitcoin and other shares as a risk management tool that can be accessed within a single Huobi Global trading account. An individual can place orders on the futures market to maximize returns, reduce the impact of spot market price fluctuations, lock down profits and losses, and ensure stable trading income by securing their crypto portfolio.

Derivatives trading, USD Coin Swaps and Futures are available on PCs, tablets and mobile devices that can be accessed from anywhere with an internet connection. The user interface has the same appearance as the spot exchange, which increases the awareness of existing Huobi customers. Cryptographic futures pairs can be traded with leverage up to 125x, but this is not recommended for beginning traders.

At Huobi are available:

- Perpetual swaps are an innovative type of futures contract that does not have a specific settlement time. These contracts allow traders to "keep" positions for as long as they want to remove time constraints.

On the Huobi Futures platform, there are both coin margin swaps and USDT margin swaps with leverage up to 125x. A financing mechanism is implemented that anchors the price of the standing swap to the price of the underlying asset. This is adjusted 3 times a day or every 8 hours.

- Inverse contracts is another name for coin margin contracts. They are a type of futures contract for delivery and also a perpetual swap. These contracts are marked "Coin-M" on the Huobi Futures Exchange.

Although trades are denominated in USD, cryptocurrency assets are used as margins. For example, trading an ETH / USD futures contract with margin coins requires the trader to enter ETH as collateral.

- Linear contracts is another name for USDT margin contracts. They are marked "USDT-M" on the Huobi Stock Exchange. The underlying asset for settlement is stablecoin, Tether (USDT).

With this type of contract, more cryptocurrencies can be traded thanks to the stability of USDT stablecoin. Linear contracts are only offered as permanent swaps on the Huobi Futures platform, which means that there are no delivery times. Traders can hold positions with USDT margins as long as they choose.

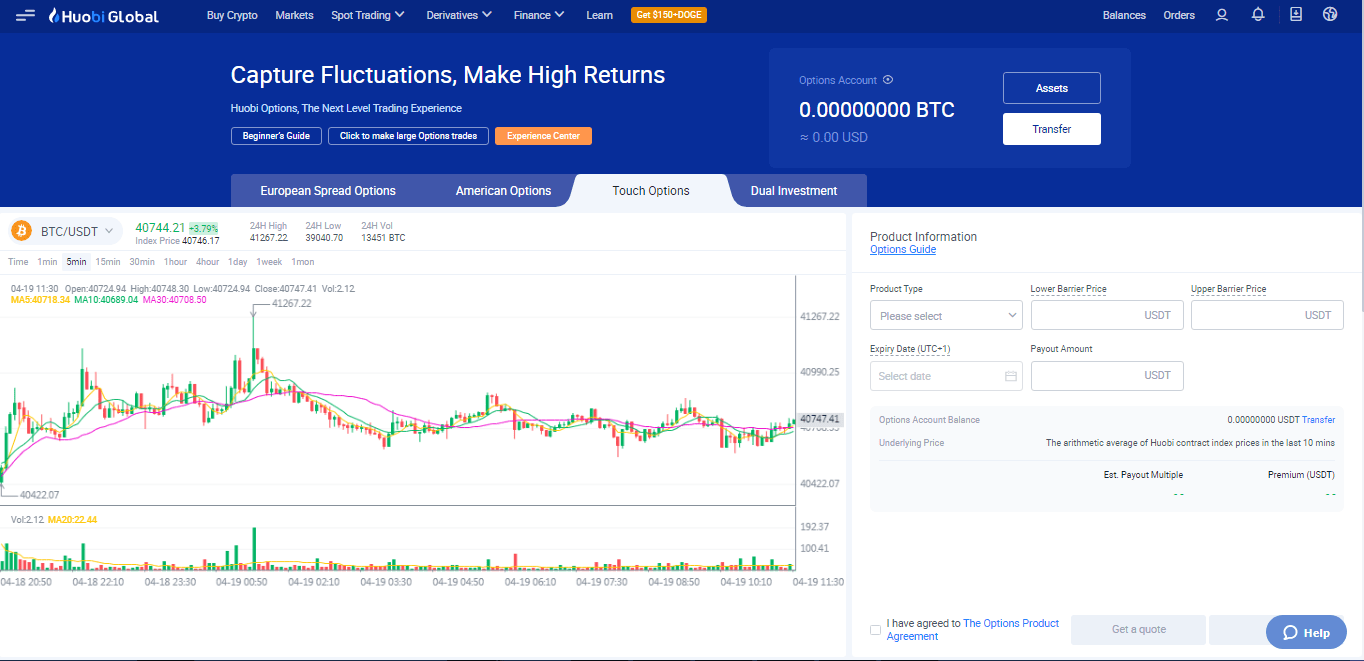

Options trading

Huobi Options offers a range of option products, such as US stand-alone options, European option spreads, options with adjusted exercise prices and OTC options. Options allow the buyer to buy or sell a certain amount of underlying assets at a certain time in the future and the buyer must pay a certain amount of option fees (premiums) to the seller. Huobi offers:

