Bitpanda is a European trading platform based in Austria offering cryptocurrencies, but also stocks and metals, with a range of products suitable for traders of all experience levels. Their native BEST token offers discounts and VIP levels that come with their own benefits. Their fees are relatively low. The exchange is very attractive to many because it provides a very intuitive and easy-to-use interface for buying and selling cryptocurrencies. The exchange also offers a wide range of payment options that make it easier for beginning cryptocurrency enthusiasts to purchase cryptocurrencies. You can choose between a basic and a professional stock exchange, both of which are available through a single account. If you would like to trade on the go, Bitpanda also offers a mobile application for Android and iOS.

Basic information

| ✅Page type | cryptocurrency exchange and exchange office |

| ✅Easy for beginners | Yes |

| ✅Mobile application | Yes |

| 🌍Company headquarters | Vienna, Austria |

| 🌍Establishment of a company | 2014 |

| 💰Selection method | Cryptocurrencies, fiat |

| 📉Available assets: | 1000+ |

| 📉Cryptomens on the stock exchange | 16 |

| 👮♂️Trust in society | high |

| ☎Customer support | 24/7 very active |

| ✅Custom wallet | Yes, Bitpanda Ecosystem Token (BEST) |

| ✅Self cryptocurrency | Yes |

| ✅Page | https://www.bitpanda.com/ |

Bitpanda reviews

Bitpanda is a trading platform offering more than just cryptocurrencies and is aimed at traders of all levels. Its most notable features include:

- Own native token, BEST. With BEST, you can get discounts on fees and VIP bonuses if you have a large enough token.

- Two exchanges under one account. In addition to the basic Bitpanda Exchange, which only allows you to buy and sell assets, you will also gain access to the Bitpanda Pro Exchange when you register, which allows you to place more advanced types of orders.

- Bitpanda Plus for institutional and high-volume investors. Bitpanda also serves those who want to trade more than average, which comes with its own special set of benefits, but also requirements before you can open this type of account.

- Five supported fiat currencies. Bitpanda is mostly aimed at Europeans, so it offers support for fiat currencies EUR, GBP, CHF and TRY, but also USD.

- Trading of stocks, metals, indices and ETFs. In addition to cryptocurrencies, Bitpanda also allows you to trade the above-mentioned assets. They are all in one account and one portfolio, allowing you to manage all your assets from one place.

- Extensive helpdesk. Almost every problem you encounter is covered by the Bitpanda helpdesk - but if that's not the case, their customer support team is here to help you and allow you to categorize your query accurately.

Overall, Bitpanda is an excellent choice for European investors and those who appreciate the breadth of their offer.

History

Bitpanda was founded in 2014 in Vienna, Austria with the aim of making investment accessible to everyone. The company was initially known as Coinimal, but in 2016 it changed its name to Bitpanda when it expanded its existing feature set. Boasting more than 4 million users and more than 400 team members, Bitpanda claims to be one of the fastest growing fintech companies in Europe.

The exchange was founded by co-executives Eric Demuth and Paul Klanschek and their CTO is Christian Trummer, who joined the team a few months after Bitpand was founded. The three form the main team behind the company.

The company's payment service is licensed by the payment service provider PSD2, a European regulation for electronic payment services. The stock exchange itself is a registered provider of digital asset services with the Austrian Financial Market Authority (FMA) under the FM-GwG and with the French Autorité des marchés financiers (AMF) under the PACTE law.

This means that the exchange is regulated and anyone who wants to trade on Bitpanda must verify their account.

Bitpanda charges

Bitpanda fees depend on which exchange you use: regular or Pro version. On the base exchange, there is a minimum amount for each asset for which you do not have to pay deposit fees, as well as deposit and withdrawal fees from the wallet, plus minimum amounts for each asset. You can find these amounts here.

