The USA is the global leader in Bitcoin mining electricity expenses, spending over $10.8 billion annually, far exceeding any other country. China and Kazakhstan follow, spending $4.4 billion and $2.8 billion, respectively. Canada and Russia also stand out with significant expenditures—Canada spends nearly $1.5 billion, driven by relatively high energy costs, while Russia contributes over $1.1 billion, highlighting their substantial roles in global mining despite lower hash rates.

Bitcoin mining requires significant amounts of electricity, impacting countries and states by increasing energy costs, causing blackouts, and driving higher carbon emissions. This study dives into these critical issues to reveal the hidden costs of Bitcoin mining operations worldwide.

Key Findings

- The global annual electricity cost of mining Bitcoin is $24.7 billion.

- Countries mining BTC emit 167% more greenhouse gases.

- The U.S. tops global Bitcoin mining electricity costs at $10.5B yearly.

- BTC-mining states experience 9x more blackouts and 5x higher costs from electricity interruptions.

- BTC-mining states emit 71% more CO₂.

Where Is BTC Mining Most Costly?

The USA is the global leader in Bitcoin mining electricity expenses, spending over $10.8 billion annually, far exceeding any other country. China and Kazakhstan follow, spending $4.4 billion and $2.8 billion, respectively. Canada ranks fourth, spending nearly $1.5 billion annually. Russia follows closely with expenditures exceeding $1.1 billion, highlighting its prominent yet costly role in global Bitcoin mining.

Within the US, Georgia leads significantly, incurring electricity costs of nearly $2.9 billion. Texas and Kentucky follow, each surpassing $1 billion.

How BTC Mining Affects Blackouts

Bitcoin mining significantly increases the frequency and severity of power outages. States engaging heavily in mining activities experience notably higher blackout rates compared to those that don’t.

Texas, with a hashrate of 11.22%, experienced 22 blackouts, affecting around 1.75 million residents, making it the most blackout-prone and disruptive BTC mining hub. Georgia, despite having the highest BTC hashrate of 30.76%, reported only 4 blackouts affecting approximately 70,514 people. This indicates Georgia’s effective infrastructure management and ability to handle significant mining activity with fewer disruptions.