Crypto loans from Huobi

Verified Huobi customers can lock crypto assets to obtain a loan in cash or digital currencywhich can be used to trade on the Spot exchange, Margin and Futures platforms or withdrawn for spending. Supported coins that can be stored and used as collateral include BTC, USDT, ETH, HUSD, HT, LTC, BCH, EOS, LINK, BSV, XRP, DOT and HPT.

For example, a person may obtain a $ 10,000 loan by depositing 0.39 BTC as collateral. Based on credit period 90, the interest rate is calculated at 0.0345 % per day or USD 310.

Huobi loans have a fixed maturity of 30, 45 or 90 days with flexible repayment options. In the event of early repayment, you do not pay any penalties or fees, but the amount of interest will be repaid before the borrowed capital. The interest rate is calculated on the basis of hours of use and is determined from the date of commencement of the loan. Interest overdue after 7 days will be charged at 3 times the interest rate.

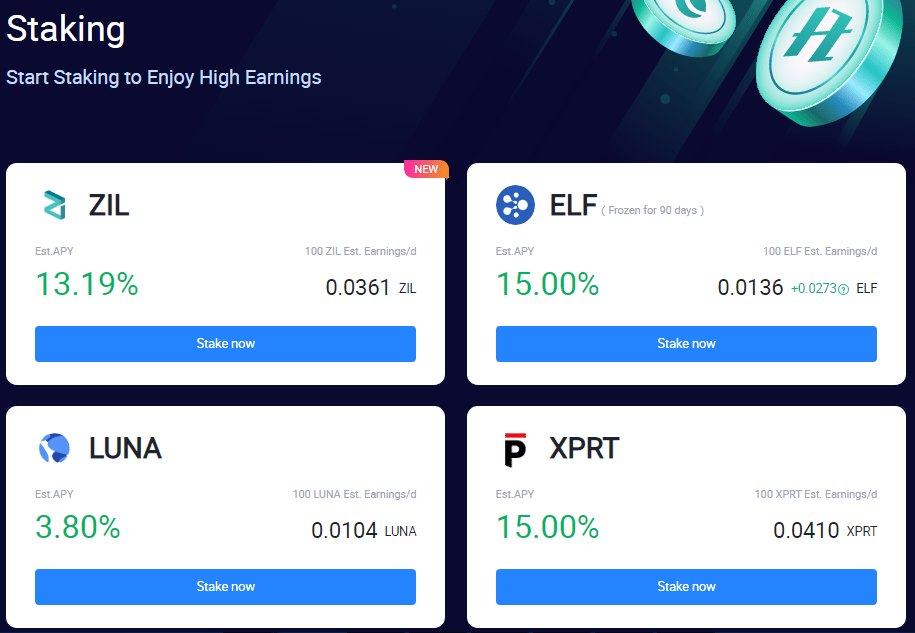

Huobi Staking

Huobi also has a coin stacking feature that allows its users to earn rewards for holding digital currencies in Huobi's wallet. Huobi is one of the best platforms in this regard thanks to its high yields and zero fees. For example, XPRT can be downloaded to Huobi Global and receive an estimated reward of 15 % APY.

Staking will suit holders of cryptocurrencies who like to lock their coins for a set period of time to earn returns. Once the coins are locked, the balance of the Huobi wallet will be deducted and the coins will be automatically placed in the pool to earn rewards.

Once the Huobi coins are locked, the assets in the Huobi account will be frozen and cannot be traded.

Huobi also offers support for upgrading the Ethereum 2.0 network to the Proof-of-Stake (POS) consensus model. Users can put Ethereum in their wallets to receive ETH 2.0 staking rewards. Rewards can only be claimed after the Etherea upgrade is complete.