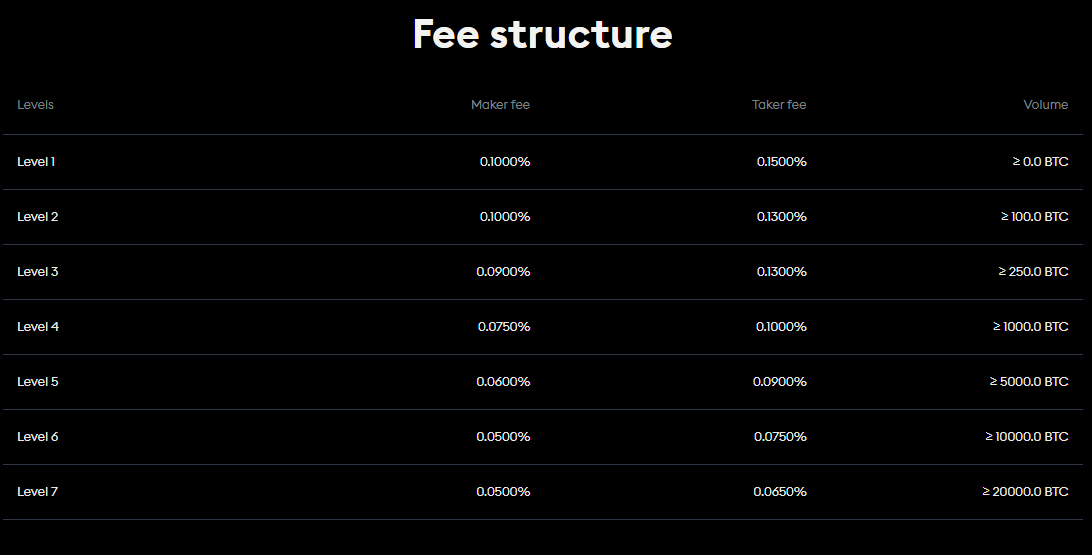

When it comes to fees, the only difference between a regular exchange and a Pro version is that the Pro version offers the option of creator and recipient trades and charges different fees for each. In other words, a basic stock exchange allows you to trade assets at a market price; on the stock exchange For this you can do with taker orders or wait until a certain price is reached, enter a macro order. The fees you will be charged will depend on your level depending on your monthly trading volume. You can see them in the following table:

BEST token

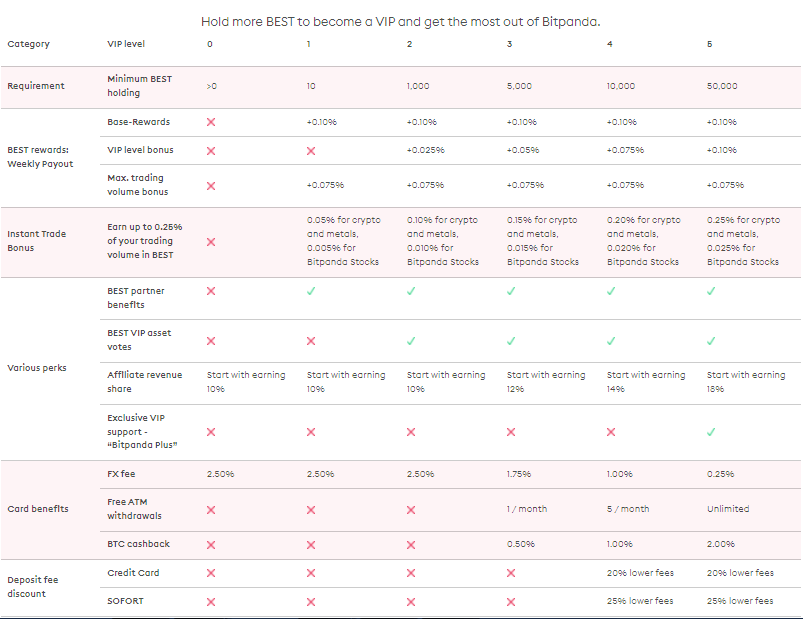

Bitpanda has its native token called Bitpanda Ecosystem Token (BEST). With this token, users can get a 20% discount on trading and deposit fees, as well as trading bonuses. There is also a minimum BEST value of EUR 0.132 for the latter and will increase by 10 % each year for the next five years. Part of the tokens spent on trade premiums are burned quarterly until only 50 % of the total stock remain.

Bitpanda has set up VIP accounts depending on the BEST amount you hold. If you are at least VIP level 2, which means you have at least 1000 BEST, you will gain a voice in strategic decisions, such as which assets will be added next. The higher the level, the more benefits.

