Since reaching an all-time high of $69,000 in November 2021, the price of Bitcoin has been falling. The current decline resulted in a June low of $17,622. The subsequent rebound created a long lower wick. The bounce confirmed the support value in the $19,200 area. Support previously served as resistance during the all-time high in 2017 and then again in January 2021.

Do not miss: 7 FAVORITE WAYS TO BUY A BITCOIN CARD IN 2022

Bitcoin stagnates and cannot get past $20,000

Since breaking this crucial barrier last Tuesday, the largest cryptocurrency has not been able to break $20,000 and is stagnant. WITHit is now trading at less than one-third of its all-time high of over $69,000 in November 2021.

The bulls tried to push the coin back up towards $22,000, but a strong selloff knocked it down again. Pas they continue their attacks, BTC may move higher in the following trading sessions. The market capitalization of all cryptocurrencies is currently $914 billion, up 0.3 % from the previous day.

The $22,000 level represents significant resistance for BTC and the coin has struggled to trade above it for a long time. BTC/USD saw a sharp drop in trading volume and the bar on the chart turned red, indicating bearish behavior. Selling pressure dominated the market.

The overall picture is still negative. After a failed weak rally last week, BTCUSD is still stuck below the 200-week moving average on the weekly charts. The RSI on the weekly charts is still oversold. Unfortunately, this does not suggest that now is a better time for the bulls to enter.

In the second quarter of 2022, Bitcoin recorded its worst performance in eleven years. Investor Michael Bury, who correctly predicted the mortgage crisis in 2007, thinks that BTC and stocks are only in the middle of a bear market cycle.

The current cryptocurrency market collapse is a good time to invest in Bitcoin, according to Changpeng Zhao, CEO of the Binance cryptocurrency exchange. Traders who can survive the current bear market will see their investments grow during the next bull phase, he said.

Other complications are the absence of demand from institutional investors, international restrictions and the collapse of critical support levels.

According to data from Glassnode, the weekly moving average number of Bitcoin addresses with a loss peaked on July 3, 2022 at 18.8 million. According to the data, the current carnage has caused the average BTC holder to suffer the biggest monthly loss since 2011.

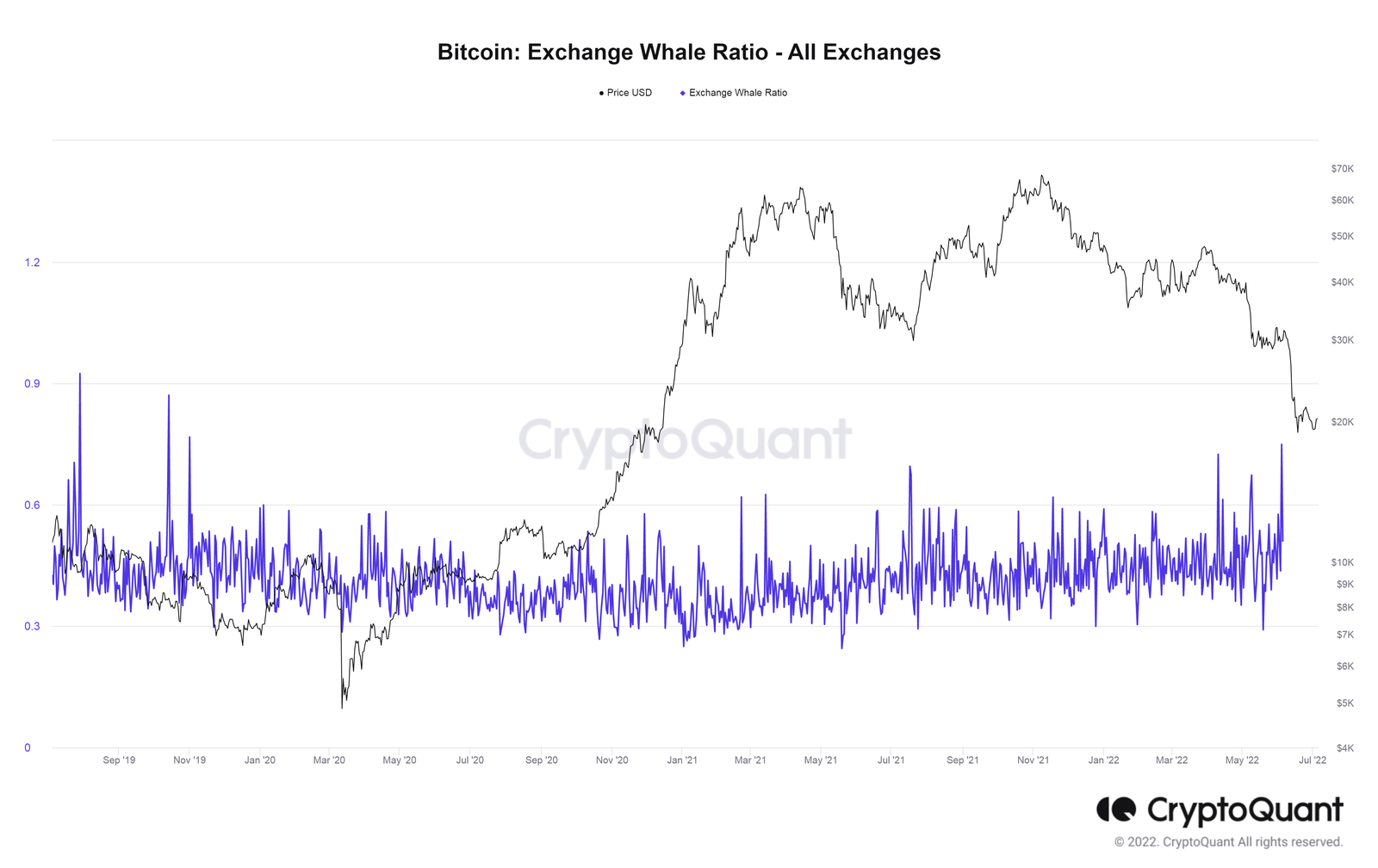

According to analysts CryptoQuant the Whale Ratio indicator, which shows the selling tendencies of the holders of large wallets, predicts that the price of Bitcoin will soon bottom out.

The analyst pointed out that whales are quickly transferring their Bitcoin holdings to cryptocurrency exchanges and will suffer significant losses.

You might be interested in: WHERE TO BUY BITCOIN AND CRYPTOMEN