Curve.com is a UK-based fintech company specifically targeted at users with multiple online bank accounts who could benefit from consolidating all of their bank cards into one, easy-to-manage smart card. Originally launched in Ireland, it is now available in the UK, Europe and is planned to expand to other parts of the world. Now he can boast more than 2 million customers

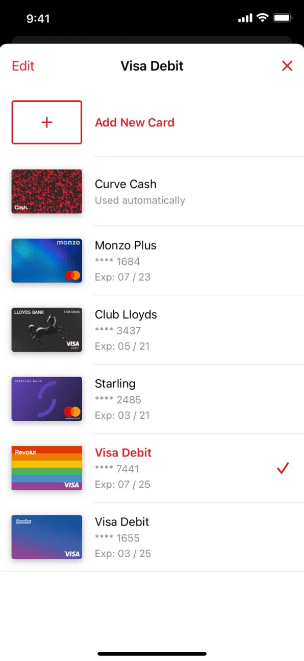

Curve provides its users with a single MasterCard debit card that can be used to make transactions from any account registered with Curve. This allows users to virtually link all of their existing debit and credit cards together on site, eliminating the need to carry multiple cards. It also makes it easier to keep accounts with expense details that are conveniently located in one, easy-to-manage location.

Curve was founded in 2015 and has since amassed serious investments from companies such as Santander InnoVentures, Investec, Oxford Capital, Taavet Hinrikus (CEO and co-founder of TransferWise) and Ed Wray (co-founder of Betfair).

Curve.com reviews

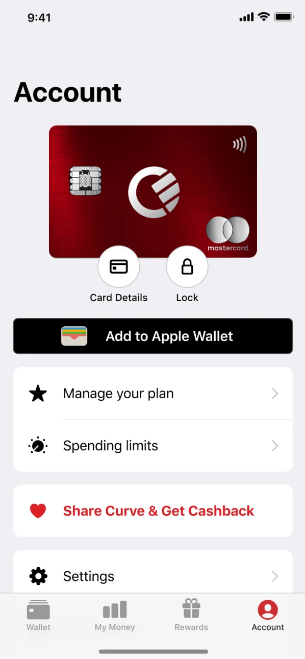

Using the Curve card brings all the features you would expect from a Mastercard with contactless payment and the ability to work with Apple Pay and Google Pay .

Once you have registered your account, your new Curve Card will be sent to you and you can then start linking your existing cards, either manually or using your mobile phone camera. Curve allows you to add all Mastercard and Visa debit or credit cards as well as some prepaid cards.

However, the card is currently unable to connect with American Express, Maestro, Diners Club, JCB or Union Pay, which could negate the whole purpose of the card for some people. The Curve card is managed through an application where you have access to all the functions of an online bank.

The application itself relies on simplicity rather than style, with a functional design allowing easy access to all functions. It is easy to navigate in the application. Curve.com benefits include:

- Curve contactless card. You get a physical contactless Curve card (which is a Mastercard debit card) and then you can use this one card to spend money on all the credit cards you have connected to it.

- Application management. Use Curve to select which of the connected cards you want to make the payment.

- "Turn back time" function. Did you choose the wrong card to pay? No problem. You have up to 90 days to "switch" purchases (up to £ 5,000) between cards.

- Expenditure notifications. Get instant notifications when you spend money on the Curve card.

- Expenditure analysis. Get categorized as you spend and see all your linked bank balances at a glance.

- Works with Apple Pay, Samsung Pay, Google Pay. Your Curve card can be added to any of these mobile payment platforms so you can pay by phone.

- Cashback at selected retailers. Get 20% cashback for purchases at certain retailers (over 100 to choose from, but you can only pick a few, depending on which Curve subscription you have).

- Competitive exchange rates when paying abroad. You get Curve exchange rates when you spend or withdraw money with a Curve card abroad.

- Anti-Embarrassment Mode - This mode protects you from card rejection. This will activate the backup card of your choice if the payment is not made.

History

The company Curve, which owns and operates the card and after which the card is named, founded Shachar Bialick in 2015. The company provided initial funding of $ 2 million in December 2015. An open beta version for iOS users was launched in February 2016. In December 2016, Curve announced that the application was made available to Android users.

At Wired Money in 2017, Curve was judged by the jury as a winning startup.

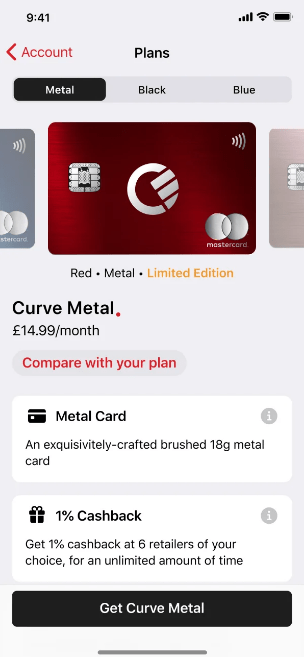

It was launched in Ireland in January 2018 and was based in London. Curve became operational in the United Kingdom in January 2018. In 2019, Curve launched a metal card. The card was made of 18 grams of stainless steel and was available in three colors: Blue Steel, Rose Gold and Curve Red Limited Edition. Only 5,000 limited Curve Red cards were printed in one series.