Bitpanda tutorial

Registration

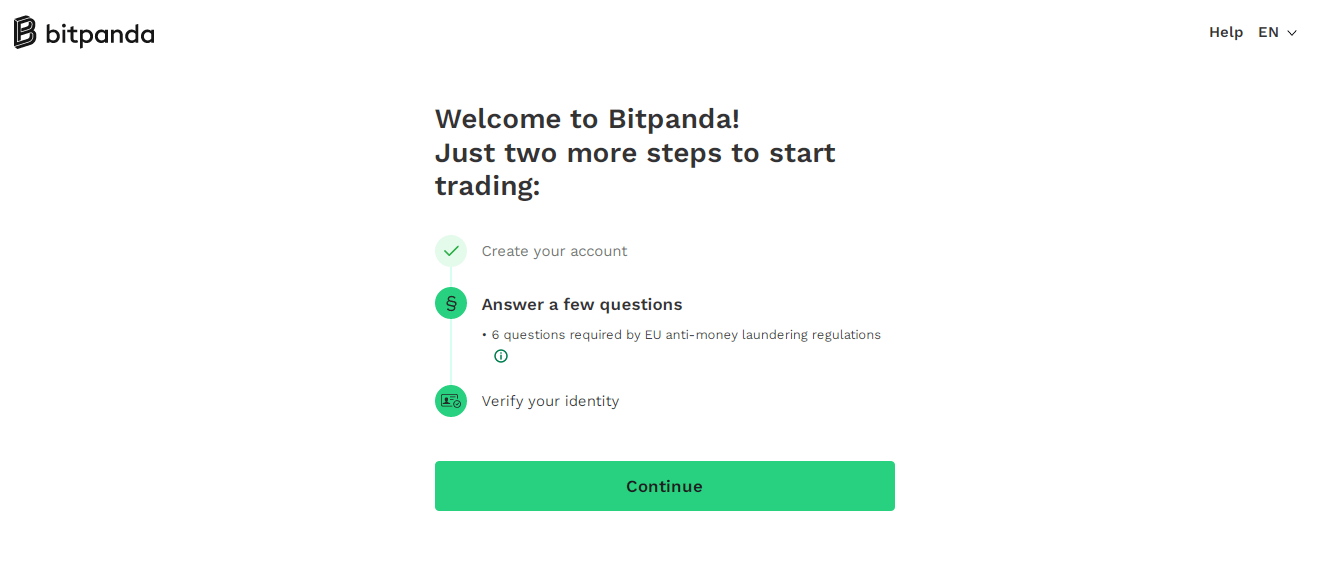

Bitpanda has a simple and intuitive user interface. By clicking on Sign-up, you will be redirected to a page where you enter your full name, e-mail address, country of residence and set a password. If you want to open a company account, you can click on the link at the bottom of the page. Once you have confirmed your email address, you will be asked to answer a number of questions required by EU anti-money laundering (AML) rules, most of which concern how much money you make and how much you intend to trade each year. and also verify your account by providing the necessary IDs. You do not have to complete the verification immediately; although this step can be skipped temporarily, keep in mind that you will need to return to it sooner or later. You will not be able to deposit or start trading until this process is complete.

Verification

You must enter a valid mobile phone number and address before going through the verification process. Bitpanda will send you a PIN code, after which you can go through the process. As for identity documents, Bitpanda accepts passports, while ID cards are accepted according to the one selected list countries available on their websites.

The Exchange also uses a practice called a verification deposit. Once your account has been verified, you must deposit between € 25 and € 2,500 by bank transfer (SEPA) or online payment methods SOFORT or GIROPAY / EPS. The limit of EUR 2,500 for deposits with EPS / GIROPAY and SOFORT will be increased after the verification deposit. The verification deposit can also be made in equivalent amounts in CHF, GBP or USD, but it is not possible to deposit cryptocurrencies before completing this process.

Even after the verification process is complete, there are some limitations. The 24-hour limit for online payments such as NETELLER, Skrill and iDEAL is EUR 10,000. Credit card deposits are limited to EUR 2,500 per 24-hour period, while bank transfers reach up to EUR 500,000. None of these limits can be further increased unless you sign up for a Bitpanda Plus account.

Bitpanda plus

The special level of a Bitpanda account is called Bitpanda Plus. This service, which is specifically aimed at traders who trade in large volumes and need to exceed the limits set by the stock exchange, also offers lower trading fees and premiums, generally taking a more personalized approach. To become a Bitpanda Plus member, you must meet at least one of the following requirements:

- You earn at least € 150,000 (gross) per year or have savings of € 500,000

- You hold a BEST VIP level 3

- You actively promote Bitpanda on your own website or have an affiliate (more than 1,000 fully authenticated users link to Bitpand)

- You own at least 2,500,000 BEST tokens

- You have at least one deposit of € 100,000 or equivalent

- You have been a Bitpanda user since 2014

Users who meet any of the criteria can sign in to the site. Applications are considered on a case-by-case basis and users may be asked to provide additional documentation before acceptance.