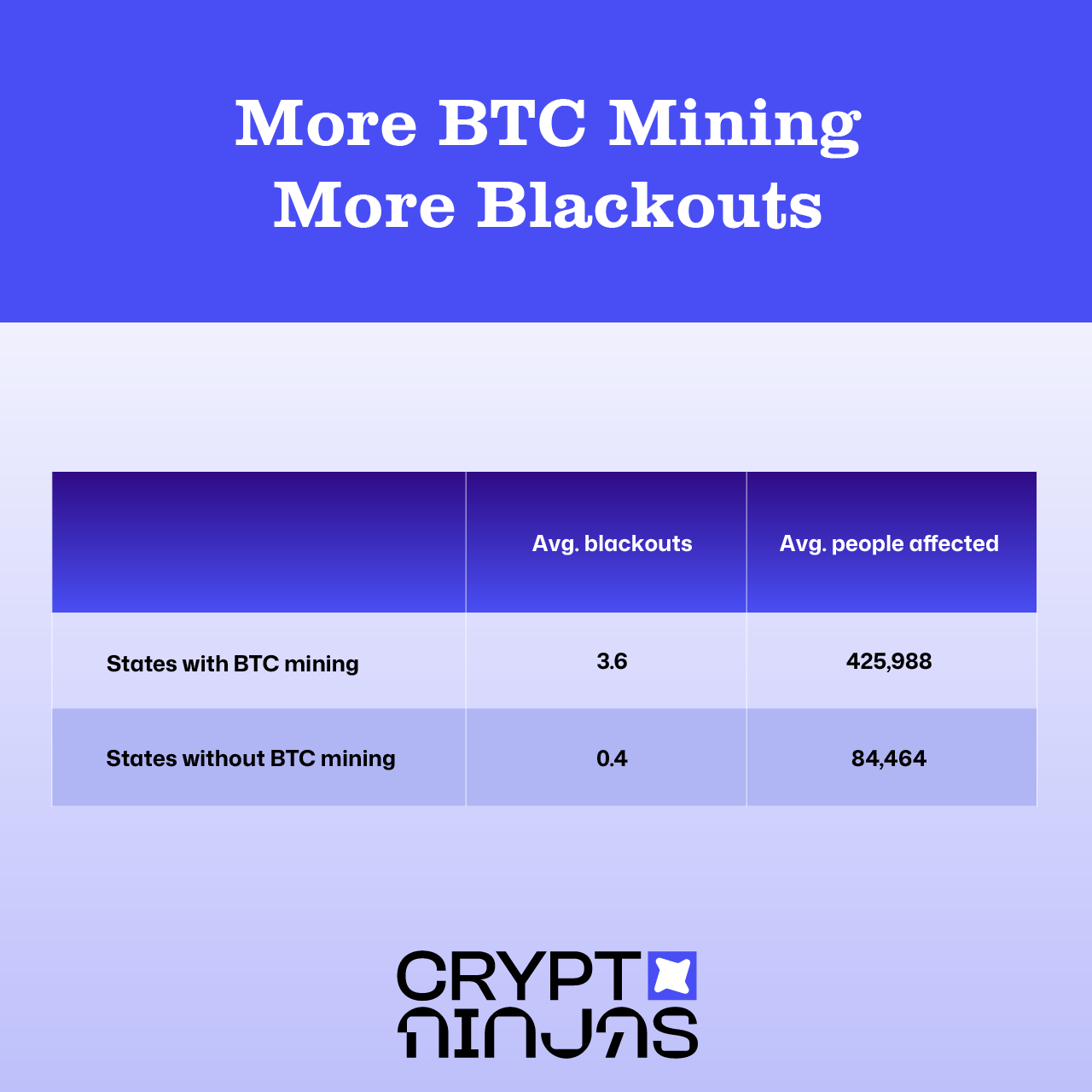

States involved in Bitcoin mining average 3.6 blackouts, affecting approximately 426,000 people, compared to states without mining, averaging only 0.4 blackouts affecting roughly 84,000 individuals. This means mining states experience nine times more blackouts, impacting five times more people.