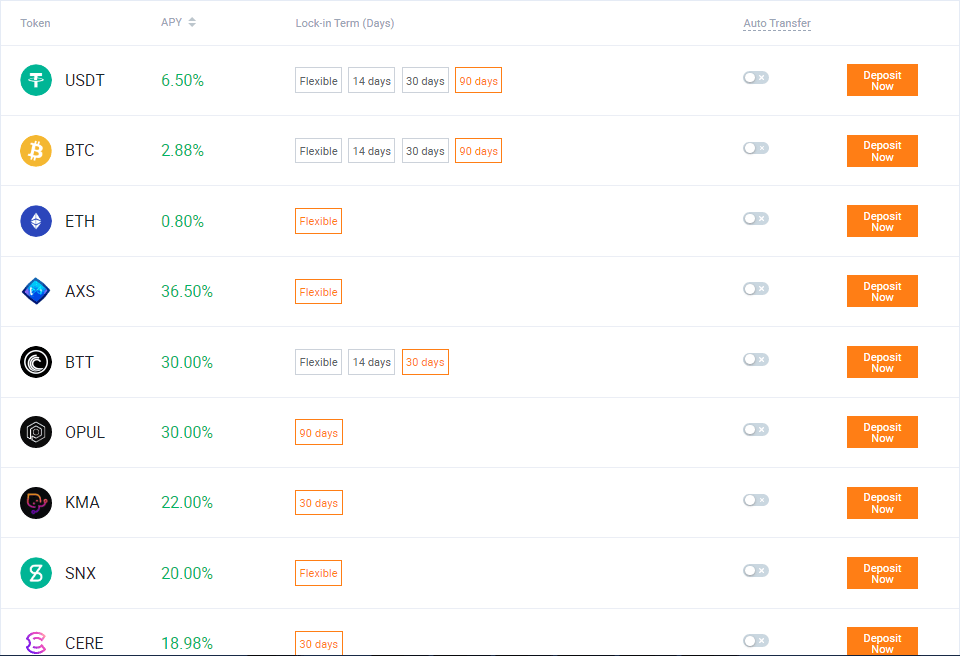

Huobi earn

Huobi has introduced a new feature called Huobi Earn, which offers flexible and robust conditions for interest on coins and tokens in Huobi's wallet. Customers can choose to deposit funds to earn interest on the most popular cryptocurrencies and DeFi tokens, which are loaded daily.

At the same time, activities such as " Prime Earn "And" Featured "as time-limited promotions based on market conditions, so that users have more opportunities to earn interest.

Huobi primepool

Primepool is an initiative that offers users an easy and convenient way to get involved in the development of projects listed on Huobi Global. With Primepool, participants have the chance to buy new tokens at a low price, earn very interesting returns for a limited time, and trade in a newly listed token once the Primepool activity ends.

Huobi mobile application

Huobi offers a robust mobile application compatible with both iOS and Android devices and allows merchants to trade on the go. It is easy to navigate and provides the same features as the desktop version. In addition, the application allows users to perform all required verifications and registrations directly from the mobile phone itself.

Huobi Token (HT)

During its operation, Huobi launched its HT token, which runs on the Ethereum blockchain. Unlike most native tokens introduced by cryptobourses, HT was not released through the ICO, but was provided as a loyalty scheme to account holders. HT token holders can pay for service charge packages or vote for new tokens.

HT gives users the right to reduce cryptocurrency trading fees by up to half, allowing users to participate in stock exchange management decisions and participate in IEOs. In addition, reducing fees on Huobi using HT is easy. Users simply hold HT tokens in their cryptocurrency and then select the option to use HT from the trading fees panel.

In addition, users have VIP membership available, which they can book to reduce the same fees to a maximum of 65 %.