Curve.com fees and limits

Using Curve is completely free, but it comes with certain limits that can only be unlocked by upgrading to the paid version of Curve.

The fees at Curve.com are relatively simple. First, Curve Standard is a completely free account, even when using your Mastercard, withdrawing money, transferring money or depositing money.

Curve is also free for international payments of up to £ 500 per month, unless there is a weekend when a fee of 0.5 % will be charged. This can help save a significant amount on fees for foreign transactions.

For purchases in currencies other than euros and dollars, a 1.5% fee is paid.

Curve.com exchange rates are calculated according to the wholesale interbank exchange rate. This is one of the main advantages of using the Curve card, as most banks will charge a minimum of 5 % in addition to market currency exchange. However, Curve charges 0% fees for all your purchases abroad. It is important to note that this is not the case on weekends, when transfers between GBP, USD and EUR will be charged a surcharge of 0.5 %. However, compared to the main banks, it is still a good exchange rate.

Withdrawals from a foreign ATM are free of charge up to GBP 200 per month, after exceeding this amount you will be charged GBP 2 or 2 %, whichever is greater.

The thing to consider is that any fees charged by Curve will be in addition to the fees charged by the underlying card or its issuing bank. Therefore, the actual cash withdrawal price will depend on whether the company that issued your credit card charges a fee.

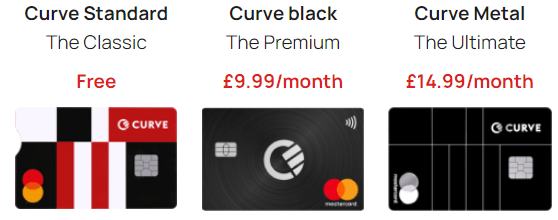

Curve.com offers Curve's three main accountswhich are as follows:

Curve Standard

Curve Standard is a freemium account that won't cost you anything on monthly fees while still giving you access to your Curve debit card and in-app features, including

- £ 200 a month to spend abroad for free

- Curve Cash - Choose up to three retailers and get 1% cashback from an extensive list covering most grocery stores, restaurant chains and retail chains.

- Contactless functions

- Curve cards come with insurance up to £ 100,000.

The main disadvantages of Curve Blue cards are the spending limits that are currently:

- Cash withdrawal of £ 200 per day

- Spending limit £ 2,000 per day

- £ 5,000 a month for 30 days

- £ 10,000 a year on a 365-day basis

If you require increased spending limits, you may want to consider upgrading your account to Curve Black.

Curve Black

The black card will take you to £ 9.99 a month, but comes with the following additional features:

- Curve Cash - Get cashback from an extensive list of most grocery stores, restaurant chains and retail chains.

- Shop abroad at no charge up to £ 15,000 a year, after which you will be charged a fee of 2 %.

- Withdrawals from ATMs are free up to £ 15,000 a year and then charge 2 %.

- Limited travel insurance.

- Increased spending limits.

- Up to £ 400 free withdrawals from foreign ATMs per month.

Spending limits for black members are currently:

- Withdrawing £ 1,000 a day

- Spending limit £ 2,000 per day

- £ 5,000 a month for 30 days

- £ 10,000 a year on a 365-day basis

Curve Metal

Curve Metal is the highest level available and will cost you £ 14.99 per month. It comes with the following benefits:

- Curve Cash

- Free spending abroad up to £ 60,000 and then 2 %.

- £ 600 per day withdrawals free of charge and then 2 %.

- Turn back time

- Curve Customer protection up to GBP 100,000

- Travel insurance

- Phone insurance

- Entrance to the lounge at the airport

- Car rental insurance

The spending limits for Curve Metal are the same as the Curve Black limits.

Curve.com tutorial

Curve has developed an easy-to-use and well-organized application that seems to elicit a positive response from users.

How to open a Curve account

Opening a Curve.com account is a fast and efficient process that allows you to access your Curve virtual card in 5 minutes and access your physical card in 5 days. To open your account, follow these simple steps:

- Download the app from the App Store or Google Play, enter your email address and phone number and personal information, including your home address.

- Select the card you want;

- Add a card - Adding debit and credit cards is safe and easy. Platfroma pit uses bank-level security and no sensitive data is ever stored on your phone. Simply enter your card details or scan the card and upload it to your Curve digital wallet. The application will ask you to verify your cards (a small amount will be removed from each card for verification purposes).