How Blackouts Cause Heavy Economic Tolls

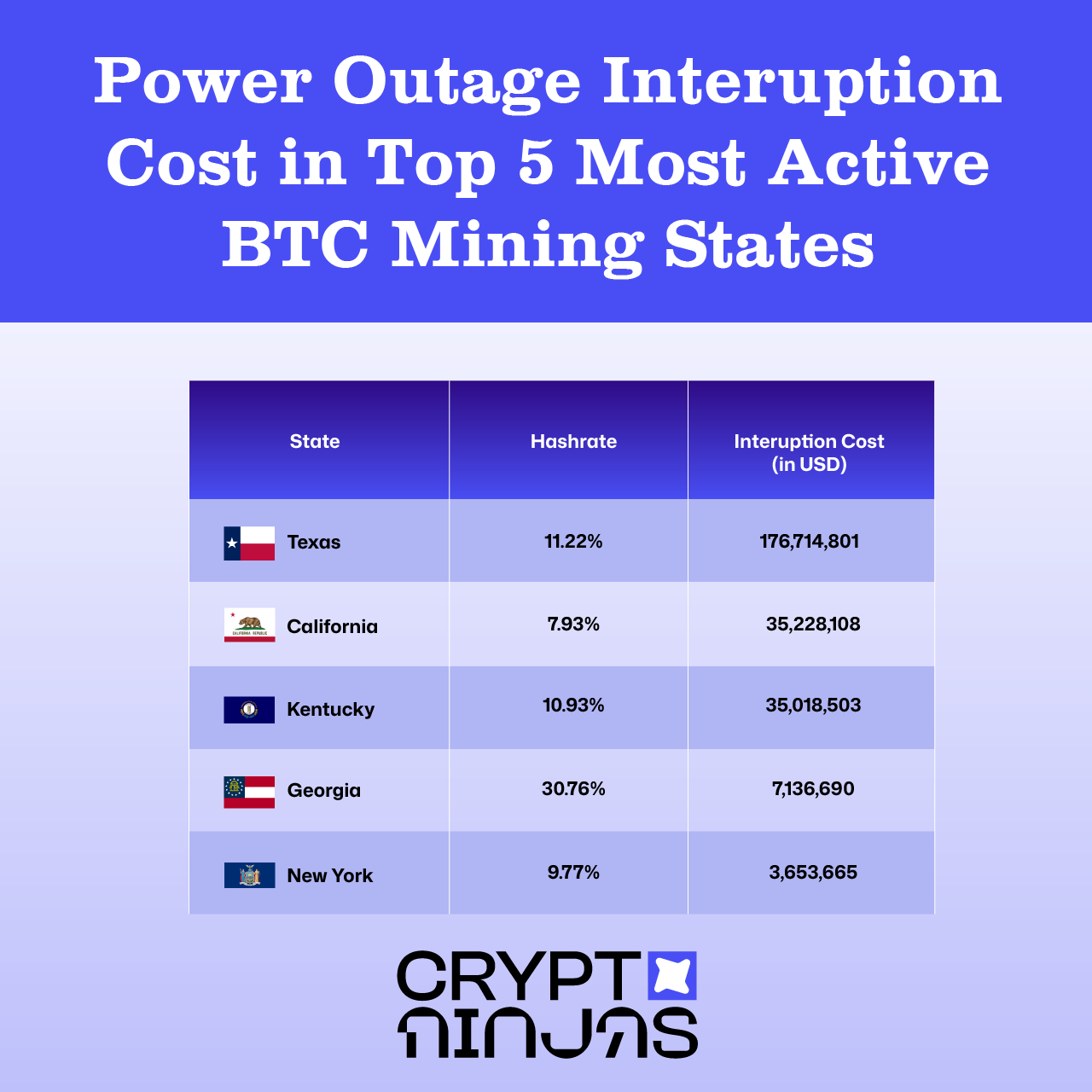

The interruption costs due to blackouts in mining-intensive states are staggering. Texas, again, tops the list with over $176 million in economic disruptions from 22 blackouts. California and Kentucky follow closely, each incurring around $35 million in interruption costs, demonstrating substantial economic vulnerability despite fewer blackouts. Georgia, despite its significant mining activity, incurs relatively lower costs ($7.1 million), showcasing effective infrastructure management. New York, with moderate mining activity, has the lowest interruption cost at $3.65 million, indicating minimal economic impact from its fewer outages.