Trading

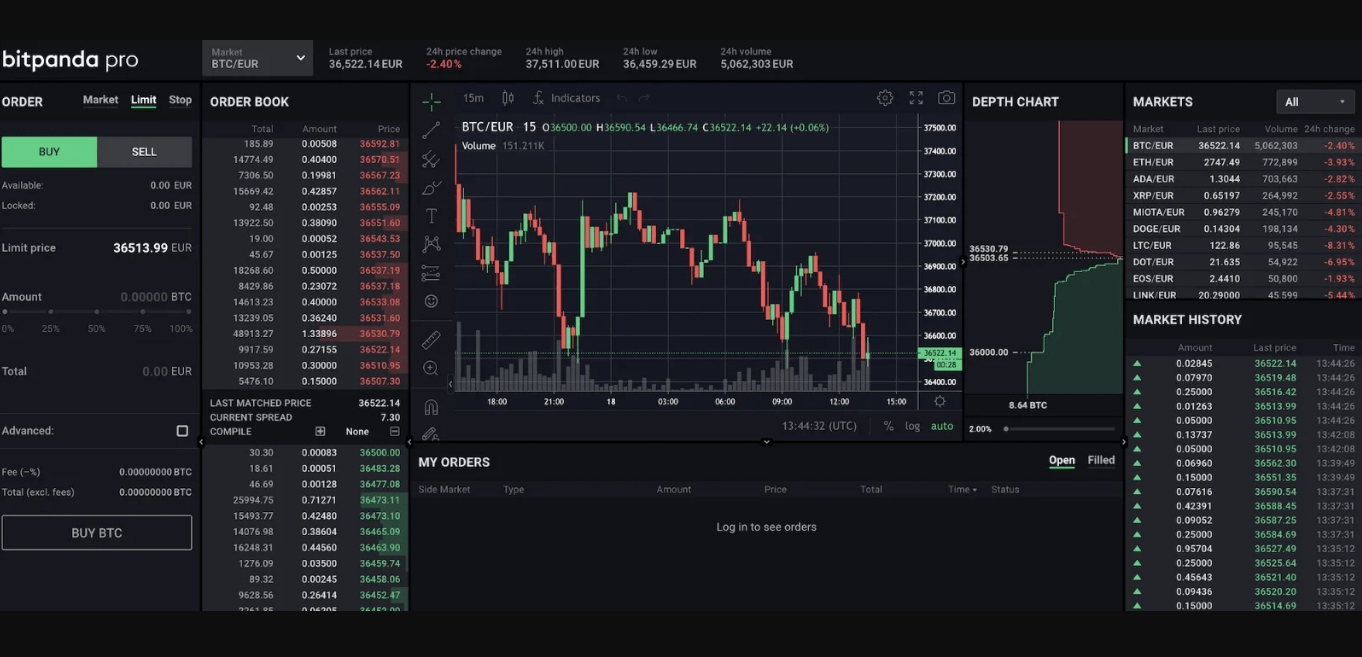

Fortunately, Bitpanda does not require you to open different accounts for your basic and professional exchanges. After opening an account, you will be asked which exchange you want to target first. There is no problem navigating between the two; the biggest difference in terms of interface is that the base panel uses a light color scheme, while the Pro version went dark.

If you are a complete novice or prefer simplicity and ease of use, then the basic stock exchange is the best choice for you. It's extremely intuitive and trades are just a few clicks away. The interface is very clean, so there's a very small chance that a wrong click will take you to a path you don't understand. However, the exchange also lists the biggest changes at the top of the screen; This is useful when you want to keep track of the market without constantly looking at the first few coins by market capitalization.

Bitpanda Pro, on the other hand, offers many more options. The interface itself is much closer to what many are used to from other exchanges, with every detail you may need to have in one place. However, this is far from overcrowded: despite the amount of information, Bitpanda is doing a good job. However, since Bitpanda is a European stock exchange, do not be shocked by prices - they are expressed in euros, unless you change them to USD.

On Bitpanda Pro you will be able to place limit and stop orders if you do not want to trade the asset at the market price. Here, too, you can choose how complex you want your business to be, ie how many different options you want to have. On the left side of the screen you can enter the required order type, validity time and execution. If you leave it as it is, it will simply go with the default options, but if you know what you are doing and need to set other parameters, the exchange will allow you to do so.

Bitpanda also offers an application for both Android and iOS; however, the exchange warns that not all desktop features may be available in the mobile version, but adds that work is being done to transfer each of them so that users can use the desktop and mobile platform interchangeably. However, Bitpanda Pro is separate from the base application, so if you prefer to use a more advanced desktop version, be sure to install the correct one on your phone.