- You can start using Curve right away by adding your Curve virtual card to Apple Pay, Google Pay, Samsung Pay or Curve Pay. Once you receive your physical card, activate it in the app and you can start paying with it.

Curve application received a rating of 4.3 out of 5 in the app store and satisfied customers praise the easy-to-use interface.

How cashback works

Any cashback you earn will appear in your Curve digital wallet. Your balance can be applied automatically or you can turn off automatic spending to save on larger purchases. To pay by cashback, simply select the Curve Cash card like any other card in your Curve wallet.

Curve Flex

Curve has introduced a feature that makes you confused Divide any payment you made last year into installments using Curve Flex, freeing up cash for whatever you need. They will know exactly in advance how much your Flex tariff will cost and how much you will repay each month.

If something goes wrong with your payment, you have an extra 7 days to pay free of charge. Curve then says he will work with customers who are struggling to repay to come up with a tailor-made repayment action plan for an extended period of time.

The APR that will be offered to you in Curve Flex repayments will vary depending on the duration of the loan and the Curve "risk profile" configured after the affordability checks.

How to do it

- Drive over for any payment you have made in the last 12 months.

- Divide it into 3, 6, 9 or 12 monthly installments and Curve will refund your original amount.

- Your first Flex payment will be due within 30 days.

Customer support

The Curve customer support feature is available in the app and as a customer you will be able to contact a customer support representative within minutes during standard business hours. Curve also offers a FAQ section on its website that addresses a wide range of issues. However, several users complained that the FAQ was difficult to understand and that customer service could respond very slowly.

As with all digital banks, customer service is very important to create a sense of trust in the user, and in this respect Curve lags behind the brand. EThere are countless reviews that complain about the complete lack of customer service, whether by chat, phone or email.

Safety

Curve, operating as Curve OS Ltd in the United Kingdom and Curve Europe UAB in the EEA, is fully licensed, authorized and regulated by the Financial Conduct Authority and the Bank of Lithuania. The company has offices in London and Vilnius and is well on its way to launching in the very near future in the USA as well.

Today, the company has around two million customers after the number of new users flew by 346 % in 2020. However, the company has some doubts about the number of customers who actually actively use the service. Data that leaked to the press in 2019, suggest that only approximately 1 % customers used their Curve card after registration. However, Curve.com has not published these numbers with reference to industry precedent.

Curve says customer privacy and data security are top priorities and that all data is protected by "industry standard" encryption and security measures.

Curve has introduced its own "Curve Customer Protection" policy, which covers most purchases up to £ 100,000. If there is a problem with your purchase and you have contacted the seller yourself but have not resolved the problem, Curve has recovered the money from the merchant.

Curve.com users are also protected by Mastercard's chargeback rights, where money can be refunded if the goods are damaged as described or the merchant has stopped trading.

All things considered, Curve is a truly reliable and secure company that can certainly be trusted as an application for processing basic financial services, such as bank card aggregation.

Benefits

- An account can be quickly set up online;

- A complete record of your spending on these multiple accounts;

- Expenditure categorization;

- Cashback;

- Curve Flex.

Disadvantages

- Restrictions on free withdrawals;

- Slow customer support.

Conclusion

The main advantage of Curve.com is that you can only go with one card, instead of carrying all your debit, credit and prepaid cards. Integration with Samsung Pay, Apple Pay and Google Pay means you only need your phone. In addition, you have a rewards credit card that earns you a cashback.

But for anyone who has a lot of cards, it can be a bit of a hassle to change cards constantly in the app depending on which one you end up paying.

To sum up, Curve is a great tool if you have many different ones map and you hate carrying them with you at all times, and if you want to save on fees for foreign transactions without getting a dedicated card for your travels. Finally, it is worth noting that this is an innovative fintech solution that will make you look cool among friends.

FAQ

Is Curve Safe?

Yes, the Curve app is completely safe. Curve cards come with custom customer protection up to £100,000. In addition, Curve customers are protected by Mastercard's chargeback rights, which provide a refund if the goods are damaged as described or the merchant has ceased trading. Remember that Curve is not a bank and you never have to deposit any of your own money into a Curve account, which means your funds are always protected, no matter what happens to Curve.

Please note that Curve is not included in the Financial Services Compensation Scheme (FSCS) as Curve is classed as an electronic money service as opposed to a real bank.

Is Curve a real bank?

No. Curve is not an online bank and has never claimed so. It offers its users a comprehensive solution to the problem of multiple bank cards. It provides features and tools that allow you to manage money as efficiently as possible, and connects all your cards for easy use when using Curve abroad and at home.

Is Curve a credit or debit card?

Is Curve a debit card? Yes. It is a Mastercard debit card and you can use it like any other debit card, wherever Mastercard is accepted, worldwide. It does not hold funds like a traditional bank card and there is no need to recharge the card every time you need to make a purchase.