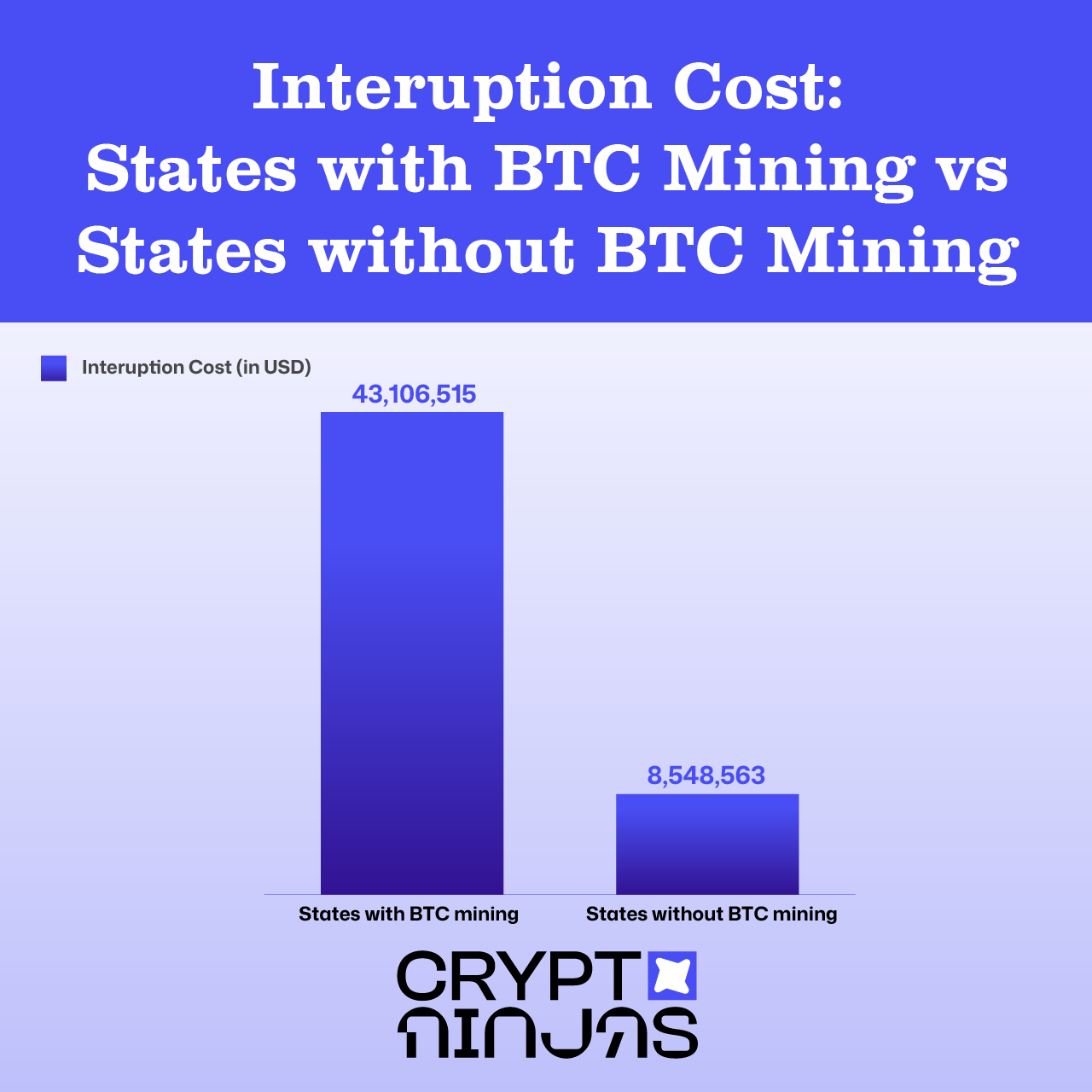

On average, states with Bitcoin mining incur interruption costs of approximately $43 million, compared to just $8.5 million for states without mining—an eightfold difference.