Bitpanda swap

Bitpanda Swap allows you to immediately exchange any asset that is supported on Bitpanda for any other supported asset. That means you can replace Bitcoin (BTC) directly for Apple shares (APPL), without having to sell BTC for euros (EUR) first. We did not find the amount of fees on the website and the helpdesk referred us to an article on the swap procedure. According to some users, the fee is 1.49 % per BTC swap and in other currencies it is 2.3 %. Anyway, you can find the swap in the Trading section.

Overview of other stock exchanges and exchange offices you will find here

Other trading options

In addition to regular spot cryptoinvestment, Bitpanda allows traders to invest in cryptoindexes. These cryptoindexes offer exposure to the world's leading cryptocurrencies without the need to purchase individual coins.

These indices are not available or traded outside the Bitpanda platform. In addition, when you invest in these cryptoindexes, you do not actually own the underlying cryptoactive. So you can think of them as investments that provide exposure to cryptocurrencies, rather than actual purchases of cryptocurrencies.

Although Bitpanda is primarily a platform for cryptocurrency trading, the company also allows you to buy and sell shares and ETFs from as little as € 1. Stocks and ETF in Bitpanda, the securities are mainly listed in the USA, but are valued in euros. You can also trade stocks and ETFs at any time, even when the US stock markets are closed.

Bitpanda also supports trading with precious metals. On the platform you can buy and sell gold, silver, palladium and platinum 24/7 again from 1 €. Every gram of metal you buy on Bitpanda is backed by metal, which is stored in the Brinks vault in Switzerland. Business and storage fees are associated with this service.

| Gold | Silver | Platinum | Palladium | |

|---|---|---|---|---|

| Purchase fee | 0.50% | 2.5% | 2.5% | 2.2% |

| Sales charge | 1% | 2% | 2% | 1.8% |

| Storage fee (paid weekly) | 20g or less: free

20g or more: 0.0125% |

200g or less: free

200g or more: 0.025% |

20g or less: free

20g or more: 0.025% |

20g or less: free

20g or more: 0.025% |

Bitpanda savings

Bitpanda savings is a way for you to set up repeat purchases of digital assets without having to perform this process manually each time. In other words, you can automate the purchase of digital assets by setting the time, date and currency - and Bitpanda will do the rest for you.

You can create multiple savings plans at once with different predefined conditions.

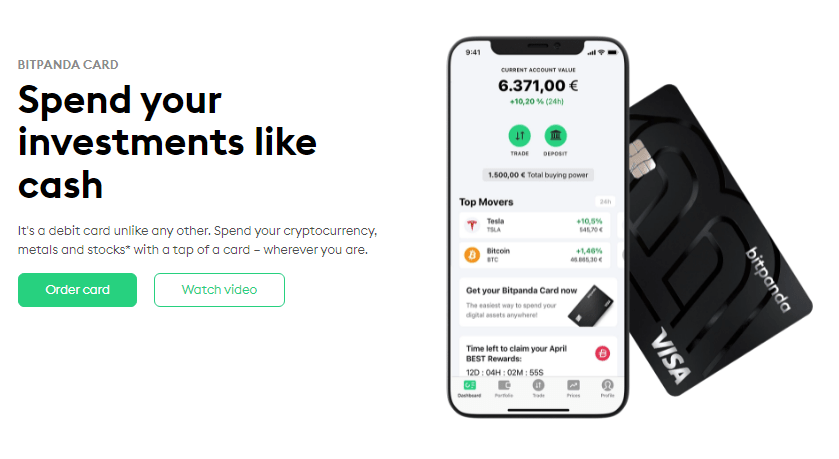

Bitpanda map

The Bitpanda card is currently only available in the euro area.

This is a Visa debit card that is linked to your Bitpanda wallet. This card allows you to spend any of your cryptocurrencies, precious metals or euros (EUR) in your account. The only fees for using the card are fees for foreign transactions and withdrawals from ATMs.

In addition to the physical card, the Bitpanda card is available as a virtual card for Google Pay and Samsung Pay. If you are a BEST VIP user, you can also get crypto rewards when paying by card.

Bitpanda pay

Bitpanda Pay offers an easy way to send euros from your account to any EU bank. This way you can use your EUR balance to pay your bills or send money to friends and family. With Bitpanda Pay, you can send between 10 and 10,000 EUR per transaction. There is also a 0.95% fee for Bitpanda Pay.

