Despite the bear market, Bitcoin and Ethereum continue to set new records.

Do not miss: TOP BOOKS ABOUT CRYPTOCURRENCIES

Bitcoin and Ethereum network usage records

When it comes to Bitcoin, the number of small holders seems to keep growing. Actually number of addresses, holding at least 0.01 BTC, or one million satoshis, has surpassed ten million, more than 10,300,000, a new all-time high.

The most represented band in this ranking is the band of addresses from 10,000 to 100,000 Sat (0.0001 - 0.001 BTC).

However, it is worth noting that it is incorrect to think that each address corresponds to one person, both because anyone can have as many addresses as they want and many users actually have more than one, and because BTC belonging to many people they are stored at individual stock exchange addresses.

So, aside from the addresses that have less than 10,000 Sat (0.0001 BTC) stored and hold just over 400 BTC in total, Bitcoin addresses can be divided into three bands of roughly similar numbers of addresses.

It is worth noting that the group holding the most BTC is a band between 1,000 and 10,000 BTC with more than five million coins.

Data from the Ethereum blockchain

Ethereum also set new records. In particular, it has been outperforming Bitcoin for some time in terms of the percentage of transaction volume carried out by addresses with the largest amount of funds.

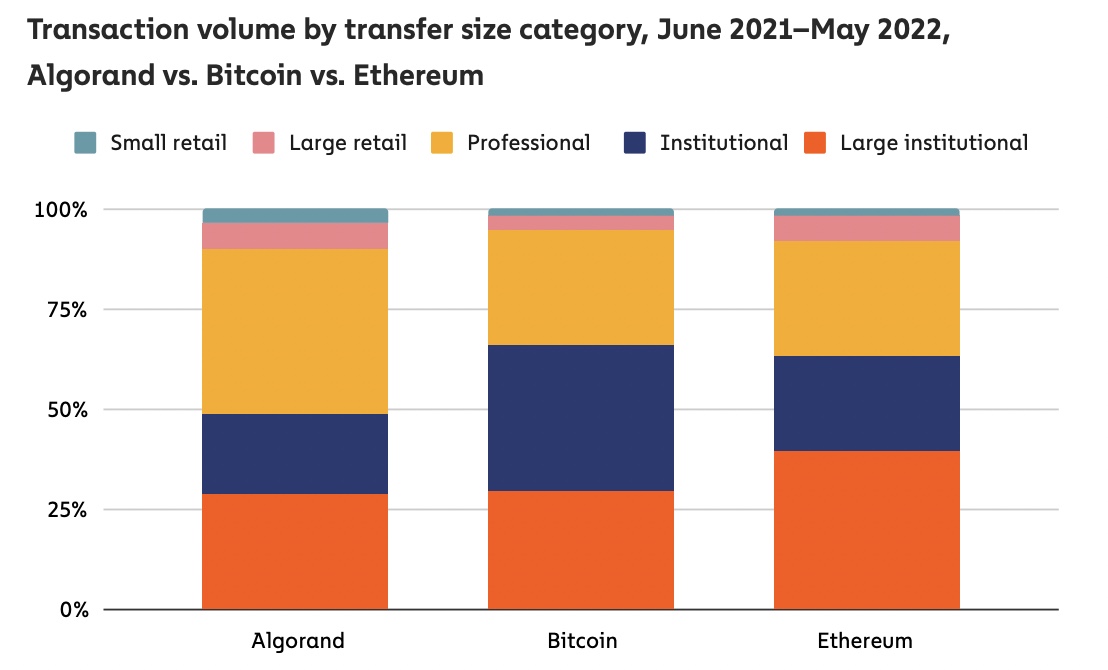

According to a recent analysis by Chainalysis, in the twelve months from June last year to the end of May 2022, up to 40 % transactions recorded on the Ethereum blockchain belonged to this category, referred to as "large institutional".

Bitcoin stopped at 30 % in this regard, while Algorand achieved the largest percentage among professionals.

What is interesting about this data is that retail investors, both small and large, are almost irrelevant, with percentages just above 10 % for Ethereum and less than 10 % for Bitcoin. However, this data does not take into account transactions that occur on the Lightning Network, as they are not recorded on the blockchain and such transactions are now preferred by retail investors.

It is clear from this data that Bitcoin and Ethereum are increasingly becoming assets used by financial institutions rather than among the masses.

You might be interested in: WHERE TO BUY BITCOIN AND CRYPTOMEN