More BTC Mining Equals Higher CO₂ Emissions

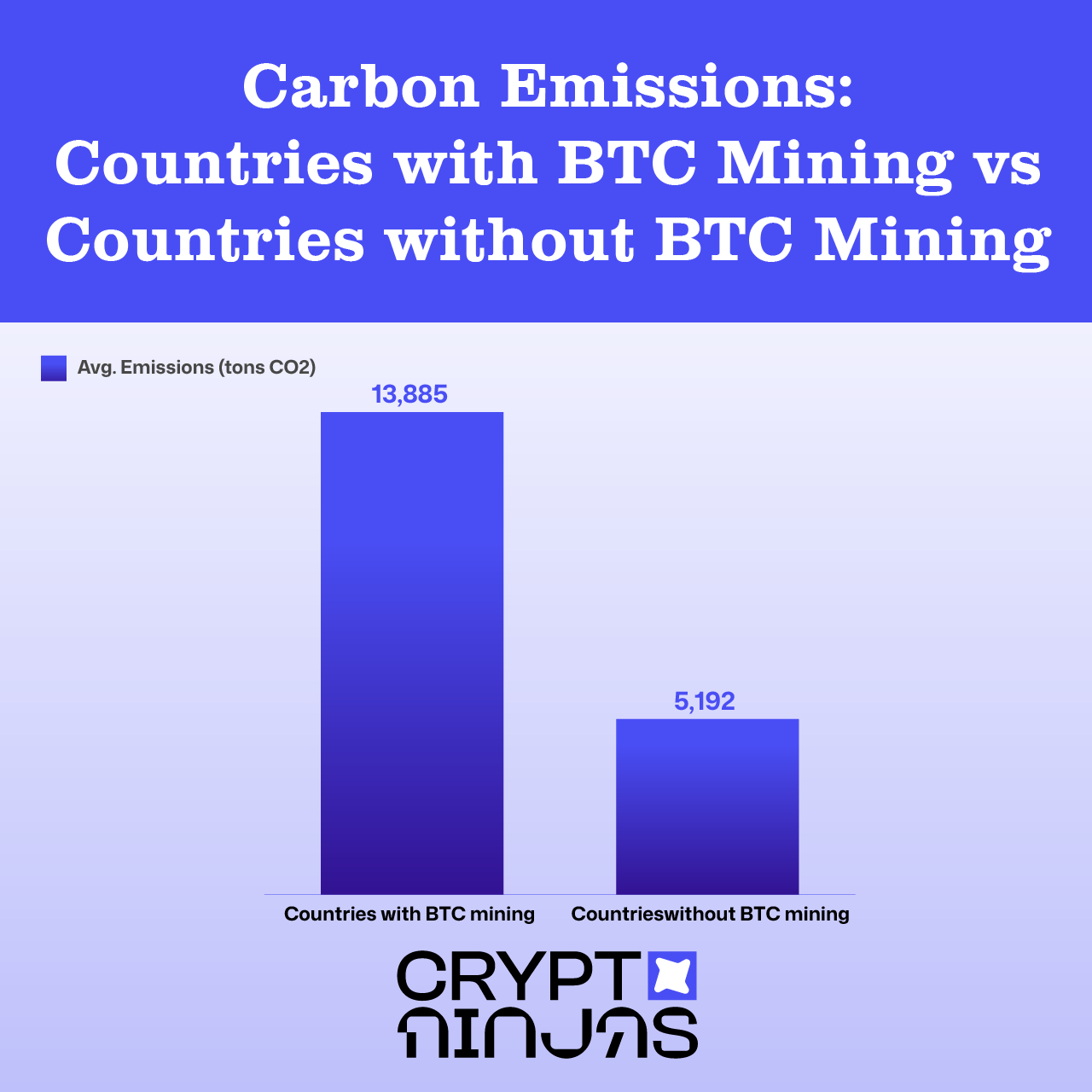

Mining Bitcoin also comes with a significant environmental toll, notably in carbon emissions. Countries mining Bitcoin produce 167% higher greenhouse gas emissions than those without mining activities.

Canada surprisingly leads the emissions, despite its lower hashrate, indicating heavy reliance on fossil fuels for mining activities. Interestingly, the USA has the highest hashrate globally yet the lowest emissions, underscoring its efficient or renewable energy-driven mining infrastructure.