Deposits and withdrawals

Depositing cryptocurrencies into your account is extremely simple: simply send assets from your personal wallet to your account wallet, either by copying the address or scanning the QR code. You have one address for each asset.

You can also enter fiat currencies. To do this, you'll need to select the currency you're entering, which must be one of the following:

- euro (EUR)

- US Dollar (USD)

- Swiss Franc (CHF)

- British Pound (GBP)

- Turkish Lira (TRY)

You will also need to choose the payment provider you want to use. Verified accounts can be inserted into their Euro wallet using SEPA, GIROPAY / EPS, SOFORT, NETELLER, Skrill, Visa and Mastercard. Other fiat currencies have a slightly more limited choice of payment providers; for example, TRY can only be entered by bank transfer. With the exception of bank transfers, you will need to confirm your deposit using the SMS-PIN you receive after entering all the details.

The choices will also depend on whether it is a fiat or a cryptocurrency. Choosing from your fiat wallets is also simple: you choose a payment provider and, if necessary, create a payout account with him (usually only required for the first withdrawal), enter the amount and confirm. For fiats, deposits and withdrawals must be at least EUR 25 or the equivalent in other currencies.

The selection of cryptocurrencies is also easy. From the Withdraw option in the upper right corner, you will need to select an asset, enter the amount and address you are sending to. When selecting ETH, you will also need to confirm that you are not investing in an ICO and that you understand that Bitpanda is not able to credit any ICO-issued tokens to your account, which would result in their loss. Withdrawals to your personal wallet take as long as it takes to obtain all receipts, depending on the coin.

It also offers the Contacts function to further simplify the selection process. This will allow you to record the address as a contact, so you don't have to copy it every time you need to send funds from your account. In addition, if your contact is the address of another Bitpanda account - in other words another user - these transactions are free and processed within seconds. All you need is the email address with which the other user registered their account. When it comes to external wallets (such as your own crypto-wallet, nothing changes but you can now save your address instead of always entering it manually.

Safety

Bitpanda uses cold storage for its assets, but does not specify how much is stored offline. The stock exchange has never been hacked and says it has state-of-the-art security measures to prevent this. For user accounts, Bitpanda will always require you to verify your identity via your email address whenever you access them from a new device, along with always using reCAPTCHA, and perform random checks when changing important data in your account, such as your email address or phone number. The exchange also offers DDOS protection as well as SSL encryption.

Bitpanda is also careful about what users can do to secure their accounts. In addition to being prompted to select a secure password, it also recommends that you enable two-factor authentication.

As for external security reports, experts only rated the Pro exchange. CryptoCompare has awarded Bitpanda Pro an A rating for its safety and ranked twentieth in its overall list of nearly 140 exchanges at the time of this writing. Overall, the stock exchange is considered one of the safest currently on the market.

- Low fees

- Two exchanges on one account

- Discounts with native token

- Regulated stock exchange

- Strong security

- Complex system of fees and limits.

- It lacks transparency regarding some functions and fees.

|

Závěrečné shrnutí

Bitpanda is a versatile stock exchange that offers more than you are used to getting. Regardless of your level of expertise, there's something for everyone, and the fact that you can use both of their exchanges with one account means that once you learn to trade, you can move up one level without having to bother opening and verifying another account. Their approach to security means you don't have to worry about where you send your funds. Bitpanda is a very safe choice for both novice and experienced bitcoiners. |

5.0

|

FAQ

Is BitPanda regulated?

No. BitPanda is not a regulated cryptocurrency exchange under any financial regulatory agency.

How does BitPanda make money?

BitPanda makes money by charging its clients trading and withdrawal fees.

How do I make a deposit to my BitPanda account?

BitPanda accepts cryptocurrency deposits as well as euro payments via Mastercard, Visa, Sofort, EPS, Giropay, Neteller, Skrill and SEPA transfers.

How can I withdraw money from BitPanda?

Withdrawals of funds from BitPanda can be made in the same way as deposits.

How can I open a BitPanda account?

To open a BitPanda account, simply enter the email address and password to set up the account. You will then be asked to provide identity verification information for deposits and withdrawals.

Reliability Is the BitPanda reliable?

Yes, BitPanda is reliable and trusted by many people around the world.

Is BitPanda a scam?

No. BitPanda is not a scam, although it is not regulated.

How Safe is BitPanda?

BitPanda is a secure cryptocurrency exchange because it uses the latest encryption technology to secure its website from hackers and enables two-factor authentication for logins and withdrawals.