Amidst the economic uncertainty affecting countless countries around the world, market strategists at Bank of America Securities said in a market note this week that the largest cryptocurrency asset, Bitcoin, is highly correlated with the well-known precious metal, gold. Bank of America analysts Alkesh Shah and Andrew Moss noted that “investors may view Bitcoin as a relatively safe haven as macro uncertainty continues.”

You might be interested in: 7 FAVORITE WAYS TO BUY A BITCOIN CARD IN 2022

Bank of America Market Strategists Think “Investors May View Bitcoin as a Relative Safe Haven”

Market strategists from Bank of America Securities, Alkesh Shah and Andrew Moss, this week they stated, that Bitcoin and gold have been highly correlated recently. This news follows a recent report published by cryptocurrency data provider Kaiko, which said that Bitcoin has been less volatile than the Nasdaq and S&P 500 indexes. According to Bank of America strategists, Bitcoin’s price volatility relative to other global assets has caused investors to think of BTC as a safe haven asset.

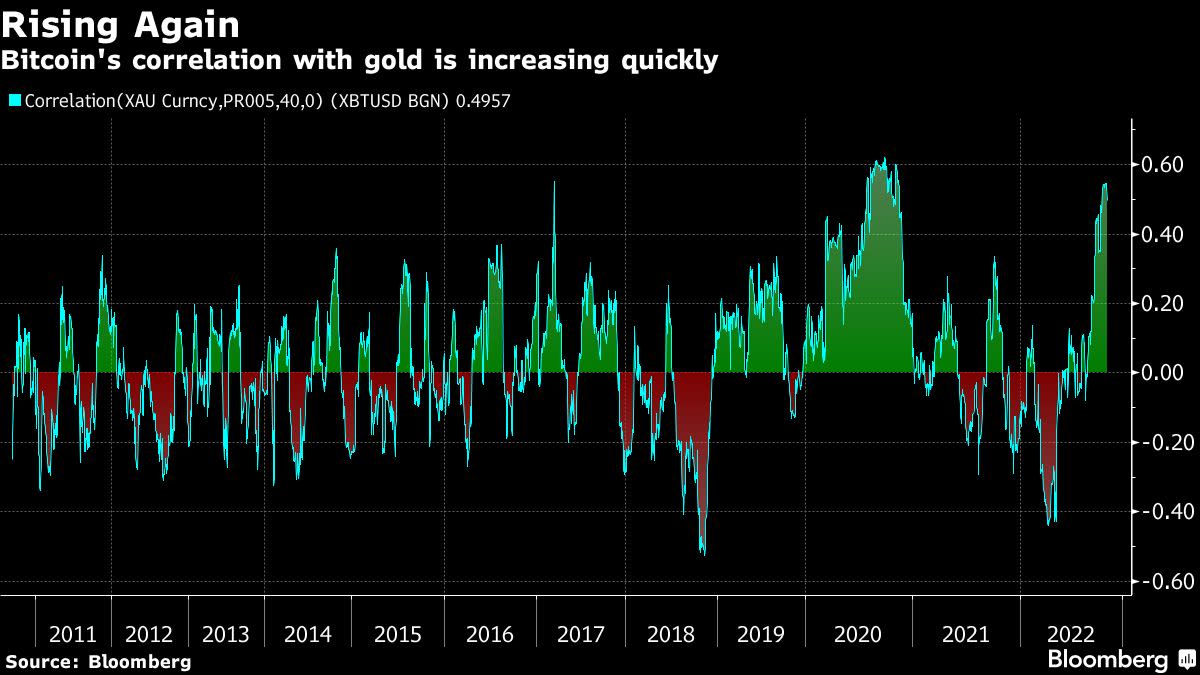

“The slowing positive correlation with SPX/QQQ and the rapidly increasing correlation with XAU suggest that investors may view Bitcoin as a relative safe haven as macro uncertainty continues and a market bottom is only just approaching,” analysts at BoA Securities wrote.

On Monday, October 24, both Bitcoin and gold prices were range-bound and less volatile compared to the stock markets. BTC is trading at just over $19,000 per coin, while an ounce of .999 fine gold is trading at $1,646.70. Shah and Moss of Bank of America have been tracking the 40-day correlation with gold, which is hovering around 0.50 this week. The 0.50 value indicates a stronger correlation with the precious metal than the zero rating in August.

The move comes as macro uncertainty has risen and analysts have warned that a rate hike by the US Federal Reserve could cause a liquidity crisis in US Treasury bonds. Market watchers expect aggressive rate hikes next month, but strategists also believe the Fed will turn around by December. Both gold and BTC have fallen significantly from their all-time highs. For example, gold hit an ATH against the US dollar on March 8, 2022, when it hit $2,074 per ounce.

Gold has lost 20.49 % against the US dollar since its all-time high 230 days ago. Digital asset Bitcoin has fallen by 72% over the last year after reaching $69,044 per coin on November 10, 2021. Gold today has a total market capitalization of approximately 10.895 trillion USD, while market capitalization BTC is approximately $369 billion.

Do not miss: WHERE TO BUY BITCOIN AND CRYPTOMEN