Deposit and withdrawal

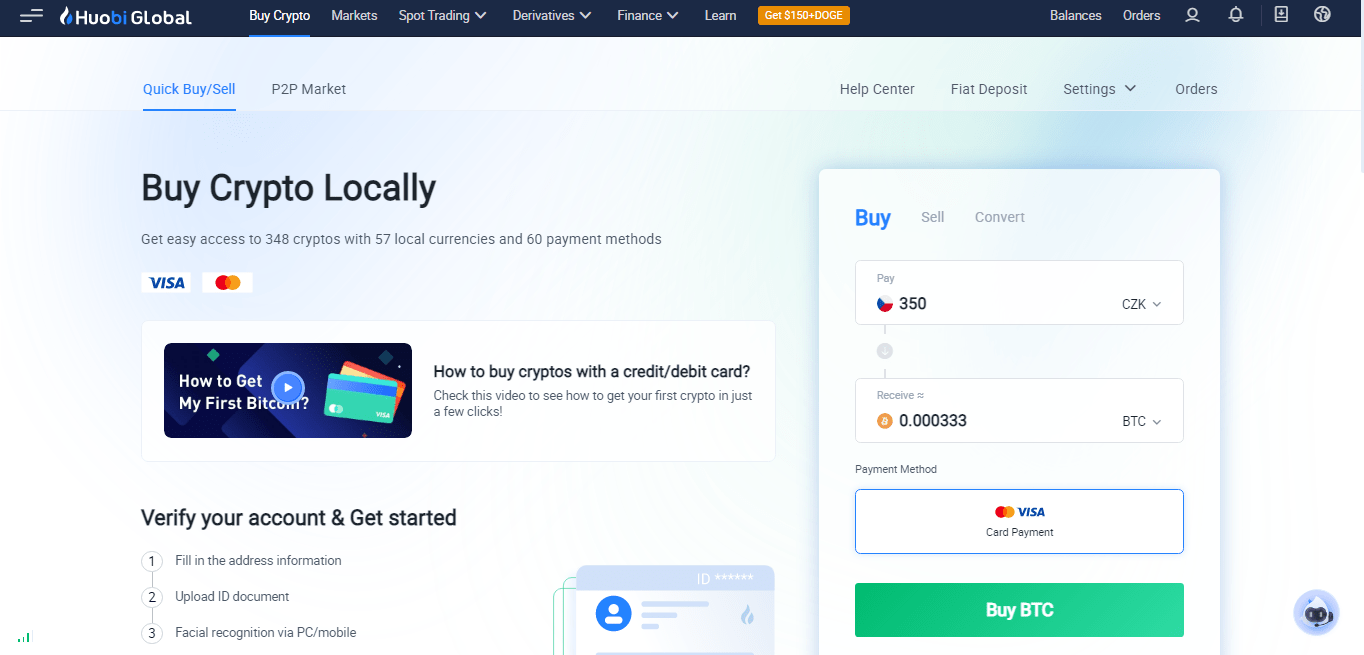

Huobi supports 8 currencies and several payment methods to fund the account. Depending on the country, the user will see the available deposit options for converting fiat currency to currency exchange. Commonly supported deposit options include bank transfer, faster payment, AdvCash, credit and debit cards, bank transfer and SWIFT.

Another deposit and withdrawal method is crypto-to-crypto.

You can also buy cryptocurrencies for Czech crowns and another 56 currencies and perform cryptocurrency conversions via the quick buy / sell service, which can be found on the main bar under the Buy Crypto tab. Unfortunately, it is not possible to sell cryptocurrencies for CZK.

Safety

Huobi has proven to be one of the safest platforms for buying and trading cryptocurrencies. The platform is a relatively safe place to temporarily store assets. Huobi Global has implemented several security measures to protect the user's personal data and funds from external threats, internal errors (eg human error) and abuse of internal authority.

Huobi has a strict protocol for separating users' digital assets into cold and hot wallets. According to the website, 98 % cryptocurrencies are stored in offline wallets with multiple signatures. The Exchange established the Huobi Security Fund with a total amount of 20,000 BTC. These funds are stored in various wallets so that they can be used in the event of an unlikely stock market hacking or incident.

No cyber security hacking incidents have been reported since its launch. Huobi is a trusted cryptobourse that meets the needs of the highest traditional standards for financial and cryptocurrency markets around the world.

Benefits

- Advanced user interface for serious cryptocurrency traders

- Deep liquidity across all trading couples

- Competitive business fees of 0.2 % per order

- Lending function to obtain interest on cryptocurrencies

- Supports staking for passive rewards

Disadvantages

- Discounts and rebates on business fees can seem confusing

- The platform can be difficult for beginners

Conclusion

To conclude our stock exchange review, Huobi has been a leading cryptocurrency exchange since 2013, with excellent features and services, security, a mobile application and competitive trading fees. The user interface, supported coins, and various trading pairs will suit most altcoin traders. For the investor, there are plenty of financial products to maximize the portfolio, such as lending, to get crypto interest and staking.

Overall, Huobi Global is a reliable and secure platform. The depth of market liquidity across its trading pairs, such as BTC / USD and ETH / USD, is attractive to retail and professional traders. In addition to other unique features hosted by the platform, the User Protection Fund certainly deserves special mention. Huobi, loaded with a wide range of services and products, is a complete package for cryptocurrency enthusiasts.

FAQ

Is Huobi safe?

Yes, Huobi is a secure trading platform, which is why it has gained immense popularity since its launch.

Are Huobi fees high?

According to various reviews of Huobi available online, Huobi's fees appear to be slightly higher than other trading exchanges.

How do I exchange coins in Huobi?

Users can exchange their preferred cryptocurrencies on Huobi by following the steps below:

Visit the home page of Huobi Exchange and click the "Trade" button.

Click on the "Exchange" tab and select the digital currency and preferred amount to exchange.

Confirm the USDT amount and value of the cryptocurrency they wish to exchange for Bitcoin or other cryptocurrencies.

Click the "Confirm" tab to complete the transaction.

What is Huobi Token (HT)

Huobi Token (HT) is a currency token and native currency issued by the Huobi Group. The token is based on the Ethereum network with a limited total delivery of 500 million. Huobi Token is the native currency of Huobi Global, which is used to provide internal functions and provide incentives such as VIP access, discounts on business fees, voting rights for new coin statements.