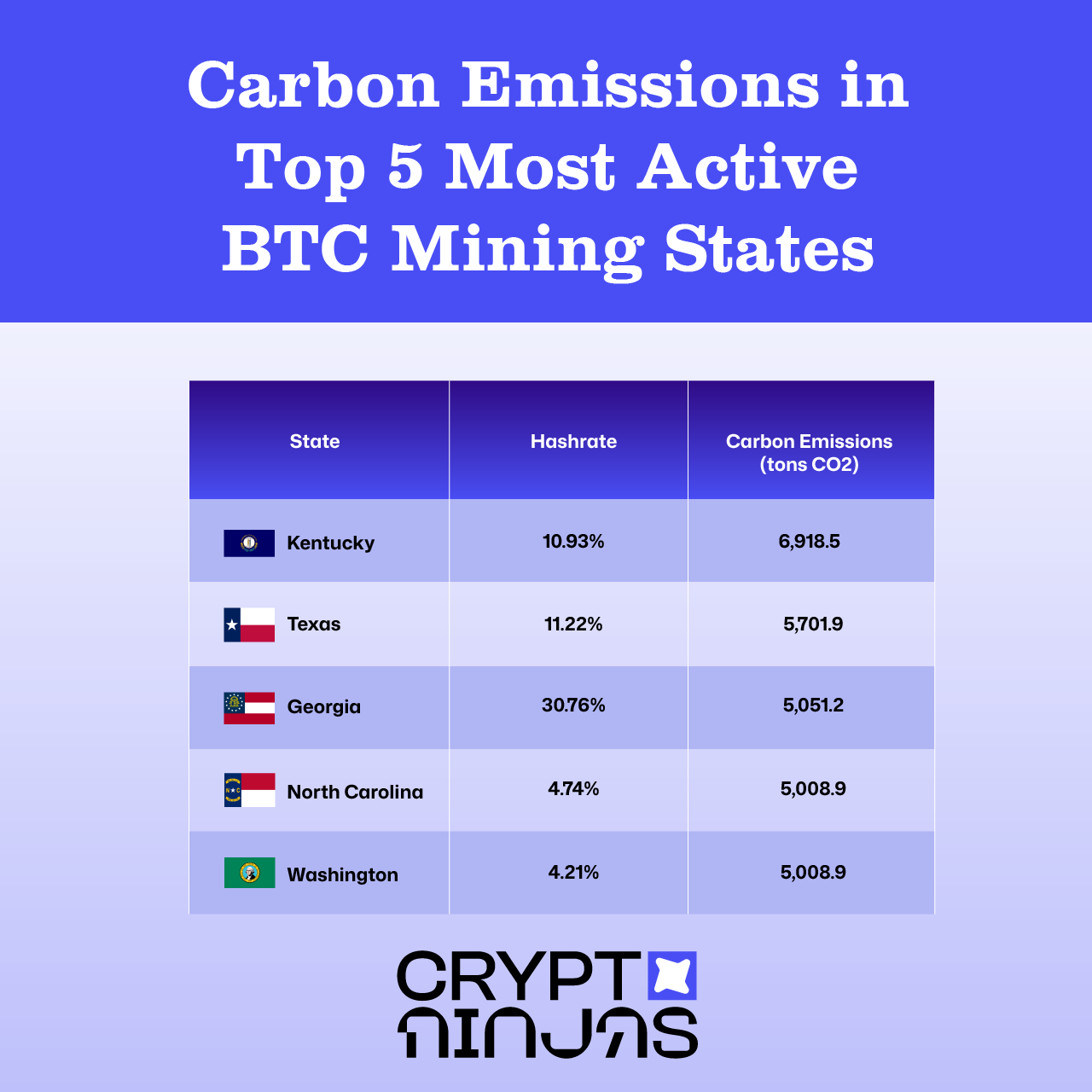

Within the US, Kentucky is the worst environmental performer, producing the highest emissions despite only ranking third in hashrate.

States with Bitcoin mining emit approximately 71% more CO₂ than those without. The substantial differences highlight a critical need for sustainable solutions in the cryptocurrency sector.

Conclusion

Bitcoin mining fuels significant innovation but also carries severe hidden costs. High economic burdens, frequent power outages, and substantial environmental harm from carbon emissions raise critical concerns. These impacts compel us to question the sustainability and ethics of current practices. The future of cryptocurrency depends heavily on adopting greener, more responsible energy solutions. Without proactive changes, the ongoing environmental and societal damages will likely escalate.

Methodology

This analysis integrates publicly available datasets and modeling approaches to estimate the regional costs, environmental impacts, and operational risks associated with Bitcoin mining. The methodology comprises the following components:

Data Collection

Data was sourced from various credible and publicly accessible repositories:

- Blackout Rates: Information on U.S blackout rates was obtained from the U.S. Energy Information Administration (EIA).

- Hashrate Distribution: The distribution of Bitcoin mining activity across regions was derived from the Cambridge Bitcoin Electricity Consumption Index (CBECI).

- Electricity Consumption: Regional and national energy use data were collected from Wikipedia (Energy Consumption per Capita) and the EIA’s State-Level Energy Use statistics.

Cost of Mining Estimation

The cost of mining Bitcoin in each region was estimated using a two-part calculation:

- Electricity Cost: This was determined by multiplying the average regional electricity price by the estimated energy consumption for mining activities in that region.

- Electricity Consumption: Estimated by combining public energy use statistics with the hashrate distribution data to approximate regional mining energy demands.

Greenhouse Gas Emissions

Carbon emissions associated with Bitcoin mining were calculated using emission factors provided by the U.S. Environmental Protection Agency (EPA). These factors were applied to the estimated electricity consumption figures to determine the environmental footprint of mining operations.

Interruption Cost Calculation

The economic cost of power interruptions was modeled using data and formulas from IceCalculator.com. This model incorporates both the frequency of blackouts and the estimated number of people affected to assess the overall impact of outages in mining regions.